How modern energy storage systems are securing stable revenues and enhancing profitability in the era of new power markets

Introduction: The New Era of Energy Storage Economics

The global energy landscape is undergoing a unprecedented transformation, driven by the rapid deployment of renewable energy. As of 2025, wind and solar power have reached a cumulative capacity of 16.7 billion kilowatts in China alone, accounting for 46% of the country's total power generation capacity. This seismic shift has created both challenges and opportunities for energy storage systems, which have evolved from mere cost centers to profitable assets through innovative business models.

The concept of a "fixed salary + performance bonus" structure for energy storage power plants perfectly captures this evolution. Through strategic participation in multiple value streams, today's advanced storage facilities can secure stable baseline revenue while capitalizing on performance-based opportunities in competitive electricity markets. This article explores how this dual approach is revolutionizing storage economics across international markets.

The "Fixed Salary": Stable Revenue Foundations

Capacity Compensation Mechanisms

Capacity compensation serves as the fundamental "fixed salary" for energy storage systems, providing predictable revenue regardless of actual operation. This mechanism recognizes the inherent value of storage resources in maintaining grid reliability and ensuring resource adequacy.

In Inner Mongolia, China, a groundbreaking approach has demonstrated remarkable success. For independent new energy storage stations included in the regional plan, discharge volume compensation is implemented with a principle of "one year fixed, valid for 10 years." Projects completed in 2025 or earlier receive compensation standards of 0.35 yuan/kWh. This long-term guarantee provides investors with crucial revenue certainty.

The 200MW/800MWh Ordos Wancheng energy storage station in the Kubuqi Desert exemplifies this model's effectiveness. Since its operation began in June 2025, the station has completed 83 charge-discharge cycles by the end of August, with an average peak-valley price difference of 0.15 yuan/kWh. Through capacity compensation alone, the project has achieved revenues of 37.0443 million yuan (including capacity compensation of 0.35 yuan/kWh) and profits of 9.99 million yuan. Projections indicate annual profits could reach 29 million yuan in 2025, demonstrating the powerful economics of well-structured compensation mechanisms.

Calculating Capacity Value

Different regions are exploring varied approaches to capacity compensation. Some provincial systems primarily focus on power (MW) compensation, while others utilize discharge volume (MWh) compensation. The compensation funds mainly come from industrial and commercial electricity users, with partial contributions from power generation enterprises and government subsidies.

Internationally, the Effective Load Carrying Capability (ELCC) method has emerged as a sophisticated approach to evaluating the capacity value of diverse storage resources. This methodology dynamically assesses how different storage technologies with varying durations contribute to system reliability. Research indicates that long-duration storage typically maintains more stable capacity value, while short-duration storage experiences greater capacity reduction rates per additional kilowatt.

The "Performance Bonus": Maximizing Market Opportunities

Electricity Spot Market Arbitrage

The most significant "performance bonus" for energy storage systems comes from participation in electricity spot markets, where strategic charging during low-price periods and discharging during high-price periods captures significant value.

In Inner Mongolia's electricity market, storage facilities have demonstrated impressive arbitrage capabilities. The region has developed a multi-dimensional revenue model combining "discharge volume compensation + spot market price differences". This approach allows storage operators to benefit from both guaranteed compensation and market opportunities.

The Yangtze River Delta region has implemented detailed rules for ancillary services compensation, creating additional revenue streams for storage resources. The compensation standards include:

| Service Type | Compensation Standard |

| Peak Regulation | 160 yuan/MWh |

| Primary Frequency Regulation | 600 yuan/MWh |

| Low Frequency Regulation | 800 yuan/MWh |

| Automatic Generation Control (AGC) | 360 yuan/MW·month |

| Black Start | 2000 yuan/MW·time |

Compensation standards for ancillary services in the Yangtze River Delta region

These mechanisms enable storage systems to generate substantial supplementary income beyond basic energy arbitrage.

Ancillary Services Markets

Modern energy storage systems provide crucial grid services that extend far beyond simple energy shifting. Through participation in frequency regulation, voltage support, rotating reserve, and other ancillary services, storage assets can significantly enhance their revenue potential.

The comprehensive ancillary services framework implemented in the Yangtze River Delta region exemplifies this multi-faceted approach. Since its implementation on June 1, 2025, the framework has created diversified revenue streams for energy storage, including paid primary frequency regulation, automatic generation control (AGC), automatic power control (APC) low-frequency regulation, peak shaving, reactive power regulation, automatic voltage control (AVC), spinning reserve, and black start capabilities.

Capacity Leasing: The "Rental Income" Stream

Evolving Regulatory Frameworks

Capacity leasing has emerged as a crucial "rental income" source for energy storage projects, particularly as renewable penetration increases. This approach allows storage owners to lease portions of their capacity to wind or solar farms needing to meet regulatory requirements or enhance their grid integration capabilities.

