The convergence of dramatically lower battery costs and sophisticated revenue stacking models has transformed solar-plus-storage from an environmental statement into an economic powerhouse.

The global energy landscape is undergoing a historic transformation. As solar adoption accelerates, the integration of energy storage systems is emerging as the critical component for maximizing returns and ensuring grid stability. What was once considered a premium add-on for environmental enthusiasts has now become an economic imperative for energy investors, utilities, and consumers alike.

In 2025, the solar-plus-storage equation has fundamentally shifted. Plummeting battery costs, expanding revenue opportunities, and increasingly sophisticated AI-driven management platforms have converged to create unprecedented investment opportunities. This comprehensive analysis explores the economic fundamentals, diverse revenue models, and strategic implementation frameworks that define today's solar-storage market.

The Dramatic Shift in Storage Economics

Unprecedented Cost Reductions

The cornerstone of the storage boom lies in dramatic manufacturing improvements and technological advancements. According to China Report Hall's *2025-2030 China Energy Storage Industry Market Analysis and Prospect Forecast Report*, the past two years have seen structural cost declines in battery production. Phosphate iron lithium battery prices per watt-hour have decreased by approximately 45% since early 2023, driving down overall energy storage system investment costs to the $120-150/kWh range.

This precipitous cost decline has fundamentally altered project economics. For commercial and industrial energy storage projects in China, Internal Rate of Return (IRR) has risen to 8%-12%, representing an increase of over 3 percentage points compared to the same period in 2023. Similar improvements are being observed across global markets, though with regional variations based on local incentives and market structures.

Policy Tailwinds Accelerating Adoption

Governments worldwide are implementing regulatory frameworks that actively enhance storage economics. China's "New Energy Storage Project Management Specification (2025 Revision)" explicitly requires new energy power stations to have storage allocation ratios of no less than 15%-20%, releasing significant grid-side independent storage demand.

Meanwhile, in the United States, the IRA bill's tax credit policies for domestic storage manufacturing have created favorable economic conditions, even as system costs remain approximately $20/kWh higher than Chinese production lines. These policy interventions are accelerating the globalization of the supply chain while improving project returns through direct financial incentives.

Multi-Layered Revenue Models: Beyond Single-Market Arbitrage

The Evolution from Simple to Sophisticated Returns

Traditional storage economics relied heavily on single-revenue streams, typically focused on peak-valley price arbitrage. This limited approach exposed projects to market volatility and significantly extended payback periods. The breakthrough in 2025 storage economics comes from stacking multiple revenue streams that collectively enhance project viability.

Table: Revenue Stream Composition for Solar-Plus-Storage Projects in Different Markets

| Revenue Stream | Grid-Scale Projects | Commercial & Industrial | Residential Projects |

| Peak-Valley Arbitrage | 45-60% of total revenue | 50-70% of total revenue | 60-80% of total revenue |

| Frequency Regulation | 20-30% of total revenue | 10-20% of total revenue | Typically unavailable |

| Capacity Payments | 15-25% of total revenue | 5-15% of total revenue | Typically unavailable |

| Green Certificate Trading | 5-10% of total revenue | 5-10% of total revenue | 10-20% of total revenue |

| Backup Power Value | Minimal | 5-10% of total revenue | 10-15% of total revenue |

Case Study: Inner Mongolia's Multi-Dimensional Profit Model

Inner Mongolia has pioneered a comprehensive approach to storage economics that effectively transforms storage facilities from cost centers to profit centers. The region has developed a "discharge compensation + spot price difference" multidimensional income model.

For independent new energy storage stations included in the regional storage plan, a compensation mechanism provides 0.35 yuan/kWh for discharge volume to the grid, guaranteed for 10 years at rates determined annually. This stable revenue base combines with participation in electricity spot market transactions, where stations charge during low-price periods and discharge during high-price periods.

