The solar and energy storage industry is undergoing a fundamental transformation driven by record-breaking technological breakthroughs and substantial cost reductions. With perovskite-silicon tandem cells now achieving 33% certified efficiency and advanced thermal management technologies enabling 98% system availability even in extreme climates, the renewable energy landscape is reaching inflection points that seemed impossible just years ago. This comprehensive analysis examines the convergence of technology innovation, supportive global policies, and dramatically improved economics that are positioning solar-plus-storage as the dominant energy solution worldwide.

Table of Contents

1. Photovoltaic Technology Breakthroughs

2. Energy Storage Innovations

3. Global Policy Landscape

4. Cost Trends and Projections

5. Regional Applications and Case Studies

6. Frequently Asked Questions

7. Conclusion

1. Unprecedented Photovoltaic Technology Breakthroughs

1.1 The Tandem Cell Revolution

The theoretical efficiency limits of single-junction silicon solar cells have long been considered an inevitable constraint on solar energy generation—until now. In a landmark achievement verified by the National Renewable Energy Laboratory (NREL), Longi Green Energy has developed a large-area (260.9cm²) crystalline silicon-perovskite tandem solar cell achieving a certified 33% conversion efficiency. This breakthrough represents nearly a 20% relative improvement over mainstream commercial solar cells and sets a new global benchmark for commercially viable dimensions.

This technological leap is particularly significant because it was achieved on a commercially scalable size, moving tandem cells from laboratory curiosities to imminently manufacturable products. The 33% efficiency rate effectively resets the industry's roadmap, demonstrating a clear path to overcoming the Shockley-Queisser limit that has constrained silicon solar cells for decades.

1.2 Beyond Tandem: The N-Type Transition

The broader photovoltaic industry continues its accelerated transition from P-type to N-type technologies, with Heterojunction (HJT) and TOPCon architectures leading the transformation. According to industry analysis, N-type technologies now deliver significant advantages in both conversion efficiency and future improvement potential compared to legacy PERC cells.

HJT cells specifically demonstrate superior performance characteristics including:

- Higher open-circuit voltage

- Lower temperature coefficient (-0.25% to -0.30%/°C compared to -0.35% to -0.45%/°C for PERC)

- No LID and PID effects

- Symmetrical structure enabling easier thinning and lower silicon consumption

- Low-temperature manufacturing process reducing energy consumption

These advantages translate to enhanced energy yield of 5-15% compared to PERC technology, depending on climate conditions and installation configuration.

Table: Comparison of Mainstream Solar Cell Technologies

| Parameter | PERC | TOPCon | HJT | Perovskite-Silicon Tandem |

| Lab Efficiency | 24.5% | 26% | 26.5% | 33% |

| Mass Production Efficiency | 23.2% | 24.5-25% | 24.5-25.2% | 30% (projected) |

| Temperature Coefficient (%/°C) | -0.35 to -0.45 | -0.30 to -0.35 | -0.25 to -0.30 | -0.25 to -0.30 (estimated) |

| Bifaciality | 70-75% | 80-85% | 90-95% | 85-90% (estimated) |

| Manufacturing Cost Premium | Baseline | +15-20% | +20-25% | +30-40% (projected) |

