Executive Summary

The global energy landscape is undergoing a transformative shift, with emerging markets like Australia, Africa, and Southeast Asia becoming critical growth engines for solar and storage adoption. Driven by divergent yet equally powerful factors—such as Australia’s groundbreaking battery subsidy and Africa’s urgent need for grid stability—these regions are leveraging customized solutions to achieve energy security and sustainability. Australia’s 23 billion AUD subsidy program is creating an unprecedented boom in household battery installations, while across Africa, innovative microgrids are powering communities for the first time. This article explores the policy frameworks, market dynamics, and technological innovations shaping these vibrant markets, supported by professional data analysis and insights into future trends.

1. Australia’s Solar Storage Boom: Policy-Driven Market Acceleration

1.1 The Cheaper Home Batteries Program: A Case Study in Effective Policy

In July 2025, the Australian federal government launched a landmark subsidy initiative—the Cheaper Home Batteries Program—allocating 23 billion AUD to accelerate the adoption of residential energy storage systems. This program provides upfront discounts of up to 372 AUD per kWh of battery capacity, covering approximately 30% of installation costs and reducing payback periods to just 4-5 years for typical households.

The policy design is particularly noteworthy for its strategic inclusivity. It supports not only homeowners but also small businesses, community facilities, and even landlords, with special provisions for low-income households. The technical requirements mandate CEC-approved products and VPP (Virtual Power Plant) compatibility, ensuring system quality while building distributed grid resources that enhance overall network stability.

1.2 Market Response: Unprecedented Adoption Rates

The market response has been extraordinarily robust, demonstrating how well-designed policies can rapidly transform energy landscapes. In the program's first month, Australia recorded 19,592 battery installations—equivalent to 26% of the entire previous year's installations. This surge represents a pivotal shift in market structure, with battery-only projects (ESS-only) for existing solar owners becoming the dominant segment.

A remarkable trend emerged in May 2025 when battery systems outsold solar systems for the first time. By July, for every 100 solar installations, there were 137 battery installations, indicating a fundamental market transformation toward storage integration. The average battery size has also increased significantly, from the historical average of 10-12 kWh to 17-18 kWh in July 2025, as homeowners maximize subsidy benefits.

Table: Australia's Battery Subsidy Impact (July 2025)

| Metric | Pre-Subsidy Trend | Post-Subsidy Reality | Change |

| Monthly Installations | ~6,000 systems | 19,592 systems | +226% |

| Average Battery Size | 10-12 kWh | 17-18 kWh | +60% |

| Battery-to-Solar Ratio | 0.7:1 | 1.37:1 | +96% |

| Leading States | Victoria | NSW (7,347), QLD (4,159), SA (3,052) | Regional diversification |

1.3 State-Level Variations and Complementary Incentives

Beyond the federal subsidy, state-level initiatives create a layered incentive structure that further accelerates adoption. Notable examples include:

- Victoria: Offers rebates of up to $1,400 for solar panels and interest-free loans for system upgrades.

- New South Wales: Provides up to $1,500 for VPP-connected battery energy storage systems.

- South Australia: Allows concession card holders to swap a decade of energy concessions for a 4.4kW solar system.

This multi-layered approach—combining federal subsidies with state-level rebates and innovative financing—creates a powerful adoption engine that addresses diverse consumer segments and needs.

2. African Markets: Customized Solutions for Grid Stability and Energy Access

2.1 The Microgrid Revolution: Powering Underserved Communities

While Australia's energy transition is driven by policy optimization, African markets address more fundamental challenges: energy access and grid reliability. Across the continent, innovative solar-storage microgrids are delivering electricity to communities that have historically lacked reliable power.

In Nigeria, a 7.6MW photovoltaic plant paired with 14MW/40MWh of storage recently began operations in Abuja, providing 24-hour power to public buildings in a region experiencing daily blackouts exceeding 8 hours. Similarly, in Djibouti's Tadjourah region, a 165kW off-grid solar facility with 500kWh of battery storage now powers homes, schools, health centers, and local businesses for the first time.

These projects share a common characteristic: they're specifically engineered for local conditions. The Nigeria installation features dual-mode intelligent switching technology that enables seamless transition between grid-connected and island modes, while incorporating enhanced dust prevention and heat dissipation systems suited to the harsh climate.

2.2 Technical Innovations for Challenging Environments

The engineering philosophy behind successful African projects emphasizes durability, adaptability, and ease of maintenance. The Djibouti project utilizes LONGi's Hi-MO X10 modules with HPBC 2.0 cell technology, specifically designed for high performance in challenging environments with features including:

- Superior temperature coefficient (-0.26%/°C)

- Enhanced anti-shading capabilities reducing power loss by over 70%

- Low degradation profile (1% first year, 0.35% annually thereafter)

These technical specifications are critical in remote locations where maintenance access is limited and system reliability directly impacts community welfare.