The results have been remarkable. The Wan Success 200MW/800MWh energy storage station project in the Kubuqi Desert, operational since June 2025, had already generated 37.0443 million yuan in revenue (including capacity compensation) and realized 9.99 million yuan in profit by the end of August. The project is expected to achieve 29 million yuan in profits in 2025, demonstrating a comprehensive Yield of over 20%.

Global Case Studies: Proven Economic Returns

United States: Tax Credit Enhancement

In the United States, the IRA tax credit provisions have significantly improved storage economics. A 100MW/200MWh project in Texas combines peak-valley arbitrage with frequency regulation services to achieve an IRR of 18% with a payback period of 4.2 years. The project leverages investment tax credits while participating in ERCOT's ancillary services market, creating a diversified revenue stack that minimizes exposure to any single price volatility.

Major technology companies are driving substantial investment in this space. Google's partnership with energyRe on a 600MW solar-plus-storage project in South Carolina demonstrates how corporate sustainability goals align with improving storage economics. Similarly, Google's collaboration with Salt River Project (SRP) to advance non-lithium long-duration energy storage (LDES) technologies points to the next frontier of storage innovation beyond current lithium-ion dominance.

China: Policy-Driven Optimization

China's storage economic model has been boosted by the expansion of peak-valley price differences to 0.7-1.2 yuan/kWh across different provinces, combined with capacity compensation mechanisms for new energy storage participating in electricity markets. These policies have dramatically improved project returns.

The Shandong Shifeng Group project illustrates this optimized economic model. Their 20MW/40MWh centralized storage + 0.8MW/1.6MWh commercial storage project utilizes a "two charge, two discharge" strategy (peak-valley price difference arbitrage + peak-shaving auxiliary services) to achieve expected annual revenues of 12 million yuan with an investment payback period of 5.8 years.

The project's technical specifications highlight why such returns are possible: using a "one cluster, one optimization" architecture with BMS sampling accuracy reaching ±0.5% and PCS conversion efficiency of 98.5%. During grid peak-shaving tests, the system demonstrated a response speed of 200MW per minute, earning 860,000 yuan in auxiliary service revenue.

Australia: AI-Driven Revenue Optimization

The Australian market exemplifies both the challenges and solutions for storage economics in volatile electricity markets. Research revealed that as electricity price volatility narrows, traditional "single-market arbitrage" becomes ineffective. The solution has emerged in the form of "multi-layered revenue structures" enabled by AI-driven management platforms.

Deye Copilot's AI-powered "Energy Saver," deployed in Australia and serving 140 countries, creates a two-tier revenue model of "base income + value-added income". For individual stations, stable returns rely on accurately capturing electricity price windows. The AI-based core algorithm integrates real-time electricity prices, weather forecasts, load predictions, and battery health data to enable automated "charge at low price + discharge at high price" operations.

The results from users demonstrate the economic impact:

- A Sydney user with a 40kWh Deye low-voltage energy storage system and 23kWP PV installation saw average monthly income increase to AUD 300—AUD 80 more than manual scheduling—reducing the payback period from 7.58 years to 5.56 years.

- A Melbourne user with a 20kWh storage system and 10kWP PV installation allocated 50% for personal station dispatch and 50% for VPP services, generating approximately AUD 160 from personal dispatch and AUD 232 from VPP participation monthly.

Strategic Implementation Frameworks

Technology Selection: Balancing Performance and Cost

The optimal technology configuration varies significantly by application and market. For grid-side projects, the trend is toward "power-type + energy-type" hybrid configurations that can simultaneously participate in frequency regulation and energy arbitrage markets, increasing overall revenue by up to 25% compared to single-function systems.

For commercial and industrial applications, load monitoring + intelligent dispatch systems have demonstrated remarkable improvements in self-consumption rates—in some cases increasing from 35% to 65%—delivering electricity bill savings exceeding 40%.

Residential systems increasingly integrate electric vehicles into a comprehensive "solar-storage-vehicle" collaborative system that improves overall economics by more than 50% compared to standalone solar-plus-storage.

