The Dual Engine of Transformation

The North American energy landscape stands at a pivotal crossroads, propelled by two powerful, concurrent forces. On one front, the artificial intelligence revolution is placing unprecedented demand on power systems, with data centers evolving into “industrial-scale new loads”. On the other, the continent’s aging electrical infrastructure struggles with reliability and capacity, a problem magnified by the increasing frequency of extreme weather events. This convergence has transformed energy storage from a complementary technology into an absolute necessity for grid resilience, economic stability, and continued technological progress. The market is responding with explosive growth, particularly in the United States and Canada, where innovative solar-plus-storage solutions are becoming the bedrock of a new energy paradigm.

This analysis delves deep into the core market dynamics, examining the distinct opportunity landscapes for commercial & industrial (C&I) storage and residential storage. We explore the technical drivers, economic incentives, and emerging solutions that are shaping investment and deployment decisions across North America.

The C&I Storage Boom: Powering the AI Economy and Stabilizing the Grid

The commercial and industrial sector is experiencing the most immediate and transformative impact, driven by the insatiable power needs of digital infrastructure.

1. Data Center Backup Power: The AI-Driven Growth Imperative

Artificial Intelligence Data Centers (AIDC) represent a fundamental shift. Unlike traditional facilities, AIDCs handling large model training exhibit intense load volatility, with power demand capable of swinging from 30% to 100% instantaneously. This characteristic, combined with skyrocketing total demand, renders conventional grid connections and backup generators insufficient.

- The Capacity Gap: Analysis indicates that from 2026 to 2028, new AIDC capacity will require an estimated 32-71 GW of new power capacity. After accounting for conventional loads and simultaneity rates, the need for new, stable, controllable power generation is projected to be 40-68 GW. Existing supply plans, including new gas turbines and other solutions like Solid Oxide Fuel Cells (SOFC), are expected to fall short, leaving a significant gap that storage is uniquely positioned to fill.

- From Backup to Core Component: Energy storage is no longer just an uninterruptible power supply (UPS). In modern, high-power data center architectures—such as the 800V DC bus systems highlighted in industry white papers—storage is integral for peak shaving, load shifting, and providing critical ride-through power. Its rapid deployment cycle (months versus years for new transmission lines or power plants) makes it the only feasible solution to keep pace with AI’s breakneck development.

- Economic and Regulatory Drivers: The financial calculus is compelling. Beyond avoiding catastrophic downtime, storage allows data centers to capitalize on wholesale electricity market arbitrage, charging during low-cost periods and discharging during peak rates. Furthermore, stringent environmental, social, and governance (ESG) goals and increasing regulatory scrutiny of diesel backup generators are pushing operators toward zero-emission backup solutions.

*Table 1: Projected U.S. Data Center & Storage Demand (2026-2028)*

| Year | Estimated AIDC Power Demand (GW) | Stable Power Capacity Needed (GW) | Projected U.S. Storage Demand from AIDC (GWh) |

| 2026 | 32 - 35 | ~40 | 10 |

| 2027 | 48 - 55 | ~54 | 27 |

| 2028 | 65 - 71 | ~68 | 39 |

For businesses evaluating on-site power resilience, understanding these trends is critical. A robust solar generation and storage system is not merely an energy cost tool but a core risk-mitigation strategy. To explore integrated solutions designed for commercial properties, review our portfolio of Commercial and Industrial Solar Storage Systems.

2. Grid Services: Monetizing Storage Through Market Participation

Beyond the data center fence line, C&I storage assets offer significant value to the broader grid, creating lucrative revenue streams for owners.

- Mitigating Grid Congestion: Locational marginal pricing (LMP) in wholesale markets means electricity costs soar in areas with transmission bottlenecks. Strategically sited storage can discharge during local peak congestion, alleviating strain and earning high clearing prices for the energy provided.

- Providing Ancillary Services: Storage’s millisecond-fast response is ideal for frequency regulation and other ancillary services grid operators procure to maintain stability. This represents a steady, capacity-based revenue stream that enhances project economics.

- Tapping into Incentives: Policies like the U.S. Investment Tax Credit (ITC), which can cover 30% of storage project costs when paired with solar, dramatically improve returns. Many states and utilities offer additional rebates or performance-based incentives for storage that provides grid benefits.

