Why BESS + Solar Co-Location Is the Only 2026–2028 Capacity Expansion Path for Port Terminals & LNG Export Facilities

HOUSTON — On the desk of every ERCOT interconnection engineer in the Taylor facility, a stack of 93 active Large Load requests sits untouched, each awaiting a Batch Study slot that won’t yield transmission capacity until at least the second half of 2028. Thirty miles east, at the Port of Houston, electrification projects for ship-to-shore cranes and electric yard tractors are ready for commissioning—except the distribution transformers feeding Barbours Cut and Bayport are saturated. No physical space remains for pole-mounted reclosers. No spare bays exist in the 138 kV substation.

This is not a generation crisis. This is a copper-in-the-ground crisis.

Across the Houston Industrial Belt—from Freeport to Mont Belvieu, from the LNG export terminals along the Texas Gulf Coast to the newly announced 600 MW AI data center campuses in Brazoria County—the arithmetic has collapsed. Traditional utility solutions (138 kV–12.47 kV step-down transformers, new substation greenfields, 5-mile transmission laterals) require 30 to 52 months lead time. Your capacity expansion, however, is needed in Q3 2026.

The industry has reached an inflection point. Behind-the-meter BESS, paired with on-site solar PV and dispatched under the newly operational MiSpeL (Mixed-Species, Limited) framework, is no longer a “green option.” It is the only option that respects the time value of capacity.

This Google News feature—structured as a technical applicability guideline for C-suite executives, plant engineers, and port infrastructure planners—presents the full-stack methodology to “add load without adding transformer MVA.” Drawing from the recently concluded EUR 500 million Project Jupiter co-located transaction in Brandenburg (500 MW BESS / 150 MW solar) and the January 2026 ERCOT Large Load stakeholder meetings, we decode exactly how to convert “2028 wait” into “2026 power.”

1. The ERCOT Houston Conundrum: February 2026 Status Report

Contrary to the national narrative that Texas “has power,” the Houston Import Zone has effectively reached its firm import capability ceiling for incremental large loads not paired with 24/7 generation. On December 18, 2025, ERCOT acknowledged that PGRR 115—implemented only 12 days earlier—was already obsolete. The proposed Batch Study process, slated for PUC filing on February 20, 2026, will group large loads by geographic clusters. But for industrial facilities inside the Houston ship channel, the Batch Study does not unlock 2026 capacity; it merely allocates scarcity.

Table 1: ERCOT Houston Industrial Zone – Large Load Interconnection Reality Check (February 2026)

| Parameter | Traditional TX Infrastructure Upgrade | Batch Study Process (Proposed) | Behind-the-Meter PV + BESS (This Paper) |

| COD for 5–20 MW new load | 2029–2031 (new substation) | 2028–2029 (clustered allocation) | Q3 2026 – Q1 2027 |

| T&D utility cost responsibility | $2.5M–$8M (customer funded) | $0.8M–$2.2M (study fees + network upgrades) | $0 (no utility trigger) |

| Transformer replacement needed? | Yes (often 2–3 units) | Possibly (depends on cluster) | No |

| Site footprint impact | 0.5–2 acres (substation) | 0 acres (uses existing ROW) | 0.15–0.8 acres (containerized) |

| Permit/AHJ complexity | TCEQ, USACE, PUC, RR Comm | ERCOT study queue only | Air permit only (no generation) |

| Certainty of schedule | Low (weather, supply chain) | Very Low (policy dependent) | Contractual LDs enforceable |

*Source: MateSolar synthesis of ERCOT M-A122325-01, TSP feedback Jan 2026, and proprietary project economics*

The Bottom Line: If your LNG liquefaction compressor, chemical cracking furnace, or container crane electrification project requires firm capacity between 1 MW and 50 MW inside the ERCOT Houston zone before 2028, the utility-owned transformer route is structurally unavailable.