Table: Solar-Plus-Storage System Configurations for Different Applications

| Application | Recommended Storage Duration | Key Technologies | Typical System Efficiency | Expected Cycle Life |

| Grid-Scale | 4+ hours | Liquid cooling, "one cluster one optimization" | 88-92% | 8,000-12,000 cycles |

| Commercial & Industrial | 2-4 hours | Modular design, seamless grid transfer | 90-94% | 6,000-10,000 cycles |

| Residential | 1-2 hours | Integrated inverter, V2G capability | 92-96% | 5,000-8,000 cycles |

Financial Structures: Reducing Capital Barriers

Innovative financing mechanisms have emerged to address the upfront cost challenges that previously hampered storage deployment.

In China, the 30-year special government bonds with coupon rates of 2.57% have created historically low financing cost windows. One leading photovoltaic enterprise calculated that using government bond funds to build smart factories reduced full-cycle financing costs by 40% compared to commercial loans, equivalent to saving 230 million yuan in financial expenses per GW of capacity.

Globally, development finance institutions have launched specialized products like the "Green Storage Loan" from China Development Bank (interest rates 3.2%-4.5%) and the European Investment Bank's "Storage Innovation Fund" that significantly reduce financing costs for qualified projects.

For residential and small commercial applications, equipment financing models patterned after the "device financial leasing + technology investment" approach that Ningde Times employed in its Hungarian 100GWh storage factory project can improve project IRR to 22%.

The Global Market Outlook

Explosive Growth Across Market Segments

The global storage industry is experiencing what can only be described as explosive growth across all market segments. The industry stands at a critical juncture similar to the early explosive growth phase of the photovoltaic industry

In overseas markets, Europe, the United States, and Australia have entered a phase of scaled deployment since 2024. Statistics show that global residential energy storage installations have increased by 180% year-over-year, while commercial and industrial storage project bidding volumes have exceeded 35GW.

This growth is restructuring the entire lithium battery industry chain. With global energy storage installation capacity expected to break through the 300GWh mark in 2025, the demand structure of the lithium battery market has undergone a fundamental shift—the proportion of power and storage applications has reversed from the previous 7:3 to 4:6. This transformation has effectively alleviated power battery overcapacity pressure while prompting upstream material companies to accelerate research and development of high-energy-density, long-cycle-life specialized storage battery technologies.

Strategic Recommendations for Investors

Based on current market dynamics and projected trends, investors should prioritize several key areas:

1. Focus on Integrated Solution Providers: Companies with system integration technological advantages, specialized long-life battery cell manufacturers, and inverter companies with global certification qualifications will benefit first from the storage boom.

2. Diversify Across Geographic Markets: With significant regional variations in policy support and market structures, a global portfolio approach mitigates regulatory risk while capturing premium returns in specific markets like the U.S. (IRA tax benefits) and China (provincial storage mandates).

3. Embrace Multi-Revenue Models: Projects designed from inception to capture multiple value streams—combining energy arbitrage, ancillary services, capacity payments, and green certificates—demonstrate significantly more resilient economics than single-revenue models.

4. Leverage Advanced Management Platforms: AI-driven optimization platforms like Deye Copilot have demonstrated their ability to enhance returns by 20-30% compared to manual operation or simple rule-based systems.

FAQ: Addressing Key Investor Questions

Q: What is the realistic payback period for solar-plus-storage projects in 2025?

A: Payback periods have improved dramatically and now typically range from 4-6 years for commercial projects and 5-7 years for residential systems, down from 7-10 years just two years ago. Specific returns depend on local electricity rates, policy incentives, and system optimization.

Q: How significant are operational differences between basic and AI-optimized storage systems?

A: The difference is substantial. Real-world data from Australia shows AI-optimized systems can generate 20-30% higher revenue through more precise price arbitrage timing and participation in multiple value streams like frequency regulation services.

Q: What percentage of solar generation should be paired with storage for optimal economics?

A: For most commercial applications, storage sizing of 1-2 hours of nameplate solar capacity currently provides the best economics, allowing multiple daily charge-discharge cycles. Grid-scale projects are trending toward 4-hour systems to capture extended discharge revenue opportunities.

