Introduction: The Pivotal Shift in Commercial & Industrial Energy Priorities

The global energy landscape for factories, industrial parks, and independent power producers is undergoing a fundamental transformation. The question is no longer whether to integrate energy storage but how to implement projects that are safe, fully compliant, and rapidly profitable. With the global commercial and industrial (C&I) energy storage market projected to grow by 62% in 2025, reaching 16.6 GWh, the opportunity is immense. However, navigating this complex terrain requires moving beyond basic equipment supply to embrace comprehensive, “turnkey” solutions that address the full project lifecycle.

This guide provides a definitive roadmap for C&I stakeholders, dissecting the core challenges of economic certainty, regulatory compliance, and seamless execution. We will explore actionable strategies and proven solutions tailored to the nuanced demands of key global markets, from the regulatory-intensive environments of Europe and North America to the high-growth emerging economies of Latin America.

Part 1: Ensuring Project Economics and Profitability Certainty

The era of relying solely on policy subsidies is over. Today’s successful C&I storage projects must prove their worth in increasingly liberalized electricity markets.

1.1 Market Dynamics: The Imperative for Intelligent Storage

Globally, the trend is toward market-driven mechanisms. Policies like China’s recent reforms, which encourage higher self-consumption of distributed solar and expose systems to fluctuating feed-in tariffs, exemplify this shift. In this environment, storage is no longer an optional add-on but a critical tool for financial resilience.

The primary value driver remains energy arbitrage—charging batteries during low-cost, off-peak periods and discharging during expensive peak hours. However, dependence on this single model is a vulnerability, as seen in regions like Zhejiang, China, where adjustments to time-of-use tariffs can significantly extend project payback periods. The forward-looking strategy is to build systems capable of capturing multiple value streams, including participation in grid ancillary services (like frequency regulation) and demand response programs.

1.2 The Power of Integrated Design and AI-Driven Dispatch

True economic optimization comes from seamless photovoltaic-storage-integration and intelligent operation. A standalone storage system is powerful, but one that is dynamically co-optimized with on-site solar generation unlocks superior value.

The cornerstone of this approach is an advanced Energy Management System (EMS) that acts as the project’s financial brain. Modern systems go beyond simple scheduling. By leveraging AI algorithms and big data analytics, they can perform highly accurate load and photovoltaic-generation forecasting. The EMS synthesizes this data with real-time and forecasted electricity prices, automatically executing the most profitable charge/discharge strategy.

The results are measurable. For instance, the Wattpower near-zero carbon park project in China implemented an AI-driven storage strategy that boosted distributed storage revenue by over 20% compared to conventional two-charge-two-discharge models, while also reducing demand charges by approximately 5%. Similarly, performance gains directly impact the bottom line; analysis shows that increasing a system’s round-trip efficiency from 85% to 89% can generate multimillion-dollar additional revenue over the project’s lifetime.

*Table 1: Global C&I and Utility-Scale Storage Market Growth Forecast (2025)*

Part 2: Navigating the Maze of Grid Compliance and Local Certification

For any cross-border or large-scale project, regulatory compliance is not a final hurdle but a foundational requirement that must be designed into the product from the outset.

2.1 The High Bar of International Market Access

Entering regulated markets requires rigorous third-party validation. In the European Union, grid interconnection codes are stringent, often requiring specific certifications for participation in frequency restoration reserves (e.g., aFRR). In North America, authorities having jurisdiction (AHJs) and insurers increasingly demand compliance with the latest safety standards as a precondition for permitting and operation.

The regulatory framework is built upon a hierarchy of standards:

- System Safety: UL 9540 is the paramount safety standard for energy storage systems in North America, encompassing electrical, electrochemical, and mechanical safety. Its companion, UL 9540A, is a critical test method for evaluating thermal runaway fire propagation and is explicitly referenced in the NFPA 855 installation standard.

- Component Safety: Key referenced standards include UL 1973 for batteries, UL 1741 for inverters and grid interconnection, and IEEE 1547 for distributed resource interoperability.

- Regional Market Labels: For Europe, the CE mark (or UKCA for the UK) is mandatory, demonstrating conformity with Low Voltage and Electromagnetic Compatibility (EMC) directives.

2.2 Building Trust Through Proven Certification and Local Expertise

For a project owner, navigating this landscape alone is impractical. Trust is built when a solution provider demonstrates both product certification and project-level execution experience.

Leading providers differentiate themselves by:

1. Offering Pre-Certified Solutions: Supplying containerized systems that have already obtained UL 9540/9540A, IEC 62933-5-2, and other relevant certifications, significantly de-risking the local approval process.

