The future of energy is unfolding before our eyes, with solar and storage at the heart of a global transformation that is both economically smart and environmentally necessary.

In a landmark development for the renewable energy sector, the International Renewable Energy Agency (IRENA) has released its first comprehensive energy storage report, "Energy

Transformation through Solar and Storage" .

This groundbreaking report, developed with unprecedented participation from Chinese company CATL and other international organizations, signals a pivotal moment for global energy transition.

The Rising Economic Advantage of Solar Plus Storage

The IRENA report delivers a powerful conclusion: "solar+storage" will become the most economical green energy solution available globally . This cost competitiveness stems from dramatic reductions in the cost of utility-scale solar and storage projects worldwide.

The economics are clear: as technology advances and manufacturing scales, the levelized cost of electricity from solar PV coupled with storage has decreased significantly. This trend is expected to continue, making renewable energy not just environmentally preferable but economically superior to conventional fossil fuel-based generation.

The report further reveals that lithium-ion battery storage is now progressing toward 4-8 hours or even longer response times, positioning it as a viable long-duration storage technology that can meet the grid's need for flexibility across extended timeframes .

Global Energy Storage: Current Status and China's Leadership Role

The global energy storage market is experiencing explosive growth, with China emerging as a dominant force. According to the report, China accounts for over 40% of global energy storage capacity, making it the world's largest market for new energy storage applications.

This leadership position extends throughout the clean energy supply chain, particularly in photovoltaic modules, battery cells, and balance of system components . This scale effect has fostered intense competition and learning curve benefits, driving down costs and accelerating global deployment.

Other markets are also showing strong growth. Data reveals that in 2024, China, the United States and Europe collectively accounted for over 90% of new installed capacity, continuing to lead the global new energy storage market.

*Table: Global Energy Storage Market Overview (2024-2025)*

| Metric | 2024 Value | 2025 Value | Growth | Primary Contributors |

| Global New Installations | N/A | N/A | N/A | China, US, Europe (>90% combined) |

| China's New Capacity | N/A | N/A | Leading globally 3 years straight | Various domestic projects |

| EU Recycling Targets | N/A | 2030: Li 90%, Co/Ni 95% | Policy-driven | EU Battery Regulation |

| Lith-ion Battery Energy Density | 200-400 Wh/L | N/A | Steady improvement | Material science advances |

Diversified Technology Pathways for Energy Storage

While lithium-ion batteries currently dominate the energy storage landscape, the IRENA report acknowledges a growing diversity of storage technologies entering the market.

According to China's Ministry of Industry and Information Technology, the country has developed a pattern where lithium-ion battery storage leads with diverse technology routes developing side-by-side, including flow battery storage and compressed air storage .

The technological evolution continues rapidly across multiple fronts:

- Solid-state batteries are advancing through oxide, polymer, and sulfide pathways, with oxide-based batteries showing particular promise for storage applications

- Flow batteries and compressed air energy storage are gaining market share, each increasing their proportion by 0.6% and 0.5% respectively compared to 2023

- Hybrid systems combining different technologies are emerging, such as lithium-ion batteries plus sodium-ion batteries, and flywheels with supercapacitors

The average energy storage duration is currently about 2.3 hours, but 4-hour and longer duration projects are increasingly common . The United States has implemented a Long-Duration Storage Research Plan and supports the research and demonstration of storage technologies exceeding 10 hours .

Policy Recommendations for Accelerated Adoption

The IRENA report provides comprehensive policy recommendations to help governments create enabling environments for energy storage deployment. These proposals come at a critical time as many nations struggle to integrate increasing shares of variable renewable energy into their grids.

Key recommendations include:

- Establishing national energy storage targets to provide clear direction and commitment to storage deployment

- Integrating storage into grid planning and design to ensure system architecture accommodates storage resources

- Improving electricity market rules to recognize and compensate the multiple values that storage provides to the grid

- Developing targeted financial products to reduce initial investment costs and make storage projects more bankable

- Creating robust grid connection safety standards and empirical platforms to ensure system reliability and safety

Ilina Radoslavova Stefanova, Director of IRENA's Coalition for Action, emphasized: "If these policy recommendations are adopted and implemented, they will advance the decarbonization of power systems, achieve 2030 renewable energy and storage targets, and lay the foundation for building a resilient, fully renewable global energy system".