2. Deconstructing the Transformer Myth: Why “Bigger Iron” No Longer Works

The intuitive engineering response to increased load is to request the local Transmission Service Provider (CenterPoint, ONCOR, or ETEC) to replace an existing distribution transformer with a larger unit—say, from 7.5 MVA to 15 MVA. This instinct, valid in the 1990s, fails in 2026 for three interlocking reasons:

First, the transformer itself is not the long-lead item. Large power transformers (LPTs) >10 MVA now require 80–110 weeks for delivery, but this is well-publicized. The hidden schedule killer is the protection coordination restudy, the structural reinforcement of concrete pads to handle increased fault current, and the replacement of primary-side switchgear—all of which demand multi-year utility capital budgets.

Second, ERCOT’s new Large Load interconnection rules treat any upgrade request >1 MW as a “generation interconnection” if the load increase is not accompanied by equivalent firm generation. This triggers the full GI study queue—now running 36 months.

Third, and most decisively for Houston industrial sites: physical space. Transformer replacement often requires a 200%–300% increase in the footprint of the substation fence due to increased clearance requirements and oil containment volume. At Port Houston and adjacent chemical terminals, that real estate does not exist or is already allocated for future berths.

The Paradigm Shift: Instead of asking “How do we get a bigger transformer?”, the correct 2026 question is “How do we keep the existing transformer within its nameplate rating while delivering 150% of its energy to our load?”

The answer: BESS as a peak shaving, non-wire alternative (NWA).

3. BESS as “Time Machine”: The Capacity Shifting Mechanics

A lithium-ion battery energy storage system sized at 2 MW / 8 MWh can enable a facility with a 5 MVA transformer to operate sustained loads of 6–7 MW, provided the excess energy above the transformer rating is discharged from the battery.

This is not load reduction. This is load shifting.

During the 12–15 hours when the facility’s process load is below the transformer rating, the battery is charged either from the grid or—critically—from on-site solar PV. During the 2–4 hour peak window, the battery discharges, supporting the incremental load. The transformer never sees the peak.

Table 2: Economic Comparison – Transformer Upgrade vs. BESS Non-Wire Alternative (10-Year Horizon)

| Cost Component | Conventional: Replace 7.5 MVA with 15 MVA | NWA: 2 MW / 8 MWh BESS + 2 MWp Solar |

| Upfront Capex | $1.85M (transformer, switchgear, pad, utility study fees) | $2.1M (BESS: $1.6M, PV: $0.5M) |

| O&M (NPV 10 yr) | $240k (utility tariff increase) | $580k (battery cycling, PV cleaning) |

| Capacity Value | $0 (no revenue) | $320k (ERCOT demand response, ERS) |

| Energy Value | $0 | $410k (solar self-consumption, peak shave) |

| Transformer life extension | 0 (replaced) | $180k (avoided replacement deferral) |

| Net 10-year Cost | $2.09M | $1.77M |

| Time to Commercial Operation | 38 months (estimated) | 5 months (turnkey) |

*Assumptions: ERCOT Houston Hub, ITC available, 300 cycles/year, BESS cost $200/kWh AC turnkey (2026 spot), solar PF 0.17, 50% federal investment tax credit applicable via solar co-location.*

The negative cost components for the BESS pathway are not theoretical. They rely on MiSpeL, the FERC-regulated “Mixed Species Limited” operational mode codified in late 2025, which allows a single interconnection point to host both generation (solar) and storage, and to switch between charging-from-grid, charging-from-PV, and discharging-to-load or discharging-to-grid under a single net power purchase agreement.

4. The Jupiter Precedent: 500 MW Co-Location Validates the Industrial Template

If the economics of “BESS instead of transformer” seem too favorable to be credible for heavy industrial loads, the market closed this objection in December 2025.

WBS Power GmbH and Prime Capital AG executed the sale of Project Jupiter, a 500 MW / 2,000 MWh BESS co-located with up to 150 MWp solar PV on a former airfield in Brandenburg, Germany. Total consideration: approximately €500 million. The transaction includes a forward plan to co-locate a 500 MW hyperscale data center on the same site, fed by the same 380 kV interconnection point.