2. Providing Localized Support: Employing in-region engineers who understand the specific documentation, testing, and communication protocols required by local utilities and inspectors. This capability to assist with on-site commissioning and grid integration testing is invaluable.

3. Addressing Evolving Standards: The standards landscape is dynamic. For example, the 2025 revision of UL 9540A introduces a more rigorous “large-scale fire test” replacing the previous installation-level test, emphasizing the need for partners at the forefront of safety engineering.

*Table 2: Core International Certifications for Grid-Tied Energy Storage Systems*

Part 3: Accelerating Deployment with Integrated Lifecycle Services

Time is money. Project delays directly equate to lost revenue and extended payback periods. The complexity of deploying containerized storage—involving international logistics, customs, local electrical codes, and civil works—demands a coordinated, single-point-of-responsibility approach.

3.1 Overcoming Logistics and Deployment Bottlenecks

Containerized Energy storage system face specific international shipping challenges, such as compliance with the European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR). Improper documentation or packaging can lead to port delays, rejected shipments, and costly demurrage fees. Furthermore, on-site challenges like local road weight limits (e.g., standard 44-ton truck limits in many regions) or crane accessibility can complicate installation.

3.2 The “Turnkey” Partner Advantage: From Concept to Cash Flow

The solution is to partner with a provider that acts as a true solutions partner, not just a vendor. This means offering an integrated service scope:

- Feasibility & System Design: Custom-sizing solutions like optimized hybrid solar systems to match specific load profiles and regulatory environments.

- Certified Equipment Supply: Providing pre-integrated, pre-tested containerized storage systems that meet destination market standards.

- Logistics & Customs Mastery: Managing the entire shipment process, including dangerous goods declarations, export/import documentation, and delivery to site.

- Local Installation & Grid Integration: Supervising civil works, electrical installation, final commissioning, and providing hands-on support for utility interconnection.

- Long-Term Operational Support: Offering remote monitoring, performance analytics, and preventative maintenance to ensure the system delivers projected returns over its 15-20 year lifespan.

Providers can further accelerate deployment by designing products tailored for logistics efficiency. For example, compact 20-foot or 40-foot container solutions with energy densities of 3MWh to 5MWh or more can maximize energy delivery per shipment while adhering to common road transport weight limits.

Part 4: Regional Strategic Focus and Solution Alignment

A one-size-fits-all strategy fails in the global storage market. Success requires tailoring the value proposition to regional priorities.

North America (The Premium Market)

- Customer Profile: Utilities, large independent power producers, sophisticated C&I entities.

- Core Demand: Ultra-high reliability, robust safety documentation (UL 9540A is critical), and technology brand reputation. Projects often require bankable engineering and support in securing project finance.

- Solution Focus: Emphasize executional excellence in complex environments, top-tier safety certifications, and a track record of working with financial institutions. Highlight solutions that integrate seamlessly with local grid operator requirements and software platforms.

Europe (The Regulation-Driven Market)

- Customer Profile: Energy cooperatives, industrial manufacturers, renewable developers.

- Core Demand: Full compliance with EU directives, cybersecurity, grid-code compatibility (e.g., aFRR), and sustainable design. Environmental, Social, and Governance (ESG) criteria are increasingly important.

- Solution Focus: Underscore CE marking, specific grid certifications, and eco-design (e.g., use of low Global Warming Potential (GWP) refrigerants in liquid-cooled systems). Promote the adaptability of systems to participate in local flexibility markets.

Latin America & Emerging Markets (The Growth Markets)

- Customer Profile: Mining companies, large-scale agriculture, utilities in countries like Mexico, Chile, Colombia, and Peru.

- Core Demand: High value-for-money, durability in harsh climates, and strong local technical support. Speed of deployment and reliability to offset diesel generation are key.

- Solution Focus: Offer robust, competitively priced containerized solutions with wide temperature tolerance. Demonstrate a commitment through local service hubs, training programs, and readily available spare parts. The ability to provide clear, long-term total cost of ownership (TCO) models is crucial.

Conclusion: Partnering for a Certain Future

The journey to a successful, profitable C&I energy storage project is complex, but the destination—energy independence, cost certainty, and sustainability—is clear. In a market evolving from policy-driven adoption to value-driven investment, the winning formula combines intelligent, revenue-optimizing technology, unassailable safety and compliance credentials, and flawless end-to-end execution.

This requires more than a component supplier; it demands a strategic partner committed to shouldering the technical and regulatory burden, ensuring your project is not just completed, but fully optimized for the long term. As the industry matures, those who choose partners capable of delivering this comprehensive “turnkey” certainty will be best positioned to capitalize on the enduring energy transition.

Frequently Asked Questions (FAQ)

Q1: With changing electricity policies, how can I be sure my storage project will remain economically viable for its entire lifespan?