Addressing Industry Challenges and Moving Beyond Mandatory Storage Allocation

The energy storage industry faces significant challenges despite its promising growth. Recently, the industry has been grappling with intense price competition that threatens sustainability and quality standards .

CATL Chairman Robin Zeng has voiced concerns about the current state of the market, noting that in just three years, energy storage system prices have dropped by approximately 80% . Recently, winning bids for some collective procurement projects have even fallen below $0.04/Wh, which severely deviates from reasonable cost levels.

This excessive focus on price has led to cutting corners on quality and safety, with reports of energy storage fire accidents appearing almost monthly in 2024 . Over 80% of these incidents resulted from poor battery cell quality and thermal management system failures.

The industry is transitioning away from mandatory storage allocation policies that previously drove installations. In China's adaptation period after the gradual withdrawal of mandatory storage allocation policies, the industry has experienced some temporary contraction but is moving toward a more market-driven development model.

This shift has resulted in regional differentiation: areas that previously relied heavily on mandatory storage allocation, like Northwest China, have seen a sharp decline in installations, while regions that have established market mechanisms, such as Shandong and Guangdong, have maintained steady installation curves.

*Table: Energy Storage Cost and Performance Metrics (2023-2025)*

| Parameter | 2023 Value | 2025 Value | Change | Implications |

| System Price (lowest) | ~$0.20/Wh | ~$0.04/Wh | ~-80% | Serious quality concerns emerge |

| Capacity Rentals | Premium levels | ~50% reduction | Significant drop | Market correction occurring |

| Storage Utilization | N/A | 31% average | Low | Need for better market mechanisms |

| Cycle Life | Varies | 5000-10000 cycles | +15x since commercialization | Technical progress substantial |

| Energy Conversion Efficiency | N/A | 90%-95% | High | Competitive with alternatives |

The Path Forward: Market Opportunities and Technological Evolution

Looking ahead, the energy storage market presents tremendous opportunities. According to the National Development and Reform Commission and National Energy Administration's "New Energy Storage Large-scale Construction Action Plan (2025-2027)", China is expected to have more than 180 GW of new energy storage capacity by the end of 2027.

This will require approximately 85 GW of new installations from the first half of 2025, driving direct project investment of about $34.75 billion.

The global distributed energy storage market is also expanding rapidly, particularly in the commercial and industrial sector. Data shows that in the first half of 2023, user-side new energy storage installations reached 138 MW, with commercial and industrial storage accounting for over 80% of this capacity.

In 2025, the market continues to expand, with first-quarter user-side commercial and industrial storage installations reaching 776.13 MW/1924.71 MWh, a 54.85% year-on-year increase in capacity .