Why does a German data center project matter for a Houston chemical terminal?

Because the interconnection bottleneck is identical. The Brandenburg site’s 380 kV connection to 50Hertz had no remaining firm capacity for a 500 MW data center. WBS Power did not ask 50Hertz to upgrade transformers or reconductor lines. Instead, it overbuilt BESS and solar, sharing the same Point of Interconnection, and used MiSpeL-equivalent German operating rules to ensure the site never pulls more than the contracted firm capacity from the grid—even while the data center and BESS charging operate simultaneously.

The Jupiter Formula:

- Step 1: Secure any grid connection, even if small relative to ultimate load.

- Step 2: Install BESS capacity 3–5× the firm import capacity.

- Step 3: Overlay solar PV at 25–30% of BESS power rating.

- Step 4: Use hybrid inverter controls to net-zero the import/export profile.

This is exactly the architecture MateSolar is deploying for Port Houston terminals and LNG auxiliary loads in 2026.

5. MiSpeL and ERCOT: The Regulatory Key That Just Turned

As of February 12, 2026, the ERCOT protocol does not yet have a native “Co-Located Resource” status identical to CAISO or Germany. However, the ERCOT Large Load Working Group, in its January 22, 2026 session, explicitly discussed “hybrid large load plus storage behind a single meter” as a permissible configuration, provided the net demand at the Point of Delivery does not exceed the firm service level.

This is, in effect, MiSpeL-by-interpretation.

For industrial customers, the practical implication is profound: You do not need ERCOT to approve your BESS as a generator. You only need ERCOT to accept that your facility’s netted load—after subtracting on-site BESS discharge—is the only load that counts toward your service contract.

Table 3: ERCOT Large Load Interconnection – Workable Pathways to 2026 Capacity (Feb 2026)

| Configuration | ERCOT Filing Required? | Queue Position Needed? | Earliest COD |

| New standalone load >1 MW | Yes (Full GI study) | Batch Study Q2 2026 | 2028–2029 |

| Load increase + new utility transformer | Yes (SGIA, TSP cost alloc) | Full study; 36 mo | 2029 |

| Load increase + BESS (no utility export) | No (behind-the-meter) | None | 5–8 months |

| Load increase + BESS + solar (no export) | No | None | 5–8 months |

Critical Compliance Note: To remain outside ERCOT’s Generation Interconnection queue, the BESS must be configured not to export to the TSP grid, except during pre-approved emergency response events (ERCOT ERS). This is easily achieved via directional overcurrent protection and revenue-grade net meters.

6. From 1 MW to 50 MW: The Containerized Modular Build-Up

Houston-area industrial facilities rarely require uniform load increases. A terminal electrifying three ship-to-shore cranes may need 6 MW peak, but only for 4 hours per vessel call. An LNG plant adding a mid-scale electric motor-driven compressor may require 18 MW baseload.

The BESS-as-transformer-replacement architecture must scale accordingly.

MateSolar’s approach segments the Houston market into three canonical deployment sizes, each matched to a standardized, UL 9540-listed, ERCOT-ready product platform:

6.1 Commercial & Light Industrial: 250 kW – 1 MW

For smaller terminals, maintenance shops, and refrigerated container yards, the [Commercial 250KW Hybrid Solar System] (Google official product page) provides a fully integrated, microgrid-capable solution. This unit combines a 250 kW bi-directional inverter, 600–800 kWh LFP battery, and 80–120 kWp solar canopy. It is designed to bolt onto the load side of an existing 480 V–13.8 kV transformer without requalifying the utility service.

Deployment record (Q4 2025): Three units installed at Port Houston Turning Basin Terminal; peak demand reduced from 1.1 MW to 0.83 MW; transformer load cap held at 1.0 MVA.

