The global commercial and industrial energy storage sector is undergoing an unprecedented revolution, transforming from a supporting player into a cornerstone of the world’s energy transition.

The global commercial and industrial (C&I) energy storage sector is undergoing an unprecedented revolution, transforming from a supporting player into a cornerstone of the world’s energy transition. With policy support strengthening and technological breakthroughs accelerating, C&I storage has achieved critical economic viability, creating substantial value for businesses worldwide through multiple revenue streams including peak-valley arbitrage, demand charge management, and carbon credit monetization.

By 2025, countries are implementing differentiated strategic approaches to storage deployment. China focuses on large-scale aggregation while Europe and the U.S. emphasize local supply chains, and the Middle East emerges as a surging market. Against this backdrop, C&I storage stands out as the most flexible and economically attractive segment, opening a $120 billion blue ocean market between 2025 and 2030.

Policy Tailwinds: Reshaping the Global Energy Storage Landscape

Global energy storage policies have entered a golden age of intensive introduction. According to the International Energy Agency, global energy storage investment will surge to $65 billion in 2025, a 49% year-on-year increase, with C&I storage becoming one of the fastest-growing segments.

China’s Scale-first Strategy demonstrates unprecedented determination. The National Development and Reform Commission and National Energy Administration’s “New Energy Storage Large-scale Development Action Plan (2025-2027)” explicitly states that by 2027, new energy storage should achieve large-scale market-oriented development, with costs dropping 30% compared to 2023 levels. This policy directly activates the market - Jiangsu Energy Regulatory Office data shows that in the first half of September 2025 alone, domestic energy storage project bidding reached 25.8GW/69.4GWh, a staggering 521.7% year-on-year increase. In provinces like Shandong and Shanxi, where peak-valley price differentials have widened to 0.7 yuan/kWh, the internal rate of return for independent energy storage power stations exceeds 12%.

Europe’s Localization Barriers are reshaping supply chains. The EU’s “Net Zero Industry Act” requires that by 2030, at least 40% of photovoltaic modules, batteries and other net-zero technology products sold in the market must originate from local manufacturing. Germany and France have taken the lead in implementing “30% local content” bidding rules, where non-EU component participation in public projects results in scoring deductions.

Spain’s Regulatory Innovation sets a benchmark for European markets. The newly enacted “Royal Decree Law 7/2025” classifies energy storage as being of “public utility” and includes it in the “urgent approval” green channel, while setting a national target of 22.5GW of energy storage capacity by 2030 . What’s even more noteworthy is that Spain’s updated grid access priority rules (RD 917/2025) eliminate the concept of “non-manageable generation” and explicitly incorporate storage, while renewable energy with storage equipment receives priority dispatch.

The Middle East’s “Dark Horse” Market continues to exceed expectations. With economic diversification pressures and ideal solar resources (annual solar radiation exceeding 2000kWh/m²), the region has become a testing ground for global C&I storage applications. Saudi Arabia’s NEOM new city is tendering 19GWh of energy storage projects, while the UAE’s Masdar, in partnership with PowerChina, is developing 5.2GW photovoltaic + 19GWh energy storage, with a single contract value reaching $6 billion.

Technology Breakthroughs: Triple Revolution Reshaping the Economics of Storage

The economic viability of C&I storage stems from three technological revolutions fundamentally changing its performance parameters.

The Long-Duration Energy Storage Revolution is breaking the “8-hour barrier.” Haichen Energy’s global first 1175Ah thousand-ampere-hour battery has achieved mass production, with a single capacity 3.7 times that of traditional 314Ah batteries and a cycle life of 8,000 cycles (capacity retention rate ≥ 90%). The matching 6.25MWh liquid cooling system enables 4-8 hours of continuous discharge, reducing the levelized cost of storage to below $0.02/kWh.

