An in-depth analysis of the post-"One Big Beautiful Bill" era, providing a roadmap for small and medium enterprises to secure subsidies and build resilient revenue streams.

Executive Summary: The New Rules of the Game

The U.S. commercial and industrial (C&I) energy storage market stands at a critical juncture. The passage of the One Big Beautiful Bill Act in July 2025 has fundamentally reshaped the policy landscape, introducing stringent new requirements for federal tax credits. For small and medium-sized businesses (SMBs), this represents both a formidable challenge and a significant opportunity. The core challenge is clear: navigate complex domestic content and Foreign Entity of Concern (FEOC) rules to secure the full Investment Tax Credit (ITC), or risk leaving a 30-40% subsidy on the table. Simultaneously, businesses must move beyond simple peak shaving to build a multi-layered, profitable operation that leverages virtual power plants (VPPs) and grid services.

This guide provides a comprehensive, actionable framework for SMBs to achieve full subsidy compliance while constructing a robust, diversified revenue model. We will dissect the updated IRA regulations, outline proven financial structures, detail advanced revenue stacking strategies, and demonstrate how modern, modular storage technology is the key to unlocking this potential.

Part 1: Policy Deep Dive - Securing Your 40% ITC in a Tightening Regulatory Environment

The foundational economic driver for any U.S. storage project remains the federal Investment Tax Credit (ITC), now directly impacted by the new legislation.

Understanding the "One Big Beautiful Bill" Amendments

The Act, signed into law in July 2025, has tightened the incentives under the Inflation Reduction Act (IRA) with two pivotal changes:

1. Strict Domestic Content Bonuses: To qualify for the base 30% ITC plus the 10% domestic content bonus (totaling 40%), projects must meet escalating U.S. manufacturing requirements. The threshold for photovoltaic components rises to 55% by 2027. This applies to structural components like modules and cells.

2. Stringent FEOC Exclusions: Beginning in 2026, projects that source battery components from Foreign Entities of Concern (FEOC) will be entirely excluded from the federal incentive system. An FEOC is defined as an entity owned 25% or more by the government of a "foreign country of concern," which includes China, Russia, Iran, and North Korea. This rule extends beyond direct ownership to include subsidiaries and entities under effective control.

Table 1: Key IRA Compliance Milestones & FEOC Rules for C&I Storage

The Compliance Pathway: A Practical Guide for SMBs

For an SMB, navigating these rules requires a proactive, documented approach:

- Partner with Providers Offering U.S.-Integrated Assembly: Seek out energy storage providers who offer solutions assembled in the U.S. through partnerships with domestic factories. The key is obtaining verifiable Localization Traceability Proof for core components like battery cells, modules, and power conversion systems (PCS).

- Demand Supply Chain Transparency: Your provider should be able to document the origin and value-add of critical components, ensuring the aggregate cost meets the domestic content percentage. Do not accept vague assurances; require detailed Bills of Materials (BOMs) and supplier certifications.

- Prioritize Non-FEOC Battery Cells: This is the most critical component. Given the 2026 deadline, ensure your battery cells are sourced from manufacturers with clearly documented ownership structures outside FEOC jurisdictions, such as South Korea, Japan, or emerging U.S. production facilities.

Part 2: Building a Resilient & Profitable Revenue Stack

Gone are the days when simple commercial time-of-use arbitrage was sufficient. The most profitable C&I storage assets today act as flexible grid resources. The Federal Energy Regulatory Commission (FERC) Order 2222 has been a game-changer, allowing aggregated distributed energy resources (DERs) as large as 15MW to participate in regional wholesale markets.

The Three-Pillar Revenue Model

We advocate for a diversified "60/30/10" revenue stack that balances steady income with high-value grid services.

- Pillar 1: Peak Shaving & Energy Arbitrage (60% of Revenue)

- This remains the foundational earnings stream. By charging batteries during off-peak, low-cost hours and discharging during expensive peak hours, businesses directly slash their utility bills. In markets like California (CAISO) or Texas (ERCOT), where peak-to-off-peak price differentials can be extreme, this alone can deliver a strong return. The model from a Kunming, China, glass factory is instructive: a 70,000 kWh annual discharge yielded significant cost savings, proving the fundamental economics.

- Pillar 2: Frequency Regulation Services (30% of Revenue)

- This is where significant additional value is captured. Grid operators like CAISO and ERCOT pay for rapid injections or absorptions of power (measured in milliseconds) to maintain grid frequency at 60 Hz. Modern battery systems with response times of ≤100ms are ideal for this service. Revenue is earned through capacity payments (for being available) and performance payments (for accurate, fast response). Theoretical models show that for a virtual power plant (VPP) participating in both energy and frequency markets, storage utilization can increase by nearly 30% compared to participating in only one market.