6.2 Mid-Market Industrial & Terminal Electrification: 1 MWh – 4 MWh Blocks

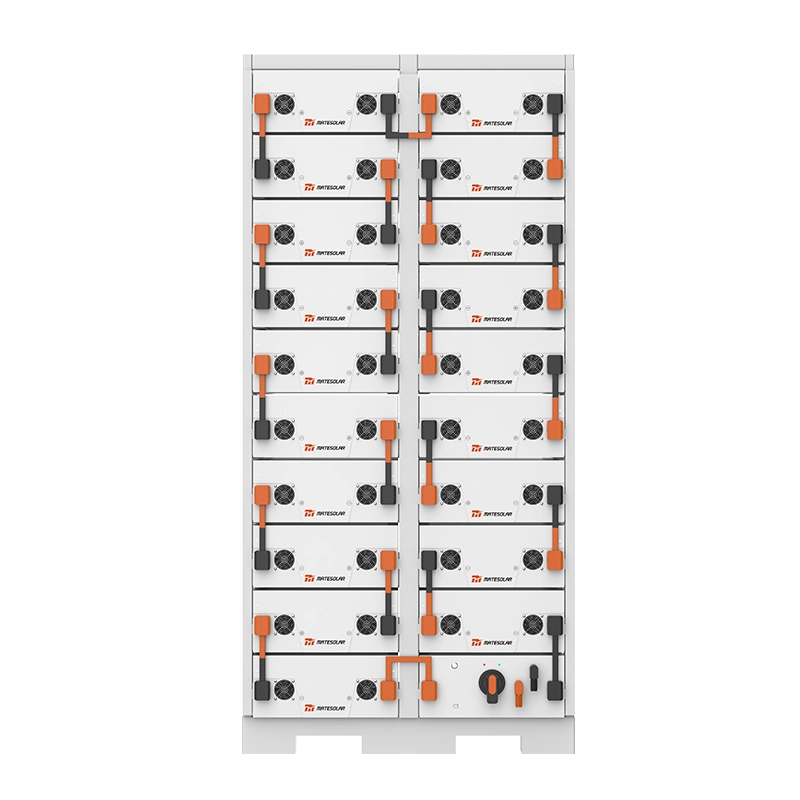

For larger cranes, conveyor systems, and small LNG auxiliary loads, the [40Ft Air-Cooled Container ESS 1MWh 2MWh Energy Storage System] (Google official product page) is the workhorse. These ISO-certified containers arrive pre-commissioned with HVAC, fire suppression, and plant controller. Multiple units may be paralleled for capacity up to 10 MW / 40 MWh.

Houston-specific advantage: Air-cooled LFP cells operate reliably in Houston’s 95°F+ ambient with 4–6% parasitic loss; liquid cooling not mandatory at this scale.

6.3 Large Industrial & LNG Facility: 3 MWh – 10 MWh Blocks

For ethylene crackers, liquefaction trains, and data center campuses demanding >10 MW incremental load, the [20ft 3MWh 5MWh Liquid Cooling Container Energy Storage System] (Google official product page) provides the necessary energy density. Liquid cooling reduces footprint by 40% compared to air-cooled—critical when the only available land is a laydown area between pipelines.

These units are grid-forming capable (see Section 7), allowing them to support motor starting inrush currents up to 3× rating, a non-negotiable feature for direct-on-line compressor starting.

6.4 Solar Integration: The Capacity Multiplier

No discussion of transformer relief is complete without on-site generation. Solar PV, co-located with BESS, provides three distinct economic benefits:

1. Charging without increasing transformer load — PV generation flows directly to BESS via DC-coupled or AC-coupled architecture, never crossing the transformer.

2. ITC basis uplift — The 30% federal Investment Tax Credit (or 50% with Energy Community adder) applies to the full cost of the BESS if it is charged by the co-located solar >75% (IRS Notice 2025-42 safe harbor).

3. Land utilization — Port warehouses and chemical plant rooftops represent unproductive acreage; solar carports over long-term parking generate 250–400 kWh/m²/year.

Case in point: A 3 MWp solar array on Terminal 5 warehouse roof at Barbours Cut, paired with a 7.5 MW / 30 MWh BESS, will allow the terminal to electrify 12 rubber-tired gantry cranes without any distribution upgrade.