Liquid Cooling Technology has become essential for high-temperature environments. Middle East field tests show that Sungrow’s liquid cooling energy storage system controls the battery temperature difference within 2°C in 50°C environments, improving efficiency by 12% compared to air cooling systems. After applying this technology in Saudi Arabia’s Red Sea New City project, energy storage availability jumped from 85% to 98%.

Grid-Forming Technology solves the grid’s “inertia deficiency” problem. Huawei’s FusionSolar 9.0 intelligent string-type grid-forming energy storage solution, released in 2025, represents a breakthrough in this field. The solution achieves six core grid-forming capabilities: short-circuit current support, virtual inertia support, wide-frequency oscillation suppression, fast primary frequency regulation, minute-level black start, and seamless grid-on/grid-off switching. In practical applications, German Schoenergie’s project using grid-forming inverters achieved millisecond-level frequency response, restoring power within 100ms during a June 2025 grid fault, preventing 50,000 households from losing electricity.

Table: Technical Parameter Comparison of Major C&I Energy Storage Technologies

| Technology Type | Energy Efficiency | Cycle Life | Duration | Levelized Cost | Application Scenarios |

| Lithium Iron Phosphate | 95-97% | 6,000-8,000 cycles | 2-4 hours | $0.20-0.30/kWh | Peak shaving, frequency regulation |

| Liquid Cooling Lithium Battery | 97-99% | 8,000+ cycles | 4-8 hours | $0.15-0.25/kWh | High-temperature environments |

| All-Vanadium Flow Battery | 70-80% | 15,000-20,000 cycles | 4-12 hours | $0.35-0.45/kWh | Industrial parks, long-duration energy storage |

| Compressed Air Energy Storage | 60-70% | 30,000+ cycles | 8-24 hours | $0.25-0.35/kWh | Large industrial users, regional grids |

| Grid-Forming Energy Storage | 96-98% | 6,000-8,000 cycles | 2-8 hours | $0.25-0.35/kWh | Weak grids, islands, microgrids |

Global Hotspot Analysis: C&I Storage Applications and Economic Returns

C&I storage applications vary across global markets, creating diversified business models and return on investment profiles.

Middle East: The “Arbitrage Miracle” Creates Astonishing Returns

GSL ENERGY’s 4.6MWh containerized energy storage system for a Lebanese industrial and commercial user, combined with a 3MW photovoltaic system, achieves “two charge-two discharge cycles” daily. The project generates direct peak-valley arbitrage of $295,000 annually, demand charge savings of $80,000-120,000, and carbon reduction benefits. If participating in grid frequency regulation services, annual gains can exceed $500,000, with an additional $100,000-150,000 in backup capacity gain. The total carbon reduction of 2,740 tons of CO2 generates $137,000 in annual carbon revenue.

This project’s success demonstrates the perfect combination of the Middle East’s abundant solar resources and C&I storage. The investment payback period is shortened to just 3.8 years, creating an attractive business case for local businesses.

Europe: Multi-Tiered Markets Unlock Value

Spain’s C&I storage market is experiencing explosive growth. The country’s electricity wholesale market daily price differentials are quite attractive - on August 27, 2025, the peak-valley price spread reached €64.47/MWh, with the annual average spread maintained in the €24-38/MWh range, creating attractive arbitrage space for energy storage projects.

More importantly, Spain is exploring long-term power purchase agreements (PPAs) for energy storage. In countries like France, Germany, Italy, and the UK, 7-year pure battery storage PPAs have been implemented, providing industrial users with fixed electricity prices while significantly improving project financing viability. Experts point out that the PPA model will accelerate the release of the first batch of energy storage projects’ market vitality, supplemented by revenues from ancillary services markets and peak-valley arbitrage.

China: Independent Energy Storage Achieves Scale

China’s C&I storage market is showing different characteristics. By the first half of 2025, the country’s new energy storage installed capacity reached 28GW, accounting for 42% of the global total, with grid-side independent energy storage representing 68%. In the C&I sector, the “two charge-two discharge” model combined with dynamic electricity prices has become the standard.