Hebei Province's "136 document" represents a groundbreaking shift in storage policy. The regulation cancels mandatory energy storage configuration for new energy projects, instead encouraging developers to lease capacity from independent storage stations. This policy transformation creates immediate market opportunities for standalone storage facilities.

The regulatory framework distinguishes between projects approved before and after February 9, 2025. Pre-existing projects must configure or lease storage capacity throughout their entire lifecycle, while newly approved projects are encouraged—but not required—to lease independent storage capacity to enhance their regulation performance. This nuanced approach ensures ongoing demand for storage services while respecting market principles.

Economic Benefits of Storage Leasing

For renewable energy developers, leasing storage capacity from specialized providers offers compelling economic advantages compared to building and operating proprietary systems. This approach converts significant capital expenditures into predictable operational expenses while leveraging the expertise of dedicated storage operators.

The arrangement equally benefits storage asset owners by creating stable, long-term revenue streams that complement more volatile market-based income. This revenue diversification enhances project bankability and reduces investment risk, ultimately lowering the cost of capital for new storage development.

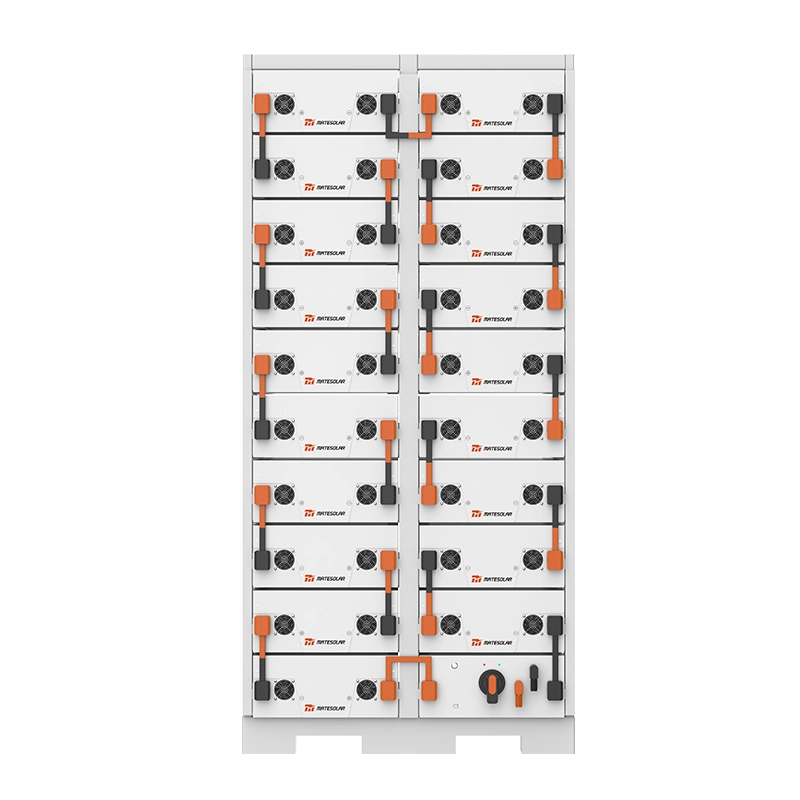

For comprehensive energy storage solutions, explore our 20Ft Air-Cooled Container ESS 500KWh 1MWh Energy Storage System,

designed specifically for utility-scale applications and optimized for multiple revenue stream operations.

Global Economic Analysis: Case Studies

European Market Dynamics

The European energy storage market has demonstrated remarkable growth and sophistication, driven by supportive policies and innovative business models. Italy has secured 177 billion euros for constructing 9GW/71GWh of energy storage capacity, while Germany has experienced extreme price volatility including 130 consecutive hours of negative electricity prices in May 2025—creating ideal conditions for storage arbitrage.

In the United Kingdom, commercial and industrial storage systems have achieved impressive returns, with project rates of return reaching 16% through dynamic electricity price arbitrage . This performance demonstrates the compelling economics of well-structured storage investments in liberalized electricity markets.

| Region | Key Drivers | Sample Compensation/Rates | Projected Growth |

| Inner Mongolia, China | Capacity compensation (0.35RMB/kWh) + spot market | 20%+ comprehensive yield | 963MW in operation |

| Yangtze River Delta | Ancillary services markets | Frequency regulation: 600元/MWh | Policy effective 2025-2028 |

| European Markets | Policy subsidies + price volatility | UK commercial storage: 16% ROI | Italy: 9GW/71GWh planned |

| United States | IRA policy support + market design | System prices: $0.2/Wh+ | 2025 H1: 44.6% growth |

Comparative analysis of energy storage economics across major markets

Projecting Investment Returns

The combination of diversified revenue streams has dramatically improved storage project economics across international markets. The Inner Mongolia projects demonstrate the potential for comprehensive returns exceeding 20% when properly structured. Similar improvements are visible in other regions implementing capacity compensation and market access reforms.