Q: How does battery degradation impact long-term returns?

A: Modern lithium iron phosphate (LiFePO4) batteries typically retain 80% of capacity after 6,000-8,000 cycles. Advanced battery management systems can extend this further, with some systems now rated for 12,000 cycles while maintaining 80% capacity.

Q: Which markets offer the strongest policy support for storage?

A: Currently, China (through provincial mandates and capacity payments), the United States (via IRA tax credits), and Australia (through innovative frequency control markets) provide the most favorable policy environments, though regulatory frameworks are evolving rapidly across global markets.

Conclusion: The Storage Economic Tipping Point

The solar-plus-storage industry has reached a definitive economic tipping point in 2025. The combination of dramatically reduced battery costs, sophisticated multi-revenue models, and AI-driven optimization platforms has transformed energy storage from a marginal investment into a compelling financial opportunity.

For project developers, energy consumers, and investors, the imperative is clear: understanding and leveraging the new economic fundamentals of solar-plus-storage is no longer optional for maximizing returns in the evolving energy landscape. The convergence of cost curve inflection points, policy dividend releases, and overseas market expansion—the three core driving forces—positions the storage industry as potentially the most certain source of excess returns in the new energy field.

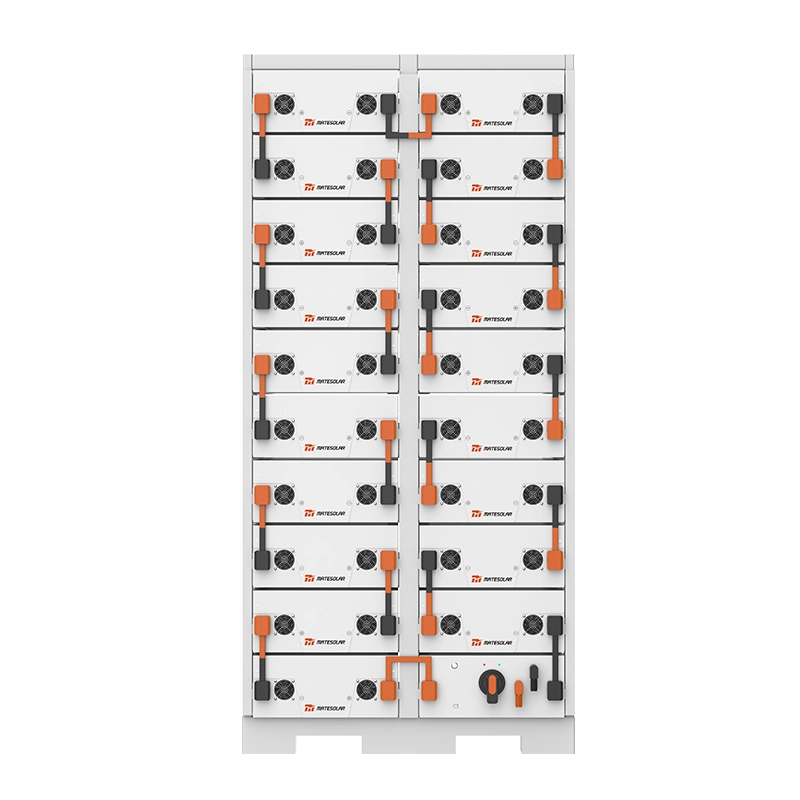

As you explore how these developments can benefit your specific energy needs, we invite you to learn more about Google's approach to solar and storage solutions through our Solar Photovoltaic Storage Power System overview and specifically consider the 500KW Hybrid Solar System

for larger residential or small commercial applications.

MateSolar specializes in delivering integrated solar-plus-storage solutions that leverage these evolving economic fundamentals to maximize client returns. As a one-stop photovoltaic energy storage solution provider, we combine technology agnostic design with sophisticated revenue optimization platforms to ensure your investment delivers superior financial and operational outcomes in today's dynamic energy markets.