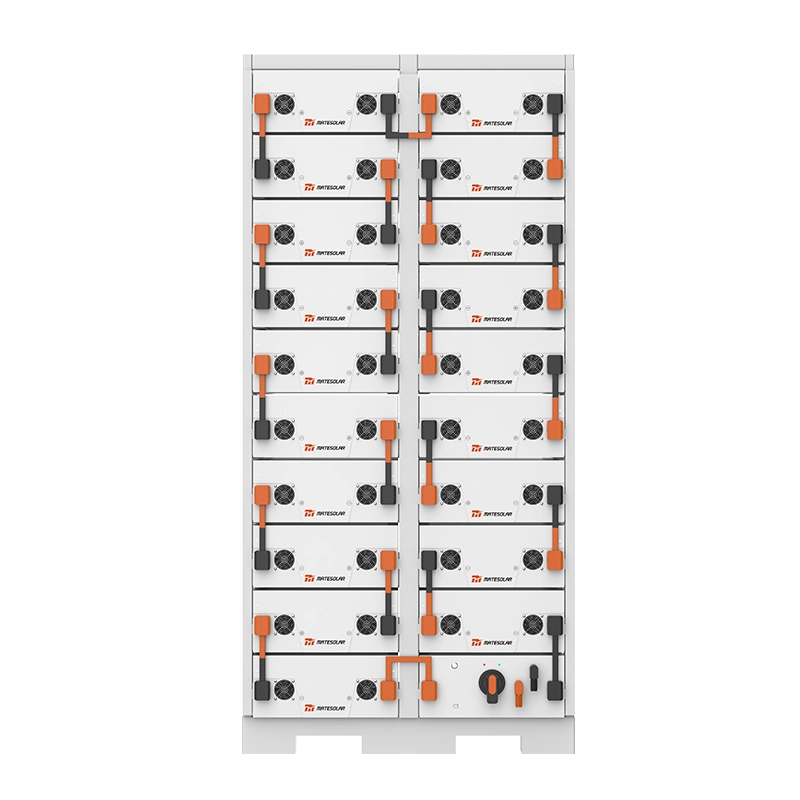

2. Energy Storage Innovations: Overcoming Temperature Barriers

2.1 High-Temperature Performance Breakthroughs

The historical limitation of energy storage systems in high-temperature environments is being systematically overcome through advanced liquid cooling technologies. Companies like CLOU have developed specialized Aqua C3.0 Pro liquid cooling systems specifically engineered for desert and high-temperature applications, enabling full-power operation at 55°C ambient temperatures without derating.

This thermal management breakthrough represents a transformative improvement in system availability, increasing operational reliability in extreme climates from approximately 85% to 98%. The technology combines insulation structure design with high-power liquid cooling units and comprehensive sealing designs with dust-proof meshes to protect against sand intrusion.

2.2 The Rise of Hybrid Storage Systems

As the industry progresses toward optimal economics, lithium-sodium hybrid systems are emerging as a crucial transition technology, blending the high energy density of lithium-ion chemistry with the cost advantages and safety benefits of sodium-ion alternatives. This hybrid approach enables developers to balance performance requirements with economic constraints, particularly for large-scale storage applications where cycle life and safety are paramount concerns.

The technology roadmap suggests sodium-ion batteries will capture an increasing share of the stationary storage market, potentially reaching 30-40% by 2027 as manufacturing scales and technology improves, with hybrid systems serving as an important bridge during this transition period.

3. Global Policy Landscape: Strategic Support Mechanisms

3.1 European "Solar Reduction, Storage Compensation" Model

Western Europe has decisively entered a "solar reduction, storage compensation" phase, systematically reducing traditional solar feed-in tariffs while amplifying storage demand through income guarantees and household subsidies.

Germany has officially eliminated negative electricity price period subsidies, with Berlin cutting balcony solar subsidies by half. The Netherlands will completely abolish the core incentive net metering mechanism for residential photovoltaics by 2027, offering only minimal compensation of €0.0025/kWh. France has eliminated the full feed-in model for residential systems, mandating a shift to self-consumption with surplus feeding into the grid while providing self-consumption bonuses.

The United Kingdom has implemented a distinctive approach with its "cap-floor" mechanism specifically supporting long-duration storage ≥8 hours, with the first round requiring a minimum of 100MW for mature energy storage technologies and the second round accepting 50MW for new energy storage technologies.

3.2 Southern Europe's High-Density Subsidies

Southern European nations are implementing some of the most generous storage subsidies globally, with Greece extending both the "Save 2025" residential renovation plan with a total budget of €396.1 million and the corporate energy storage subsidy plan with a total budget of €153.7 million. Italy has launched the MACSE mechanism with 15-year operational subsidies estimated at approximately €32,000/MWh/year for 4-hour lithium battery systems.