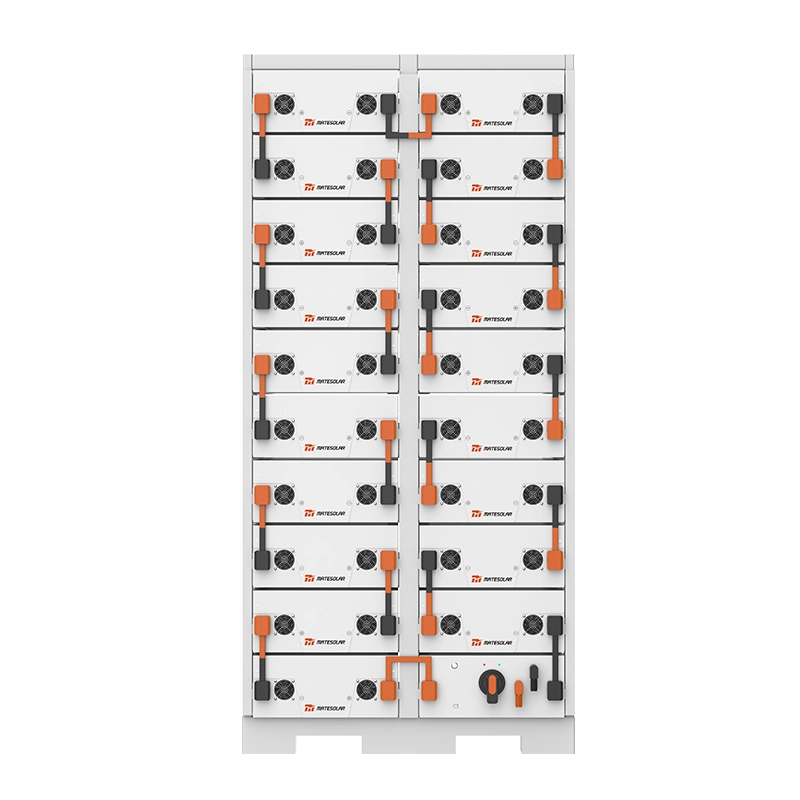

For businesses seeking to leverage these opportunities, MateSolar's Solar System products

https://www.mate-solar.com/category/system

provide comprehensive monitoring and management solutions that optimize performance and ROI of solar-plus-storage installations. These integrated systems are particularly valuable as the industry moves toward more sophisticated operational requirements.

For larger installations, the 250KW Hybrid Solar System

offers a complete solution for commercial and industrial applications, combining high-efficiency generation with advanced storage technology and intelligent energy management.

FAQs: Understanding the IRENA Report and Energy Storage Trends

Q1: Why is the IRENA report significant for the solar and storage industry?

This report represents the first comprehensive energy storage study from a major international renewable energy organization, with unprecedented participation from industry leaders including CATL . It provides authoritative validation that solar-plus-storage has become the most economical green energy solution, which should accelerate policy support and investment globally.

Q2: How quickly is energy storage capacity growing in China?

China's new energy storage capacity has experienced phenomenal growth, reaching approximately 95 GW by the first half of 2025 . This represents a 110% increase year-on-year and is 32 times the capacity at the end of the 13th Five-Year Plan period.

Q3: What are the main revenue streams for energy storage projects?

Energy storage projects typically generate revenue through multiple streams: peak-valley price arbitrage (the core revenue source), demand management (reducing maximum monthly demand to lower capacity charges), demand response payments, and policy subsidies . In regions with favorable policies, internal rates of return can reach 15% or higher .

Q4: How are energy storage technologies evolving beyond lithium-ion?

While lithium-ion continues to dominate, alternative technologies are gaining traction. Flow batteries and compressed air storage have increased their market share by 0.6% and 0.5% respectively since 2023 . Solid-state batteries are advancing through oxide, polymer, and sulfide pathways, with oxide-based batteries showing particular promise for storage applications.

Q5: What policy changes are driving the energy storage market evolution?

The industry is moving away from mandatory storage allocation policies toward market-driven mechanisms. Key policy developments include the national rollout of electricity spot markets, green electricity direct connection policies, zero-carbon park requirements, and the introduction of capacity compensation mechanisms for independent storage.

The IRENA report underscores a pivotal moment in global energy transition—solar coupled with storage has achieved economic superiority over conventional options . This technological evolution, supported by increasingly favorable policies and market mechanisms, creates unprecedented opportunities for businesses and investors alike.

As lithium-ion technology continues to advance while alternative storage solutions gain market share, the entire energy ecosystem is transforming toward greater flexibility, sustainability, and resilience.

Companies that recognize these trends and position themselves to leverage integrated solar-storage solutions will be best positioned to benefit from the energy transition already underway.

MateSolar is committed to being your trusted partner in this transition. As a comprehensive photovoltaic energy storage solution provider, we offer end-to-end services from design and installation to maintenance and optimization of solar-plus-storage systems tailored to your specific needs. Our expertise ensures you can navigate this evolving landscape effectively, maximizing both economic and environmental returns from your energy investments.