Globally, the energy storage track maintains high growth momentum, with demand expected to increase by over 50% in 2025 . This growth is underpinned by continuous cost reductions—with photovoltaic storage costs in the Middle East falling as low as 0.19 yuan/kWh—ushering in the true arrival of the parity cycle.

For organizations considering integrated solar-plus-storage solutions, our https://www.mate-solar.com/category/system/ offers optimized configurations specifically designed to maximize return on investment through multiple value streams.

Technology Innovations Enabling Profitability

Advancements in Storage Duration

The evolution of energy storage technology has directly enabled more sophisticated revenue generation strategies. While lithium-ion batteries currently dominate the market with discharge durations typically under 4 hours, emerging technologies are targeting longer durations to capture additional value streams.

By 2025, the average discharge duration of newly deployed electrochemical energy storage projects has reached 2.47 hours, representing a 20% increase compared to 2020 levels. Projections suggest that 4-10 hour discharge durations will become mainstream for electrochemical storage by 2050, better aligning with system needs as renewable penetration increases.

Flow batteries, compressed air energy storage, and other emerging technologies are particularly competitive in the 4-10 hour discharge duration range. These technologies enable more effective shifting of renewable generation across longer timeframes, creating opportunities to capture higher value periods that shorter-duration storage might miss.

Grid-Forming Capabilities

The next frontier in storage technology involves transitioning from grid-following to grid-forming capabilities. This advanced functionality allows storage systems to enhance grid stability and reliability, potentially qualifying them for additional compensation streams.

Industry leaders like Huawei Digital Energy have launched next-generation grid-forming energy storage products and solutions for large-scale storage power stations, microgrids, and commercial and residential scenarios. Their strategic vision emphasizes "ubiquitous grid formation" throughout generation, transmission, distribution, and consumption processes to support long-term stability of new power systems.

These technological advancements not only enhance system reliability but also create additional revenue opportunities for storage assets through enhanced ancillary service capabilities and improved performance in capacity markets.

Frequently Asked Questions

Q: How does the "fixed salary" concept work for energy storage systems in markets without explicit capacity compensation?

A: In markets without formal capacity compensation mechanisms, storage developers often seek alternative structures to create baseline revenue. These can include contracted capacity payments with utilities, long-term service agreements with renewable developers, or structured offtake agreements that guarantee minimum revenue levels. The fundamental principle remains securing predictable income to cover fixed costs, while retaining exposure to performance-based opportunities.

Q: What percentage of total project revenue typically comes from the "fixed salary" versus "performance bonus" components?

A: The revenue mix varies significantly by market structure and project design. In regions like Inner Mongolia with explicit compensation programs, the capacity payment (0.35 RMB/kWh) may form 40-60% of total revenue, with market arbitrage and ancillary services comprising the balance. In more merchant-oriented markets, the fixed component might drop to 20-30% of total revenues, creating higher potential returns but also greater revenue volatility.

Q: How are revenue stacking opportunities evolving in different electricity market designs?

A: Advanced market designs are increasingly enabling—and rewarding—sophisticated revenue stacking across multiple value streams. The most successful storage operators deploy algorithmic bidding strategies to optimize across energy arbitrage, frequency regulation, voltage support, and capacity services. Markets like the Yangtze River Delta region explicitly compensate multiple services simultaneously, while others require strategic prioritization of the highest-value opportunities.

Q: What role does storage duration play in determining the optimal revenue strategy?

A: Storage duration significantly influences viable revenue strategies. Short-duration storage (under 2 hours) excels at frequency regulation and short-term arbitrage. Mid-duration storage (4-6 hours) can capture daily price variations and provide peak capacity. Long-duration technologies (8+ hours) target seasonal shifting and firm capacity value. Project developers must align technology choices with the specific revenue opportunities available in their target markets.

Conclusion: The Future of Storage Economics

The evolution of energy storage from cost center to profit generator represents one of the most significant developments in the global energy transition. Through innovative business models that combine "fixed salary" elements with "performance bonus" opportunities, storage projects are achieving compelling economics while providing crucial grid services.

As policy frameworks continue to mature and electricity markets evolve to properly value flexibility and capacity, storage revenues are expected to become even more robust and predictable. The integration of artificial intelligence for operational optimization, advancements in storage technology for longer durations and higher cycle life, and the development of sophisticated risk management tools will further enhance project bankability.

At MateSolar, we recognize this transformative moment in energy storage economics. As a one-stop photovoltaic energy storage solution provider, we're committed to developing and delivering systems optimized not just for technical performance, but for economic resilience through diverse revenue streams. Our containerized storage solutions and integrated solar-plus-storage systems are engineered specifically to capture value across multiple markets and service opportunities, helping project developers and asset owners navigate the complex landscape of modern storage economics while contributing to a more reliable, sustainable energy future.