Data from EESA shows that as of October 2024, China’s C&I storage installed capacity reached 3.7GWh, a year-on-year increase of over 3 times, with full-year installed capacity expected to reach 6GWh, a year-on-year increase of over 50%. A typical C&I storage project in Zhejiang Province under the “two charge-two discharge” model, considering peak-valley price differences of 0.7 yuan/kWh, can achieve an internal rate of return of up to 27.59%.

Table: Economic Comparison of Typical C&I Energy Storage Projects in Different Regions

| Region | Typical Configuration | Investment Cost | Main Revenue Sources | Annual Revenue | ROI | Payback Period |

| Middle East | 3MW PV + 4.6MWh Energy Storage | $1.8-2.2 million | Peak-valley arbitrage, demand charge savings, carbon trading | $500,000+ | 22-28% | 3.5-4.5 years |

| Southern Europe | 2MW/4MWh Energy Storage | $1.2-1.5 million | Electricity arbitrage, ancillary services, capacity markets | $350,000-450,000 | 18-25% | 4-5.5 years |

| China | 1MW/2MWh Energy Storage | $600,000-800,000 | Peak-valley spread, capacity leasing | $150,000-200,000 | 15-20% | 5-7 years |

| North America | 3MW/6MWh Energy Storage | $2.0-2.4 million | Demand management, backup power, VPP participation | $600,000-800,000 | 20-26% | 3.8-5 years |

| Southeast Asia | 500kW/1MWh Energy Storage | $300,000-400,000 | Diesel displacement, power quality improvement | $80,000-120,000 | 12-18% | 5.5-8 years |

Future Outlook: Opportunities and Challenges in the 2025-2030 C&I Storage Market

Between 2025 and 2030, the global C&I energy storage market will maintain rapid growth while undergoing profound structural changes.

Technology Iteration will further reduce costs and improve efficiency. Sodium-ion batteries with costs 30% lower than lithium batteries are already being deployed - CATL’s 1GWh sodium battery energy storage project in Pakistan is a typical example. Flow battery cycle life has exceeded 20,000 cycles, with Dalian Rongke’s 100MW/400MWh all-vanadium flow battery project operating stably for three years, reducing the levelized cost of storage to $0.035/kWh.

Application Scenarios will continue to expand. The transportation sector has become a new blue ocean for C&I storage. Spain’s Turbo Energy created a 1MW/2MWh solar-storage-charging integrated hub for Uber. Using AI scheduling algorithms, it achieves daily charging for 300 electric vehicles with a grid capacity of only 600kW, boosting peak power supply capability to 1.6MW while reducing charging costs by 40%.

Grid Connection Challenges remain the “last mile” restricting development. According to an IRENA report, currently 20% of global energy storage projects experience grid connection delays exceeding one year. The EU estimates that unified energy storage grid connection standards could release 15GW of stranded projects - a more urgent need than any technological breakthrough.