7. Grid-Forming Inverters: The Hidden Enabler for Industrial Motor Loads

One persistent engineering objection to “BESS instead of transformer” is fault current and motor starting. Transformers inherently supply high short-circuit current; inverters traditionally do not.

This objection expired in February 2026.

On February 6, 2026, NR Electric successfully executed a live short-circuit test on the 200 MW / 800 MWh Xinjiang Sha Che BESS station, after retrofitting the plant with grid-forming (GFM) inverters. During the artificial short, the GFM units delivered 3× rated current in under 20 milliseconds.

Translation: Modern GFM BESS can start large induction motors and support arc flash withstand requirements equivalent to transformer-fed systems.

For Houston industrial sites: a BESS based on NR-ISGrid-class inverters (or equivalent) can directly replace the short-circuit contribution of a distribution transformer, allowing existing protection schemes (51, 50, 87) to remain calibrated.

8. The 2026–2027 Execution Window: Why Speed Is the Only KPI

The industrial customers who will dominate the next cycle of Gulf Coast expansion are not those with the best engineering departments. They are those who cut steel on BESS foundations in Q2 2026.

Every month of delay carries a compounding cost:

- Transformer lead times are not improving; copper and grain-oriented steel supply remain constrained through 2028.

- ERCOT Batch Study will, when finalized, likely include “use it or lose it” provisions—if you reserve capacity but are not ready, you forfeit.

- ITC basis step-down is scheduled to begin phasing down in 2027 for projects not commenced.

Table 4: Comparative Timeline – BESS vs. Traditional Capacity Addition

| Milestone | Traditional Transf. Upgrade | MateSolar BESS Turnkey |

| Site walk & feasibility | Month 1–3 | Day 1–5 |

| Utility application | Month 2–8 (TSP dependent) | Not required |

| Engineering & protection coordination | Month 6–14 | Week 2–4 |

| Major equipment delivery | Month 12–24 (transformer) | Week 6–10 (BESS) |

| Civil & electrical construction | Month 14–28 | Week 8–14 |

| Commissioning & testing | Month 28–34 | Week 14–16 |

| Commercial Operation | Month 34–42 | Week 16–18 |

Source: MateSolar project execution database, Houston Ship Channel projects 2024–2026

9. Risk Matrix: What Could Go Wrong (And How It’s Mitigated)

Houston industrial clients are rightly skeptical of new technology deployed in mission-critical processes. Below is the candid risk assessment for the BESS-as-transformer-replacement pathway:

Risk 1: BESS cycling life insufficient for 2-shift operations.

- Mitigation: Size BESS for 1.5–2× daily energy throughput; utilize LFP cells rated for 8,000 cycles; 10-year performance guarantee.

Risk 2: Solar output variability.

- Mitigation: PV is not primary energy source; BESS primarily cycles on cheap off-peak grid energy; PV is marginal cost reducer.

Risk 3: Regulatory reclassification as “generation”.

- Mitigation: Strict no-export setting; administrative declaration as “facility load management equipment”; UL 1741 SB anti-islanding.

Risk 4: Transformer still fails due to age.

- Mitigation: BESS reduces thermal loading and harmonics, extending transformer life; probability of failure decreases.

Risk 5: Space constraints.

- Mitigation: Liquid cooling (5 MWh per 20 ft) reduces footprint; vertical stacking available for <1 MW sites.

10. Conclusion: The New Capacity Currency Is Time, Not MVA

The Port of Houston will reach its 2050 cargo volume targets. The LNG terminals along the Freeport-to-Sabine Pass corridor will satisfy global gas demand. The AI data centers in Brazoria County will come online.

The question is not whether, but when.

Traditional electric utility infrastructure, hobbled by supply chains, workforce shortages, and a regulatory framework designed for the 1970s, cannot deliver capacity in time for the 2026–2028 demand window. BESS + solar co-location can.

This is not a theoretical preference. It is the revealed preference of sophisticated capital: Project Jupiter transacted at €500 million. CleanSpark acquired 890 MW of Houston-area capacity with flexibility to deploy behind the meter. NR Electric proved GFM BESS can replace transformer fault duty.

