Issuing Authority: MateSolar Industry Research Institute

Release Date: December 17, 2025

Report Period: 2026 - 2027

Executive Summary

The global residential energy sector is at a pivotal inflection point. As we transition into 2026, the narrative has decisively shifted from mere adoption of solar photovoltaics (PV) to the strategic integration of intelligent storage. This Blue Paper, leveraging extensive market analysis and technological forecasting, posits that 2026 will be the inaugural year of the Grid-Independent Prosumer. Driven by a confluence of policy recalibrations, advancing technology, and growing demand for resilience, home energy systems are evolving from financial investments into critical household infrastructure. This report provides a comprehensive analysis of the key drivers, regional paradigms, technological frontiers, and strategic imperatives that will define the global market in the coming 24 months, offering stakeholders a definitive roadmap for navigating this transformative period.

1. Introduction: The Dawn of the Prosumer-Centric Energy Era

The traditional, unidirectional model of energy consumption is obsolete. The rise of distributed energy resources (DERs), particularly rooftop solar PV, has given birth to the “prosumer” — a homeowner who both produces and consumes energy. In 2026, this evolution enters its most significant phase: the shift from grid-dependent prosumption to managed grid independence.

The core catalysts for this shift are:

1. Policy Maturation: The sunset of blanket feed-in tariffs (FiTs) and simplistic net metering in pioneer markets.

2. Economic Imperative: Soaring retail electricity prices and increased volatility, making energy autonomy a financially sound strategy.

3. Technological Convergence: The maturation of lithium iron phosphate (LFP) battery technology, smart inverters, and artificial intelligence (AI)-driven energy management systems (EMS).

4. The Resilience Demand: An increased frequency of extreme weather events and grid instability, elevating backup power from a convenience to a necessity.

This Blue Paper serves as an essential resource, dissecting these interconnected trends to provide homeowners, installers, investors, and policymakers with the insights needed to understand and act upon the opportunities presented by the global residential storage boom.

2. Global Market Analysis: A Tripartite Landscape

The global market for residential solar-plus-storage is no longer monolithic. It has fragmented into three distinct archetypes, each with unique drivers and growth trajectories for the 2026-2027 period.

Table 1: Global Residential Storage Market Archetypes (2026 Forecast)

| Market Archetype | Defining Regions | Primary Driver | Key Consumer Value Proposition | Growth Outlook (2026-2027) |

| Post-Subsidy Optimization | Germany, Italy, Netherlands, Japan, Australia | Maximizing Self-Consumption | Financial optimization of existing PV assets; energy bill minimization in the absence of strong export tariffs. | Steady, driven by retrofit additions to existing PV fleets. |

| Resilience & Grid Services | United States (esp. CA, TX), Canada, UK, France | Energy Security & Value Stacking | Reliable backup power during outages; participation in utility Virtual Power Plant (VPP) programs for revenue. | High, fueled by climate concerns and innovative utility partnerships. |

| Fundamental Electrification & Security | Chile, Argentina, Brazil, Caribbean nations (e.g., Jamaica), South Africa | Grid Reliability & Access | Provision of basic, reliable electricity in the face of frequent outages (load-shedding) and weak grid infrastructure. | Very High, driven by fundamental need rather than financial incentive. |

2.1 Europe: The Laboratory of Self-Consumption

Europe remains the most sophisticated market. The Netherlands has initiated its “Post-Net-Metering” transition, with the final phase-out in 2027 creating an immediate urgency for storage adoption in 2026. Germany’s market is characterized by a high penetration of “solar-only” homes now seeking storage retrofits to optimize self-consumption, supported by attractive low-interest loans like the KfW 270 program. The European Union’s “Solar Standard” initiative, mandating solar-ready roofs on new buildings, will further catalyze integrated storage solutions from the outset of construction.

2.2 North America: A Tale of Resilience and Policy Navigation

The U.S. market is bifurcated. States like California, under NEM 3.0, have made storage an economic necessity for new solar systems, creating a near-100% attachment rate. In regions like Texas and the Southeast, resilience against extreme weather is the paramount driver. The federal Investment Tax Credit (ITC), solidified at 30% for standalone storage through 2032, provides a powerful nationwide incentive. However, complexities from the One Big Beautiful Bill, including domestic content adders and interconnection reform, will shape supply chains and project economics in 2026. Canada sees parallel growth, particularly in provinces with time-of-use rates and remote communities.

2.3 Latin America & the Caribbean: Leapfrogging to Energy Security

In this region, storage is a solution to foundational challenges. Countries like Chile and Argentina face chronic grid congestion and price volatility. In nations like Jamaica and the Dominican Republic, high electricity costs and hurricane vulnerability drive adoption. The model here is not just backup but “solar-as-the-primary-source”, with the grid as a backup. This leapfrog dynamic presents a massive opportunity for standardized, plug-and-play storage solutions and innovative financing models tailored to emerging economies.