For medium-scale commercial operations, a standardized, high-efficiency solution can optimally capture these opportunities. Systems like the 250KW Hybrid Solar System are engineered to provide substantial on-site consumption offset while having the capacity and advanced controls to participate in grid service programs seamlessly.

The Residential Storage Revolution: Security, Savings, and Self-Sufficiency

While C&I storage addresses macro-economic challenges, the residential market is fueled by personal priorities: security, predictability, and long-term savings.

1. Reliability as a Primary Demand Driver

The increasing frequency and severity of wildfires, storms, and heatwaves have exposed the vulnerability of North America’s centralized grid. For homeowners, a multi-hour or multi-day outage is more than an inconvenience; it can mean spoiled food, unsafe temperatures, and lost work.

- Beyond the Generator: Traditional gasoline generators are noisy, polluting, and require fuel storage and maintenance. Solar-charged battery storage offers silent, automatic, and renewable backup power. Modern systems can prioritize critical loads (refrigeration, medical equipment, lighting) for days, provided solar recharge is available.

- The Safety Imperative: As storage adoption grows, so does scrutiny on safety. Leading products now undergo extreme testing, such as the UL 9540B large-scale fire test, which evaluates fire containment and propagation risk under catastrophic failure conditions. Homeowners should prioritize systems certified to these highest safety standards, which demonstrate an ability to contain fire and prevent thermal runaway between modules.

2. Long-Term Economic Optimization

For homeowners with rooftop solar, adding storage transforms the system’s economics, especially as net metering policies become less favorable in many regions.

- Maximizing Self-Consumption: Storage allows homeowners to store excess solar generation from midday for use in the evening, dramatically reducing reliance on grid power during high-rate periods.

- Rate Arbitrage: In areas with time-of-use (TOU) rates, where electricity costs can triple during peak “on-peak” windows, storage enables buying low (or storing solar) and using it when rates are high. Over a system’s 15-20 year lifespan, this daily cycling compounds into substantial savings.

- Future-Proofing: Investing in a storage-ready solar system protects against rising utility rates and provides energy independence. A well-sized system, such as a Residential 12KW Hybrid Solar System, can cover a significant portion of a typical home’s annual load while providing essential circuit backup.

Navigating Challenges: Technology, Durability, and Integration

The storage boom is not without its hurdles. Success requires navigating technical and economic complexities.

- Battery Durability & Total Cost of Ownership: The industry is shifting focus from upfront cost ($/kWh) to long-term value and cost per cycle ($/cycle). A battery’s degradation rate is the single most critical factor in project economics. As illustrated in Table 2, a difference of a few percentage points in annual degradation can determine a project’s financial viability.

- Extreme Condition Performance: AIDCs and residential systems alike face environmental extremes. Storage systems must operate reliably in desert heat, alpine cold, and high humidity, demanding robust thermal management and component design.

- Grid Integration & Interconnection: The backlog for utility interconnection studies is a major bottleneck. Streamlined, pre-certified system designs and experienced partners are essential to navigate this process.

Table 2: Impact of Battery Degradation on Project Economics (Illustrative)