A: The key is to design for multiple revenue streams from the beginning. While energy arbitrage is fundamental, selecting a system with an advanced, software-upgradable EMS allows it to adapt and participate in future grid service markets (frequency regulation, capacity markets) as they mature. Look for providers who demonstrate active software development and a strategy for continuous value optimization.

Q2: What is the single most important safety certification I should look for in a containerized battery system for a U.S. project?

A: For utility and large C&I projects in North America, UL 9540A test compliance is paramount. It is not a certification mark itself, but a test report that is critically reviewed by fire marshals and insurers under NFPA 855. Ensure your provider has a current, comprehensive UL 9540A test report from a reputable laboratory for the exact system model you are purchasing.

Q3: We are a developer in Chile/Mexico with limited in-house storage expertise. What type of partnership model should we seek?

A: You should prioritize providers offering full Engineering, Procurement, and Construction (EPC) services or a deeply supportive “partner” model. This includes detailed front-end engineering design (FEED), handling of all international logistics and customs, providing local supervisory engineers for installation, and securing grid interconnection. This “hands-on” support is more valuable in emerging markets than a marginal discount on equipment.

Q4: How critical is the choice between air-cooled and liquid-cooled thermal management for containerized systems?

A: It is a major design choice impacting cost, lifetime, and performance. Liquid cooling is generally superior for high-power, high-energy density systems and in environments with extreme ambient temperatures, as it provides more uniform cell temperatures, prolonging battery life and maintaining performance. Air-cooling can be a cost-effective solution for milder climates and less aggressive duty cycles. A reputable provider will recommend the optimal technology based on your specific site conditions and operational profile.

Q5: What ongoing operational costs should we budget for after the system is commissioned?

A: Beyond potential software subscription fees for advanced EMS features, primary operational costs include electricity for auxiliary loads (cooling, controls), periodic preventative maintenance (filter changes, connector torque checks), and potential performance degradation over time. High-quality systems with efficient thermal management (low auxiliary load) and long-performance warranties will minimize these lifetime costs. Insist on a transparent total cost of ownership (TCO) model from your provider.

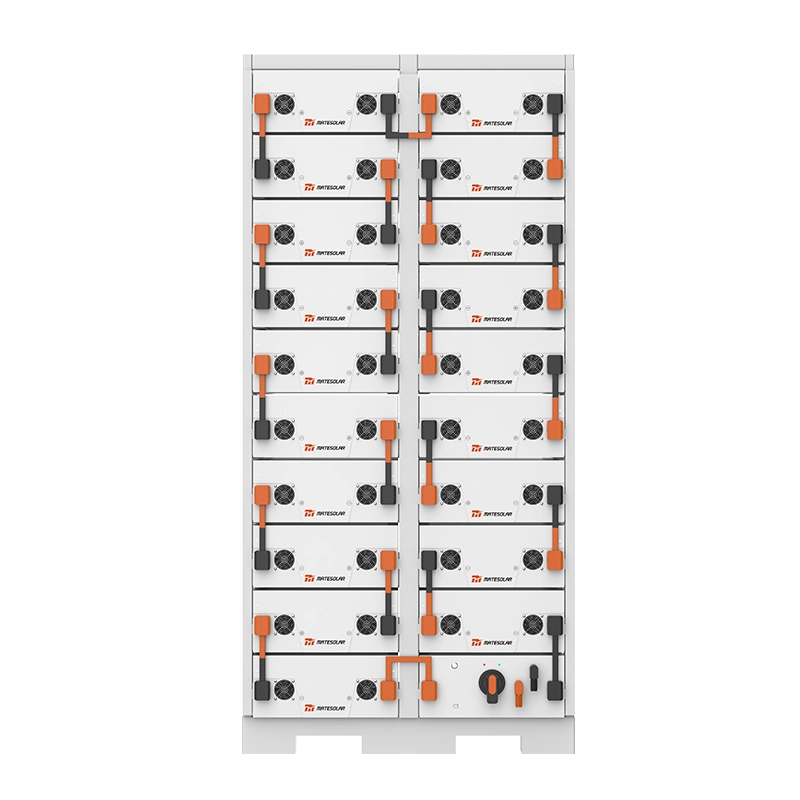

MateSolar, as a global one-stop photovoltaic and energy storage solutions provider, is engineered to be this definitive partner. We translate the complexities outlined in this guide into actionable certainty. Our solutions, from intelligently managed 500KW hybrid solar systems

for commercial facilities to our utility-grade 20ft 3MWh 5MWh liquid-cooled containerized storage systems,

are built with compliance, durability, and profitability as core design principles. We invite you to explore our comprehensive approach and dedicated product solutions designed to deliver turnkey success for your next project.