3. Technological Vanguard: Intelligence, Integration, and Safety

The competitive landscape in 2026 will be won on software and system integration, not just hardware specifications.

3.1 The AI-Powered Home Energy Platform

The next generation of Home Energy Management Systems (HEMS) will be predictive and prescriptive. Utilizing machine learning algorithms that analyze historical consumption, weather patterns, and real-time grid data, these platforms will autonomously optimize for multiple objectives: minimizing cost, maximizing self-consumption, and ensuring backup readiness. The integration of vehicle-to-home (V2H) and vehicle-to-grid (V2G) protocols will see EVs become dynamic assets within this platform, managed for both mobility and home energy needs.

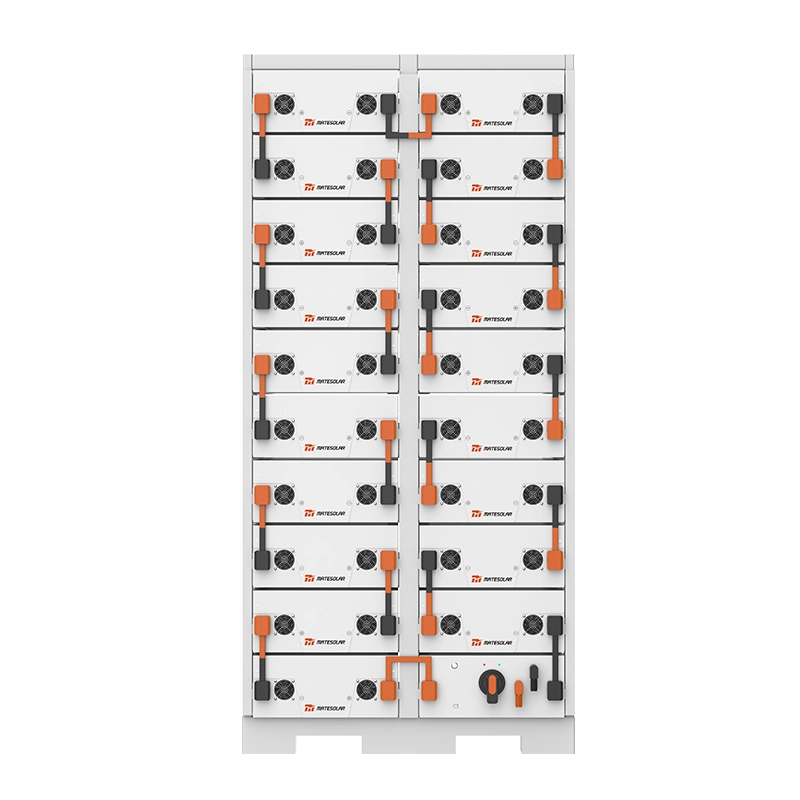

3.2 The Modular & Scalable Battery System

The trend toward modular, stackable battery units will accelerate. This allows homeowners to start with a base capacity and scale economically as their needs evolve—whether from adding an EV, a heat pump, or simply seeking longer backup duration. LFP chemistry will be the undisputed standard, prized for its safety, longevity (>6,000 cycles to 80% depth of discharge), and thermal stability.

3.3 Safety as a System Architecture

Safety transcends cell chemistry. In 2026, leading systems will feature:

- Pack-Level Safety: Advanced Battery Management Systems (BMS) with per-module monitoring and passive propagation prevention.

- Cybersecurity Hardening: As systems become more connected, protection against digital threats will be a critical certification criterion.

- Fire Mitigation Integration: Seamless communication with household fire alarm systems and certified, fire-resistant enclosures will become market expectations.

4. The Strategic Imperative: System Sizing and the Hybrid Solution

Selecting the right system is a critical strategic decision. For comprehensive solutions tailored to various home needs, explore our portfolio of Residential Solar and Storage Systems.

For homeowners with significant energy demands—large residences, home offices, multiple EVs, or a desire for whole-home, multi-day backup—a commercial-grade hybrid system represents the optimal balance of power, capacity, and value.

Table 2: Specification & Application Analysis: Residential 25KW Hybrid Solar Energy Storage System

| Parameter | 2026 Technical Benchmark | Strategic Advantage for the Prosumer |

| Continuous AC Output | 25 kW | Powers entire home loads simultaneously, including central A/C, well pumps, and EV chargers, without compromise. |

| Battery Capacity (Modular) | 30 - 50+ kWh (scalable) | Enables multi-day energy independence during grid outages and maximizes self-consumption of solar production. |

| PV Input Capacity | Supports 30kW+ DC arrays | Future-proofs for expanding solar generation to meet total household electrification (heating, cooling, transportation). |

| Grid Services Readiness | VPP and grid-support functionality compliant. | Unlocks potential revenue streams by allowing the system to provide grid stability services when permitted. |

| Core Value Proposition | 1. Total Energy Resilience: Uninterrupted power for all critical and non-critical loads. 2. Bill Elimination: Drastic reduction or zeroing of grid imports, even during peak periods. 3. Future-Proof Platform: Designed for seamless integration with V2H and smart home ecosystems. |

To understand how this system can be engineered for your specific energy independence goals, visit our detailed product page for the Residential 25KW Hybrid Solar Energy Storage System.