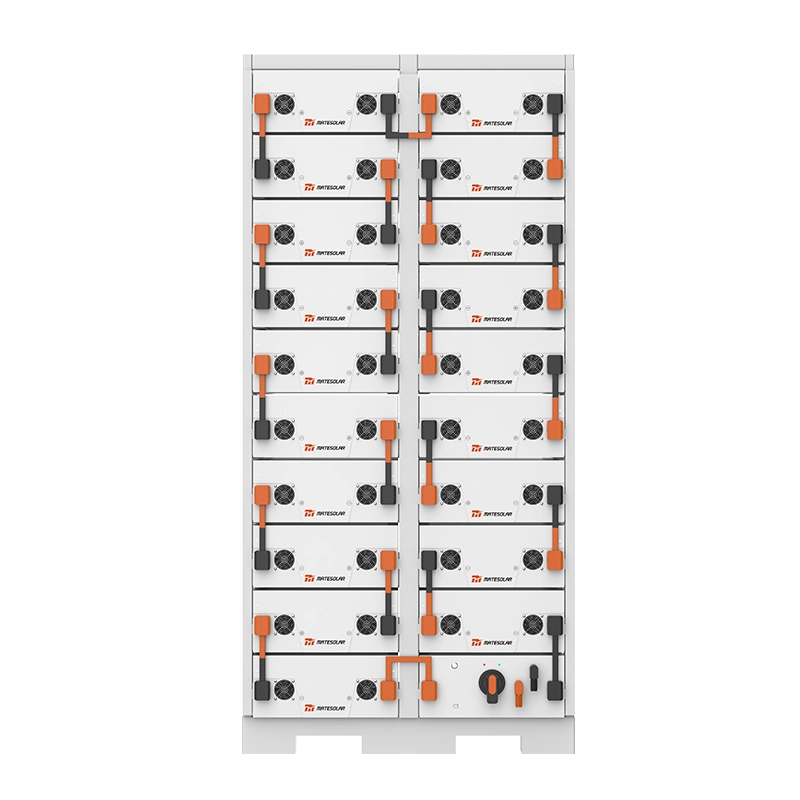

For large-scale C&I or utility applications, overcoming these challenges requires a focus on standardization, safety, and durability. Containerized solutions like the High Voltage Outdoor Cabinet ESS (100-200KWh) are designed for this purpose, offering pre-engineered, compliant, and durable storage in a single deployable unit, significantly reducing on-site complexity and long-term operational risk.

FAQ: Demystifying Solar Energy Storage in North America

Q: With the AI data center boom, will there be enough storage supply for residential and commercial projects?

A: While data centers are creating massive new demand, the supply chain for battery cells and systems is scaling rapidly. The markets are somewhat segmented, with data centers often opting for utility-scale, front-of-the-meter solutions. The growth is actually driving innovation and cost reductions that benefit all sectors. Planning ahead with a reputable provider ensures timely deployment.

Q: How long does a home battery system last, and what is the warranty?

A: Most modern lithium iron phosphate (LFP) home battery systems are designed to last 15-20 years. Warranties typically guarantee a certain remaining capacity (e.g., 70%) after 10 years or a specific number of cycles (e.g., 6,000-10,000). It’s crucial to read warranty terms carefully.

Q: Can my storage system pay for itself by selling power back to the grid?

A: The primary economic model is avoiding costs (self-consumption, backup) and arbitrage (time-of-use shifting). Some regions have programs for aggregated residential storage to provide grid services (virtual power plants), which can add revenue, but pure “sell-back” rates are generally low. The economics are strongest when you maximize using your own stored solar energy.

Q: What is the single most important factor in choosing a C&I storage system?

A: Total lifecycle cost and reliability, not just upfront price. Evaluate the provider’s track record, the battery chemistry’s proven degradation curve, the sophistication of the energy management software, and the quality of local service and support. A system that degrades slowly and operates reliably will deliver far greater net value.

Q: How does extreme cold affect battery performance and safety?

A: Low temperatures can reduce a battery’s available capacity and charging speed. High-quality systems include integrated thermal management (heating and cooling) to maintain the battery within its optimal operating range, ensuring performance and safety year-round. This is a critical feature in Canadian and northern U.S. climates.

Conclusion: Building a Resilient, Decarbonized Future

The narrative is clear: North America’s energy future will be built on a foundation of distributed, intelligent storage. The dual engines of AI-driven power demand and infrastructure modernization are creating a sustained, multi-decade growth cycle for the storage industry.

For businesses, the mandate is to secure operational continuity and tap into new value streams. For homeowners, the goal is to achieve energy security and cost predictability. In both cases, success hinges on choosing not just a product, but a trusted partner with deep expertise in system design, grid integration, and long-term performance.

This is where MateSolar stands apart. As a leading one-stop provider of comprehensive photovoltaic energy storage solutions, we deliver more than equipment. We provide certainty—from initial site assessment and financial modeling to flawless installation, regulatory navigation, and long-term system optimization. Our portfolio, from residential units to massive containerized systems, is built on the principles of safety, durability, and intelligence, ensuring our customers are powered for what’s next.

The energy transition is here. With the right strategy and partners, it presents an unparalleled opportunity for resilience, savings, and leadership.