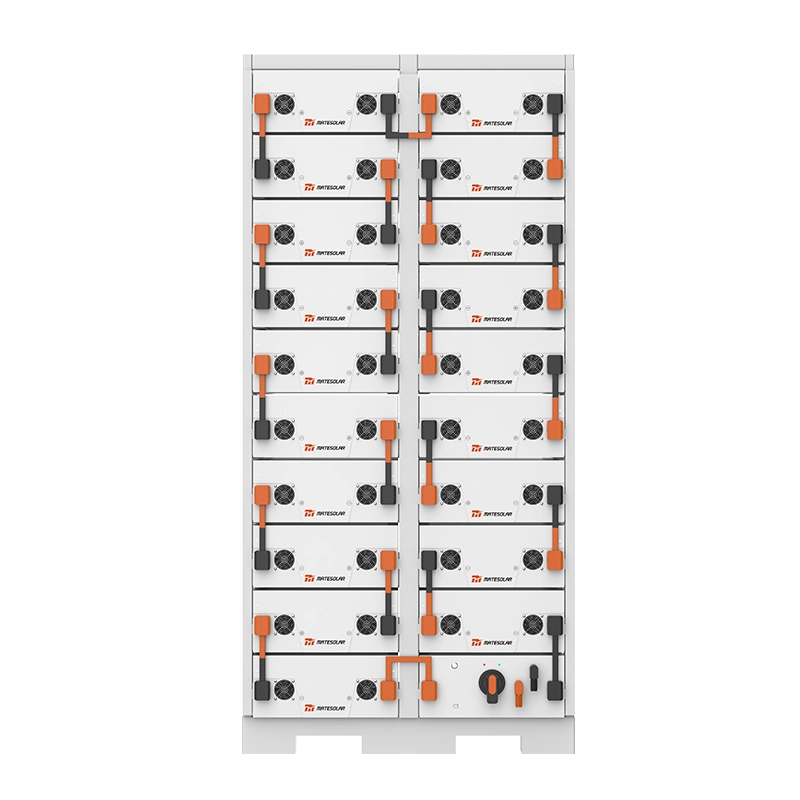

For enterprises considering investing in C&I storage, our 500KW commercial hybrid solar system

provides an ideal solution, particularly suitable for medium and large enterprises or industrial parks with stable electricity demand, typically achieving investment payback periods of 4-6 years.

FAQs: Commercial and Industrial Energy Storage

Q1: What are the main revenue sources for commercial and industrial energy storage projects?

A: C&I energy storage projects mainly generate revenue through: (1) Peak-valley arbitrage - charging during low electricity price periods, discharging during high price periods; (2) Demand charge management - reducing maximum power demand to lower basic electricity fees; (3) Ancillary services - participating in grid frequency regulation, backup capacity and other services; (4) Carbon trading gain - obtaining carbon emission reduction gain through clean energy use; (5) Government subsidies - obtaining equipment subsidies or tax incentives from some regions.

Q2: What is the typical investment payback period for C&I energy storage projects?

A: Currently, C&I energy storage projects typically have payback periods of 3-8 years, depending on local electricity price differences, policy support, and utilization rates. The Middle East region can achieve 3.5-4.5 years, Europe and the United States 4-6 years, while China and Southeast Asia generally take 5-8 years. For example, a 4.6MWh project in Lebanon achieves a payback period of just 3.8 years through “two charge-two discharge” cycles and multiple revenue streams.

Q3: What are the key technological advancements currently driving C&I storage development?

A: Key technologies include: (1) Long-duration energy storage technology - represented by 1175Ah large-capacity batteries, achieving 4-8 hour energy storage duration; (2) Liquid cooling technology - solving heat dissipation problems in high-temperature environments; (3) Grid-forming technology - enabling energy storage systems to independently support grid frequency and voltage; (4) AI scheduling algorithms - optimizing charge-discharge strategies to maximize gains.

Q4: How do different countries’ policies affect C&I energy storage economics?

A: Policies directly impact C&I storage economics through: (1) Subsidy policies such as the U.S. IRA bill’s 30% tax credit; (2) Market mechanisms including China’s requirement for new energy projects to configure storage, and Europe’s capacity market; (3) Grid connection policies like Spain’s energy storage “emergency approval” green channel; (4) Electricity price mechanisms such as China’s expansion of peak-valley price differences, directly increasing energy storage arbitrage space.

For businesses with unstable power supply or high energy costs, our solar photovoltaic energy storage power system provides a comprehensive solution covering project planning, equipment supply, installation and commissioning, and after-sales service, ensuring projects achieve maximum economic benefits.

MateSolar, as a one-stop photovoltaic energy storage solution provider, is committed to offering global customers high-quality, efficient, and reliable C&I energy storage products and customized solutions. Our team of professional engineers possesses extensive industry experience and technical expertise to provide you with comprehensive energy optimization services, helping your business achieve energy transition and cost reduction goals in the new energy era.

Take the first step toward energy independence—contact MateSolar today for a personalized commercial energy storage assessment!