5. Financial Models and Regulatory Considerations for 2026

5.1 Evolving Financing Pathways

The capital expenditure barrier continues to lower through innovative models:

- Storage-as-a-Service (SaaS): Third-party ownership models where homeowners pay a monthly fee for backup power or managed savings.

- Property-Assessed Clean Energy (PACE): Gaining traction in more U.S. states as a viable long-term financing tool.

- Green Appliance Bundling: Partnerships between storage providers, HVAC companies, and EV dealers to offer integrated electrification financing.

5.2 The Critical Role of Interconnection and Standards

As penetration increases, grid interconnection will become more complex. In 2026, expect wider adoption of IEEE 1547-2018 standards, requiring advanced inverter functionalities like voltage and frequency ride-through. Navigating interconnection studies, fees, and utility-specific requirements will be a key differentiator for installers. Homeowners must prioritize working with certified professionals who understand this evolving landscape.

6. Strategic Recommendations and Future Outlook

For Homeowners (2026 Decision Framework):

1. Audit & Prioritize: Conduct a detailed energy audit. Define primary goal: Is it bill savings, backup for essential loads, or whole-home independence?

2. Think Platform, Not Product: Select a system with an open, upgradeable software platform (HEMS) that can integrate future technologies like V2H.

3. Secure Expertise: Partner with installers certified by equipment manufacturers and well-versed in local utility and incentive paperwork.

For the Industry:

The market will reward providers who deliver a seamless, branded customer experience—from digital quoting and financing to professional installation, commissioning, and long-term performance monitoring and support.

Looking to 2027 and Beyond:

We anticipate the rise of community-based microgrids, where clusters of homes with storage systems can island together during widespread outages. Furthermore, the integration of storage with heat pump water heaters and HVAC systems will create new avenues for thermal storage and load flexibility, deepening the value stack for the prosumer.

Appendix: Frequently Asked Questions (2026 Edition)

Q1: We have net metering now. Why should I consider adding storage in 2026?

A: Net metering policies are subject to change and are being revised downward globally. Adding storage in 2026 future-proofs your investment. It allows you to capture the full value of your solar generation by using it directly, insulating you from future policy shifts that reduce export credit rates. It also provides the immediate, non-financial benefit of backup power.

Q2: Is my data secure with a cloud-connected energy management system?

A: Data security is paramount. In 2026, leading manufacturers will comply with stringent regional data protection regulations (e.g., GDPR, CCPA). Before purchasing, inquire about the provider's data privacy policy, encryption standards, and whether you own your generation/consumption data. Opt for systems that offer transparent user controls over data sharing.

Q3: How does extreme cold or heat affect battery performance and lifespan?

A: Lithium-ion batteries have optimal performance temperature ranges (typically 15-25°C). Extreme cold can temporarily reduce available capacity, while extreme heat can accelerate long-term degradation. For 2026, look for systems with intelligent thermal management (active liquid cooling or advanced phase-change materials) and proper installation in climate-controlled environments (e.g., garages, not uninsulated sheds) to ensure longevity and safety.

Q4: What is the true total cost of ownership (TCO) over 10 years?

A: Beyond the upfront hardware and installation cost, consider: 1) Degradation: A quality LFP battery will retain ~60-70% capacity after 10 years. 2) Maintenance: Most systems are maintenance-free, but inverter replacement may be needed within 15-20 years. 3) Value Generated: The TCO must be weighed against 10+ years of avoided electricity costs, potential VPP revenue, and the intangible value of resilience. A detailed financial model should project these cash flows.

Conclusion

The period of 2026-2027 represents a foundational chapter in the democratization of energy. Residential solar storage is transitioning from an emerging technology to a cornerstone of the modern, resilient, and efficient home. Success in this new era will belong to those who view storage not as a standalone product, but as the intelligent core of a holistic home energy platform.

About MateSolar:

MateSolar is a global leader in providing integrated, one-stop solar storage solutions. We combine premium, certified hardware with our proprietary AI-driven energy management platform. Our network of certified partners delivers seamless design, financing, installation, and lifelong support, empowering homeowners worldwide to achieve true energy independence and resilience. We are not just supplying technology; we are enabling a sustainable and secure energy future, one home at a time.