3.3 Explosive Growth in Eastern Europe

Eastern European markets are demonstrating unprecedented support for energy storage, with Poland, the Czech Republic, and Hungary implementing large-scale, high-budget storage subsidies primarily supporting grid-connected storage. This regional transformation positions Eastern Europe as an essential emerging market with growth projections exceeding 100% annually through 2027.

4. Projected Cost Reductions: The Path to Market Dominance

4.1 Battery Cost Plunge and System Economics

The fundamental driver of storage adoption continues to be rapidly declining costs. Since 2023, China energy storage system battery prices have cumulatively decreased by 50%, falling to just $66/kWh (¥0.47/Wh) in 2025. This precipitous decline has transformed project economics, reducing the levelized cost of electricity (LCOE) for solar-plus-storage projects from $80/MWh to $68/MWh.

When combined with regional capacity compensation mechanisms—such as Xinjiang's $0.016/kWh policy—costs can be further reduced to approximately $60/MWh, already positioning solar-plus-storage as cost-competitive with coal-fired power ($35-65/MWh) in many markets.

4.2 Full Lifecycle Cost Projections

The comprehensive analysis of storage economics must consider the total lifecycle cost, including initial investment, operational expenditures, replacement costs, and end-of-life processing. The industry is projecting reductions of approximately 30% in full lifecycle costs by 2027 compared to 2023 levels, driven by:

- Chemistry improvements increasing cycle life from 6,000 to 10,000+ cycles

- Manufacturing scale reducing battery pack costs by 25-30%

- Power electronics integration cutting balance-of-system costs by 20-25%

- Advanced software optimizing utilization and reducing degradation

*Table: Energy Storage Cost Reduction Projections (2023-2027)*

| Cost Component | 2023 Baseline | 2025 Projection | 2027 Projection | Key Drivers |

| Battery Cells | $95/kWh | $75/kWh | $60/kWh | Chemistry innovation, manufacturing scale |

| Power Conversion | $125/kW | $110/kW | $95/kW | Integration, material efficiency |

| System Integration | $85/kWh | $70/kWh | $55/kWh | Standardization, design optimization |

| Installation | $65/kWh | $55/kWh | $45/kWh | Modular designs, simplified commissioning |

| Soft Costs | $120/kWh | $100/kWh | $80/kWh | Streamlined permitting, customer acquisition |

| Total Installed Cost | $490/kWh | $410/kWh | $335/kWh | Comprehensive improvements |

| Levelized Storage Cost | $125/MWh | $95/MWh | $85/MWh | Performance and lifetime improvements |

5. Regional Applications and Implementation Strategies

5.1 High-Temperature Applications: Middle East Case Study

The Middle East represents both the most challenging environment for energy storage and one of the fastest-growing markets, with the region accounting for 23.4% of Chinese energy storage companies' overseas orders in H1 2025, totaling 37.55GWh. Countries like Saudi Arabia are aggressively pursuing renewable energy targets through their "2030 Vision", aiming for 50% renewable energy by 2030.

Companies like Kehou have deployed specialized liquid cooling solutions specifically engineered for the region's extreme conditions, featuring:

- High-temperature optimized thermal management maintaining full power output at 55°C

- Enhanced sealing and filtration systems preventing sand and dust ingress

- Advanced battery degradation algorithms extending cycle life in high-temperature conditions

- Grid-forming capabilities supporting weak grids in remote locations

Similar approaches have proven successful in projects like the Chilean Atacama Desert energy storage project, demonstrating the global applicability of these thermal management technologies.

5.2 Commercial and Industrial Applications

For commercial and industrial enterprises, the economic case for solar-plus-storage has transformed dramatically. A 100KW Commercial Hybrid Solar System now delivers compelling returns across most global markets, particularly with the emergence of dynamic electricity pricing in markets like Germany.