- Pillar 3: Demand Charge Management & VPP Participation (10% of Revenue)

- This pillar focuses on capacity-based savings and aggregation. Utilities often charge commercial customers a "demand charge" based on their highest 15-minute power draw in a billing cycle. Storage can smoothly shave these peaks. Furthermore, by aggregating with other assets through a Virtual Power Plant (VPP) platform like Sunrun or others, your storage can be dispatched as a single, larger resource to meet grid needs, earning capacity payments or shared revenue from the VPP operator. Suzhou Taihu New City Energy Center in China provides a real-world case: by aggregating its cooling load into a VPP for demand response, it earns approximately $2,000 per event and about $50,000 annually.

*Table 2: Sample Annual Revenue Potential for a 500kW/1MWh System in ERCOT (Texas)*

| Revenue Stream | Mechanism | Estimated Annual Revenue | Notes & Requirements |

| Energy Arbitrage | Buy low, sell high based on wholesale or time-of-use rates. | $40,000 - $70,000 | Highly dependent on market volatility and price spreads. |

| Frequency Regulation | Provide fast-responding power to grid operator (e.g., ERCOT's Reg-Up/Down). | $30,000 - $60,000 | Requires fast-responding inverter (<100ms) and market participation agreement. |

| VPP Capacity/Dispatch | Provide capacity or energy through an aggregator to the grid. | $10,000 - $20,000 | Requires contract with a VPP aggregator; revenue can be fixed or performance-based. |

| Demand Charge Reduction | Reduce peak power draw from the grid, lowering utility fees. | $15,000 - $30,000 | Direct savings on utility bill, not a direct "revenue" stream but critical for ROI. |

| Total Potential | $95,000 - $180,000 | Illustrates the $95-180/kWh range. Assumes optimal operation and market access. |

Part 3: Financial Engineering: Overcoming the Initial Investment Hurdle

High upfront cost is the primary barrier to entry. Fortunately, innovative financial models directly address this.

- "Zero-Down" SOL Loans: Specialized lenders like Sunstone Credit now offer Solar & Storage Opportunity Loans (SOL). These can cover 100% of project costs with terms up to 10 years. The monthly loan payment is structured to be less than the projected monthly energy savings, creating positive cash flow from day one.

- Integrating the ITC: The beauty of the federal ITC is its direct application to tax liability. With a "zero-down" loan, the business owner receives the 30-40% ITC credit after project completion. This capital can be used to:

- 1. Make a large principal payment on the loan, drastically reducing monthly payments.

- 2. Replenish working capital.

- 3. Reinvest in business operations.

- Alternative Models: EMC and Leasing: For businesses that cannot utilize tax credits directly, Energy Management Contracts (EMC) or leasing arrangements are ideal. A third-party investor owns, installs, and maintains the system, selling the stored energy to the host business at a discounted rate. The "Yiqichu" model from China, which offered 0% down and a 2.5% interest rate, demonstrates the power of such structures to unlock the market.