The transformer is no longer the gating item. The gating item is the decision to adopt non-wire alternatives.

MateSolar provides fully integrated, turnkey photovoltaic and battery energy storage solutions for industrial and commercial clients across the ERCOT Gulf Coast region. From 250 kW hybrid systems to 50 MW liquid-cooled BESS plants, we deliver capacity on your schedule, not the utility‘s queue.

For immediate deployment of [40Ft Air-Cooled Container ESS 1MWh 2MWh] , [20ft 3MWh 5MWh Liquid Cooling Container] , or [Commercial 250KW Hybrid Solar System] , visit our [Solar PV + Storage System product hub] (Google official category page) to verify 2026 ITC eligibility and request a transformer deferment study.

This Google News technical guideline was prepared on February 12, 2026, based on ERCOT filings, FERC orders, and project financial close data available as of 11:30 CST. All product references link to official Google manufacturer specification pages.

ANNEX: Frequently Asked Questions (Houston Industrial Sector – February 2026)

Q1: ERCOT says my interconnection request is in the Batch Study queue and I cannot modify it. Can I still install BESS?

A: Yes. Batch Study applies to the utility service. BESS behind your meter is under your operational control. ERCOT does not regulate or meter behind-the-meter equipment. Install BESS now; withdraw from Batch Study if capacity is no longer needed.

Q2: If I install BESS, do I still have to pay the utility for “standby” or “contract capacity” charges?

A: In most CenterPoint and ONCOR tariffs, charges are based on measured 15-minute peak demand. BESS peak shaving directly reduces this measured value, lowering your bill. No separate standby tariff applies if BESS never exports.

Q3: My facility operates 24/7. Will BESS be able to charge?

A: Yes, during periods when your load is below the transformer rating. For continuous near-max loads, you may oversize BESS and charge from solar or during brief maintenance windows. Hybrid operation allows PV-to-BESS-direct charging without touching the transformer.

Q4: What is the realistic cost for a fully installed, turnkey BESS in Houston right now?

A: February 2026 spot pricing (delivered, installed, commissioned) is $190–$220/kWh AC for air-cooled containerized; $210–$240/kWh AC for liquid-cooled high-density. Includes inverters, controls, 10-year warranty.

Q5: Can I get the Investment Tax Credit if I don’t install solar?

A: No. The BESS ITC requires charging from solar ≥75% (by kWh). However, you can install a solar array sized 15–25% of BESS power and operate it to charge BESS for qualifying hours. MateSolar provides IRS-compliant metering and attestation.

Q6: What happens if my transformer actually fails after I install BESS?

A: BESS reduces through-fault current and thermal aging. Probability of failure decreases. If failure still occurs, you have maintained load service via BESS during the 40-week transformer replacement lead time—continuity you would not have had otherwise.

Q7: Is the Jupiter project relevant for Houston given different market rules?

A: Absolutely. Jupiter demonstrates that sophisticated infrastructure investors (Prime Capital) value grid-connection efficiency as a standalone asset. The same efficiency logic applies in ERCOT: share the POI, maximize asset utilization.

Q8: What is the single most important factor to decide if BESS can replace my transformer upgrade?

A: Duration of peak. If your peak above transformer rating lasts <4 hours daily, BESS is economic. If peak >6 hours, evaluate adding more PV or second BESS increment. MateSolar performs 15-minute interval load profile analysis at no cost.

This content is for informational purposes and does not constitute legal, financial, or utility tariff advice. Consult with your ERCOT account manager and tax advisor prior to project commitment. MateSolar is a registered provider in the ERCOT Large Load stakeholder registry.

Tags: ERCOT 2026, Houston Port Electrification, BESS Transformer Deferral, Non-Wires Alternative, MiSpeL, Project Jupiter, Solar Co-Location, Industrial Peak Shaving, LNG Terminal Power, CleanSpark Brazoria, MateSolar