*Table: Comparative Analysis of African Solar-Storage Projects (2025)*

| Project Parameters | Nigeria Microgrid | Djibouti Off-Grid System | Zambia Cooma Plant |

| Solar Capacity | 7.6 MW | 165 kW | 50 MW |

| Storage Capacity | 14MW/40MWh | 500 kWh | 20 MW |

| Primary Technology | Dual-mode intelligent switching | High-efficiency modules (-0.26%/°C) | Integrated smart O&M |

| Community Impact | 24-hour power for public buildings | First electricity for rural village | Powers thousands of households |

| CO2 Reduction | 10,175 tons annually | Not specified | ~80,000 tons annually |

2.3 The Economic Transformation Perspective

Beyond immediate electricity access, these projects deliver transformative economic impacts. The Nigeria project reduces energy costs by 35% while eliminating the economic disruptions caused by frequent blackouts. In Zambia, the 50MW Cooma solar station with 20MW of storage addresses the country's chronic power instability that has hampered industrial production and economic development.

President Hakainde Hichilema has designated the project a "national priority" as part of Zambia's "Gigawatt Power Plan" to add 1,000MW of generation capacity by 2025—highlighting how solar-storage solutions are moving from alternative energy to mainstream critical infrastructure across Africa.

3. Global Trends: Emerging Markets as Growth Accelerators

3.1 The Numbers: Quantifying the Storage Boom

The simultaneous expansion across diverse geographies reflects a broader global pattern. According to industry analyses, the global energy storage market is expected to reach 106.04GW/265.1GWh in 2025, representing 43%/49% year-on-year growth . While established markets like the United States and Europe maintain steady growth, emerging markets are becoming increasingly significant contributors to this expansion.

Several converging factors drive this global phenomenon:

- Policy Stimulation: Australia's subsidy model demonstrates how targeted incentives can rapidly activate latent demand.

- Economic Imperatives: In Africa, the economic cost of unreliable power creates compelling business cases for solar-storage solutions.

- Technology Advancements: Improved battery chemistry, falling costs, and sophisticated energy management systems make solutions viable across diverse applications.

- Energy Security Concerns: Global volatility intensifies the focus on domestic renewable resources rather than imported fuels.

3.2 The China Connection: Supply Chain Dynamics

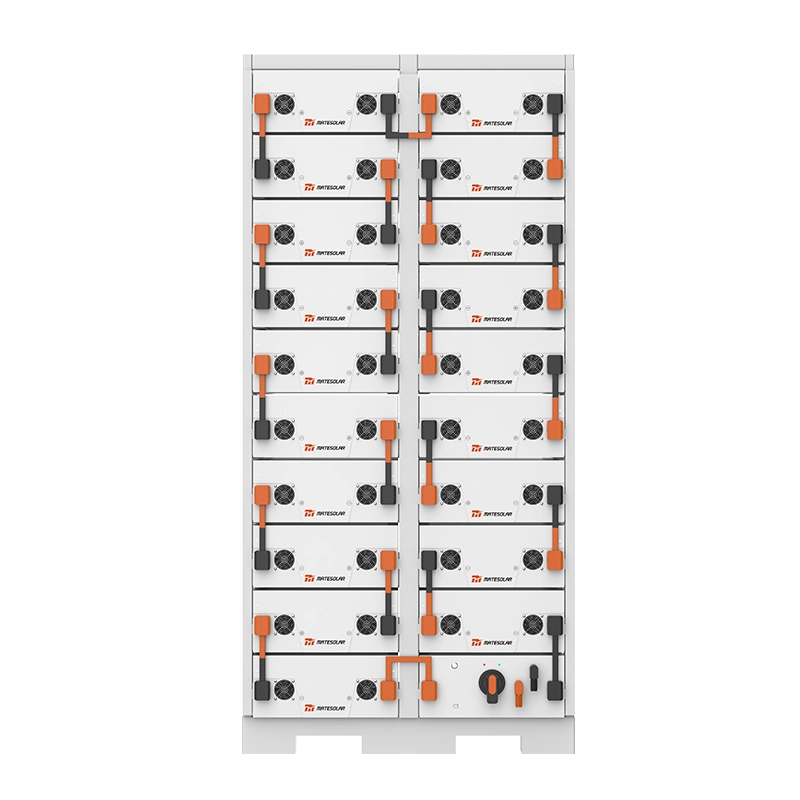

Chinese manufacturers play a pivotal role in supplying these global markets, with leading companies achieving remarkable penetration through strategic market adaptation. SG Solar, for example, captured 31.4% of Australia's residential storage market by May 2025—surpassing established players like Tesla and Huawei—through a highly integrated "five-in-one" system that combines a solar inverter, storage battery, EV bidirectional charging pile, energy management system, and backup power module in a single cabinet.