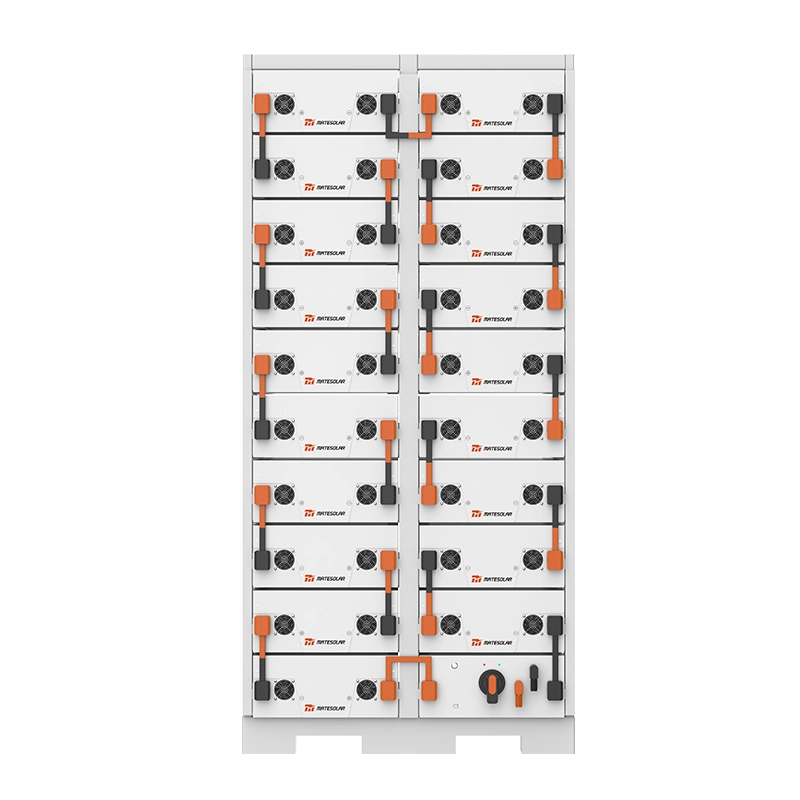

Part 4: The Technology Enabler: Modular, Grid-Interactive Systems

To participate in advanced revenue streams, the technology must be capable. Modern C&I storage solutions are defined by:

- Modularity & Scalability (1-15MW): Systems should be built from pre-integrated, containerized units (like 500kW building blocks) that can be easily stacked or paralleled to meet exact needs and allow for future expansion.

- Grid-Forming & Fast Response: Inverters must be capable of "grid-forming" to provide stability in weak grid areas and must have sub-100ms response times to qualify for lucrative frequency regulation markets.

- Advanced Energy Management System (EMS): The brain of the operation. A sophisticated EMS automatically optimizes dispatch across all revenue streams—scheduling arbitrage, responding to VPP signals, and bidding into ancillary service markets—to maximize total return.

For businesses with high and consistent energy demands, a comprehensive solution like a 500KW Commercial Hybrid Solar System that combines generation and storage is often the most effective path to energy independence and maximized savings. You can explore the technical specifications and benefits of such integrated solutions on our product page for Complete Kit 500KW Commercial Hybrid Solar System.

Part 5: Implementation Roadmap & FAQ

A 12-Month Roadmap to Operation

1. Months 1-2: Energy audit & feasibility study. Analyze utility bills, site constraints, and local market rules (CAISO, ERCOT, etc.).

2. Months 2-4: Secure financing. Obtain loan pre-approval or finalize EMC terms.

3. Months 4-6: Finalize vendor selection. Contract with a provider who guarantees IRA compliance and offers grid-interactive technology.

4. Months 6-9: Interconnection application & permitting. Submit detailed applications to your utility and local authority.

5. Months 9-11: Installation & commissioning.

6. Month 12: Grid connection, VPP enrollment, and commencement of optimized revenue operations.

Frequently Asked Questions (FAQ)

Q1: I'm not sure if my business's energy profile is right for storage. What should I look for?

A: Ideal candidates have: 1) High electricity bills (typically >$10,000/month), 2) A sharp peak demand profile, 3) Operations during peak utility hours, and 4) Available space for equipment. A qualified provider can conduct a free preliminary analysis.

Q2: How do I verify that my storage supplier meets the IRA domestic content rules?

A: Require a detailed Domestic Content Certificate or a Supplier's Certificate of Origin. Reputable providers will have this documentation ready and will often include compliance guarantees in their contracts.

Q3: Is participating in a VPP or frequency market risky for my own energy security?

A: A well-designed system and contract prioritize your facility's needs. The EMS will always maintain a reserve of energy for your critical peak shaving. VPP dispatches are typically for short durations and are forecasted, so they can be planned around.

Q4: What's the typical lifespan and maintenance commitment for a C&I battery system?

A: Modern lithium iron phosphate (LFP) systems are designed for a 15+ year lifespan with 10+ year warranties. Maintenance is minimal, primarily involving periodic inspections, thermal management system checks, and software updates, often covered under a long-term service agreement.

Q5: We have existing solar PV. Can we add storage?

A: Absolutely. Most modern storage systems are AC-coupled, meaning they can be seamlessly added to an existing solar array. This is a highly effective way to increase self-consumption of solar energy and enhance ROI. To understand how storage integrates with various solar setups, you can review the architecture of different Solar Photovoltaic Energy Storage and Power Generation Systems.

Conclusion: The Time for Strategic Action is Now

The U.S. C&I energy storage market is maturing rapidly. The regulatory window for full incentives is clearly defined, and the financial and technological tools to succeed are readily available. The businesses that will thrive are those that view storage not as a simple cost-saving appliance, but as a strategic energy asset—a source of resilient power, a new revenue center, and a cornerstone of their sustainability and financial strategy.

Success requires a partner that understands the entire value chain: from the intricacies of IRA and FEOC compliance to the technical nuances of grid services and the structuring of creative finance. This is where MateSolar positions itself as your essential one-stop solution provider. We combine policy expertise, premium technology, and financial acumen to deliver turnkey solutions that guarantee subsidy maximization and build optimized, profitable energy assets for your business.