These integrated systems typically feature:

- High-efficiency N-type bifacial modules maximizing energy yield per square meter

- Intelligent energy management systems optimizing self-consumption and grid interactions

- Scalable battery storage (typically 2-4 hours duration) enabling demand charge management

- Grid-forming capabilities providing backup power during outages

The business case has been strengthened by numerous policy developments, including carbon markets, corporate renewable energy procurement mandates, and accelerated depreciation benefits in key markets.

6. Frequently Asked Questions

Q1: When will perovskite-silicon tandem cells become commercially available?

A: The technology roadmap indicates initial commercial modules will arrive between 2026-2027, with full-scale industrial production expected by 2028. The recent 33% efficiency achievement on commercial-sized cells (260.9cm²) significantly accelerates this timeline.

Q2: How do liquid cooling systems achieve 98% availability in extreme heat?

A: Advanced liquid cooling systems like the Aqua C3.0 Pro combine precision thermal management (maintaining cell temperature differentials ≤2.5°C), environmental hardening (sealed components and advanced filtration), and intelligent control algorithms that preemptively adjust operation based on conditions. This comprehensive approach enables full-power operation at 55°C ambient temperature without derating.

Q3: What is driving the projected 30% reduction in storage lifecycle costs by 2027?

A: This reduction stems from multiple factors: battery chemistry improvements (increasing energy density and cycle life), manufacturing scale (GWh-scale factories reducing unit costs), system integration advances (simplified designs and reduced component counts), and software optimization (extending operational life through superior battery management)

Q4: How do policy changes in Europe specifically favor storage over standalone solar?

A: European markets are systematically transitioning from feed-in tariffs (favoring solar generation regardless of timing) to market-based mechanisms that reward grid support services. Key policies include: eliminating net metering (Netherlands), implementing dynamic pricing (Germany), and providing specific storage subsidies (UK capacity market), all creating revenue streams exclusive to storage.

Q5: Are lithium-sodium hybrid systems economically viable today?

A: Hybrid systems currently deliver the strongest economics in specific applications: where daily cycling is required but peak power demands are moderate, and where safety considerations justify a premium. As sodium-ion costs continue declining (projected 25-30% reduction by 2026), these hybrid systems will become economically attractive across broader applications.

7. Conclusion: The Inevitable Transition

The convergence of record-breaking cell efficiencies, dramatically improved storage reliability, and supportive policy frameworks has created an irreversible momentum toward solar-plus-storage as a foundational energy infrastructure. The industry has progressed from technology demonstration to commercial scalability across global markets.

With 33% efficient tandem cells demonstrating a viable path beyond theoretical limits, and advanced thermal management eliminating the last technical barriers in extreme climates, the focus now shifts to deployment acceleration and system optimization. The projected 30% reduction in full lifecycle costs by 2027 will further cement the economic advantage of these technologies.

For organizations evaluating their energy strategy, the question is no longer if but how quickly to adopt solar-plus-storage solutions. From the comprehensive 100KW Commercial Hybrid Solar System

for small and medium enterprises to utility-scale installations, the technology has proven its reliability, economics, and sustainability credentials. Our solar photovoltaic energy storage power system provides a comprehensive solution covering project planning, equipment supply, installation and commissioning, and after-sales service, ensuring projects achieve maximum economic benefits.

At MateSolar, we're committed to accelerating this transition through integrated solution offerings that combine the latest technological innovations with practical deployment expertise. Our end-to-end approach ensures that each project maximizes return on investment while providing grid-stabilizing services to the broader energy system. The solar-plus-storage revolution has reached its implementation phase, and the time for strategic adoption is now.

MateSolar is a leading provider of comprehensive solar and storage solutions, delivering cutting-edge technology integration for commercial, industrial, and utility clients globally. Our expertise spans project development, technical design, financing, and ongoing optimization to ensure maximum project value throughout the system lifecycle.

Take the first step toward energy independence—contact MateSolar today for a personalized commercial energy storage assessment!