This success story highlights how manufacturers who tailor products to specific market requirements can achieve rapid growth in these dynamic environments. However, market entry requires careful attention to certification requirements, particularly CEC approval in Australia, which mandates strict standards for battery capacity (5-100kWh), cycle life (10+ years), and round-trip efficiency (≥90%).

4. Technological Innovation: Meeting Diverse Market Needs

4.1 Platform Solutions: Google's Project Sunroof and Beyond

While hardware innovations capture much attention, digital platforms play an increasingly crucial role in accelerating adoption. Google's Project Sunroof, initially launched in 2015, exemplifies how digital tools can demystify solar adoption for homeowners. By leveraging Google Maps' 3D modeling and high-resolution aerial mapping technology, the platform provides personalized assessments of solar potential, system sizing recommendations, and connections to local installers.

For comprehensive system solutions, explore Google's solar energy storage systems, which integrate advanced forecasting, monitoring, and control capabilities to maximize returns across diverse market conditions.

4.2 Hybrid System Architectures: The 150kW Solution Category

Between residential systems and utility-scale projects exists a critical category: commercial and community-scale solutions. The 150kW hybrid solar system represents an optimal size for many applications across emerging markets—powering small businesses, agricultural operations, schools, and municipal buildings while providing grid stabilization services.

These systems typically combine high-efficiency bifacial panels, smart inverters with grid-forming capabilities, and modular battery storage that can be scaled as needs evolve. Their flexibility makes them particularly suitable for environments with unreliable grid connections or limited infrastructure development.

5. FAQ: Addressing Key Market Questions

Q1: How long will Australia's battery subsidy program continue?

A: The current subsidy framework extends through 2030, with step-down reductions in subsidy rates anticipated as adoption increases. However, analysts project that the initial funding allocation could be exhausted as early as 2028 if current adoption rates continue, creating urgency for prospective participants.

Q2: What are the primary technical requirements for products under Australia's subsidy program?

A: Key requirements include: (1) electrochemical storage systems (e.g., lithium iron phosphate); (2) listing on the Clean Energy Council certified products directory; (3) storage capacity between 5-100kWh; (4) installation alongside new or existing PV systems; and (5) VPP compatibility for participation in virtual power plants.

Q3: How do African microgrid projects address maintenance challenges in remote locations?

A: Successful implementations incorporate multiple strategies: using modules with low degradation rates (as low as 0.35% annually); remote monitoring capabilities; training local technicians for basic maintenance; and designing systems with redundancy and fault tolerance specifically for environments with limited service access.

Q4: What financing models are proving effective for solar-storage projects in emerging markets?

A: Diverse models have emerged, including: (1) Build-Operate-Transfer arrangements used in Zambia's Cooma plant ; (2) Power Purchase Agreements that enable development without upfront public expenditure; (3) Property-assessed clean energy financing; and (4) Pay-as-you-go models that make systems accessible to lower-income households.

6. Conclusion: The Path Forward for Emerging Markets

The simultaneous solar-storage boom across Australia, Africa, and Southeast Asia demonstrates that no single approach fits all emerging markets. Successful market development requires deep localization—whether adapting to policy frameworks like Australia's subsidy program or addressing the specific technical challenges of off-grid applications in Africa.

For industry participants, several principles emerge as critical success factors:

1. Agility in policy response: Markets are evolving rapidly, requiring flexible business models and product strategies.

2. Emphasis on certification and compliance: Regulatory approval gates represent both barriers and opportunities for disciplined players.

3. Partnership with local stakeholders: Success hinges on understanding nuanced market needs through collaborative approaches.

4. Digital integration: Smart energy management systems increasingly differentiate solution value propositions.

As these markets continue their rapid evolution, they offer not just commercial opportunities but laboratories for innovation that will ultimately benefit global energy transitions. The lessons learned in adapting to diverse challenges—from Australia's sophisticated subsidy mechanism to Africa's rugged operational environments—will inform next-generation solutions worldwide.

About MateSolar: As a comprehensive photovoltaic storage solution provider, MateSolar specializes in delivering customized solar-storage systems for diverse global markets. Our expertise spans from Australia's subsidy-optimized residential solutions to Africa's ruggedized microgrid implementations, always prioritizing performance, compliance, and long-term value. With technical support spanning certification management, system design, and ongoing optimization, we partner with clients to navigate complex market environments while maximizing returns on energy investments.

This analysis synthesizes current market data, policy developments, and technology trends to provide a comprehensive overview of solar-storage dynamics across key emerging markets. Specific program details and incentives may evolve; readers are encouraged to consult official sources for the most current information.