As the renewable energy sector matures, a sophisticated fusion of distributed solar and storage technologies is rewriting the rules of commercial energy management.

The once-familiar pattern of distributed solar development is hitting a critical juncture. In 2025, approximately 60-70% of new solar capacity comes from distributed projects, with commercial and industrial applications accounting for about 30% of this segment. Yet, beneath these growth figures lies a pressing challenge: curtailment rates in some distributed projects exceed 20%, severely undermining their economic viability.

The industry is transitioning from policy-driven growth to market-driven sustainability. As Cui Nan, Deputy General Manager of Suzhou GCL Ji Tan Energy Technology, explains, "Distributed solar faces restrictions in red zones where grid capacity is limited, making it difficult to feed excess electricity into the grid, and commercial and industrial storage is highly influenced by time-of-use pricing policies, resulting in fragile revenue calculation models."

The Contemporary Landscape of Distributed Solar-Plus-Storage

The evolution of distributed energy resources has reached a new phase of sophistication. Where simple rooftop solar installations once sufficed, businesses now require integrated systems that address multiple value streams simultaneously.

The policy landscape has shifted dramatically with Document 136 issued in January 2025, pushing renewable energy fully into electricity markets. This market orientation reduces non-technical costs but introduces new complexities in revenue optimization. Simultaneously, Document 1192 clarifies transmission and distribution pricing methods, favoring local consumption of renewable energy.

The national push for 180GW of energy storage by 2027 underscores the strategic importance of storage in this new energy paradigm. The challenge lies no longer in simply installing solar capacity, but in configuring storage solutions that transform solar generation from a intermittent resource into a dispatchable one.

The Dual Challenge: Curtailment and Fragile Economics

The Achilles' heel of distributed solar has always been its intermittency and grid dependency. Two specific pain points have emerged as critical barriers to wider adoption:

1. The Curtailment Dilemma

Solar generation peaks during midday hours when electricity prices typically hit their lowest point. Without storage, this valuable energy often goes to waste or is sold back to the grid at minimal rates. The Shache project in Xinjiang exemplifies this challenge, where AI-controlled storage reduced curtailment to under 3%, but many projects without such systems face significantly higher losses.

2. The Profitability Precision Problem

Current revenue models for commercial storage rely heavily on peak-valley price arbitrage. However, with electricity spot markets becoming more prevalent, the spread between peak and off-peak rates is compressing. In Zhejiang province, where 25% of China's commercial storage is installed, project developers are noticing that spot market price differentials are already lower than regulated time-of-use differentials, signaling an eventual compression of arbitrage opportunities.

Configuration Optimization: The Path to Enhanced Returns

Strategic sizing of storage components represents the most critical lever for optimizing solar-storage projects. The conventional approach of simply allocating storage based on solar capacity is giving way to more nuanced methodologies.

Active Storage Allocation Strategy

Cui Nan proposes an "active storage allocation" method where storage is sized according to midday curtailment duration and absorption capacity. For a typical 5MW solar project, pairing it with 50% capacity for two hours of storage (5MWh for a 5MW project) can transform the economics.

The operational strategy is precise: storage charges during midday hours when solar generation peaks and prices slump, then discharges during the evening peak (after 4 PM). This approach smooths solar output and enhances electricity value, with demonstrated cases showing project ROI increases where owners' annual electricity savings grew by 50% compared to solar-only projects.

Technological Innovations Enabling Efficiency Gains

Recent advancements in storage technology are creating new opportunities for optimization:

- AI-Driven Energy Management: The Shache project in Xinjiang employs a desert "green brain" energy management system that uses AI algorithms to increase power generation from bifacial modules by 8% while keeping curtailment below 3%.

- Modular Prefabrication: Prefabricated containerized solutions have reduced construction cycles by 40%, significantly lowering soft costs.

- Efficiency Optimization: Distributed modular systems like those used in the Huayan energy storage station in Ningxia achieve system conversion efficiency of 89.94% through PCS and battery cluster optimization that keeps systems operating in their most efficient range 90% of the time.

Table: Performance Comparison of Energy Storage Technologies for Commercial Applications

| Technology Parameter | Lithium-Ion (Current) | Lithium-Ion (Projected) | Non-Lithium LDES |

| System Conversion Efficiency | 88-92% | 90-94% | 60-80% |

| Cycle Life | 6,000-8,000 | 10,000-12,000 | 15,000-20,000 |

| Cost Trend (per kWh) | Decreasing 10-15% annually | Stabilizing | Currently higher, decreasing |

| Duration Capability | 2-4 hours | 4-8 hours | 8-100+ hours |

| Technology Maturity | Commercial scale | Advanced development | Pilot/demonstration |

Case Studies: Operational Models Demonstrating Success

Case 1: Taxing Grid Infrastructure - The Wenzhou Expressway Model

The Wenzhou Expressway Management Center has implemented a differentiated approach to "solar-storage-charging" integration based on geographical conditions and functional requirements, creating a "one-station-one-policy" green energy layout.

At the Taishun Toll Station, a closed-loop energy system incorporates 30kW of solar panels, a 215kWh smart storage cabinet, and two 120kW DC charging piles. The system generates 35,000 kWh annually, with storage ensuring power availability during peak evening hours or cloudy weather. The strategic genius lies in positioning these facilities along transportation corridors where electric vehicle charging demand naturally aligns with solar generation patterns.

The Wentong Toll Station exemplifies a different approach, maximizing space utilization by installing 150kW solar panels on idle station roofs and slope areas, creating a "zero-land-occupation" power station. With annual generation reaching 160,000 kWh, it not only meets the toll station's needs but also feeds approximately 60,000 kWh back to the grid via a 10KV dedicated line.

Case 2: Industrial Application - The Shifeng Group Implementation

Shifeng Group's 20MW/40MWh centralized storage plus 0.8MW/1.6MWh commercial storage project demonstrates the industrial scale potential. The project employs a "two-charge-two-discharge" strategy (peak-valley arbitrage + peak-shaving auxiliary services) to achieve anticipated annual revenue of ¥12 million with a payback period of 5.8 years.

The project's technical sophistication includes:

- "One-cluster-one-optimization" architecture with BMS sampling accuracy of ±0.5%

- PCS conversion efficiency of 98.5%

- Response speed of 200MW/minute in grid peak-shaving tests, generating ¥860,000 in auxiliary service revenue

The system increases the self-consumption rate of solar power from 65% to 92%, dramatically reducing curtailment while creating multiple revenue streams.

Table: Financial Analysis of Representative Commercial Solar-Plus-Storage Projects

| Project Metrics | Wenzhou Expressway | Shifeng Group | Huayan Storage Station |

| System Scale | 30kW solar + 215kWh storage | 20MW/40MWh storage + 0.8MW/1.6MWh | 200MW/400MWh |

| Annual Generation | 35,000 kWh (Taishun) | Not specified | Charged: 67,504,500 kWh (H1 2025) |

| Utilization Hours | Not specified | Not specified | 630.89 hours (H1 2025) |

| Key Revenue Streams | Self-consumption, EV charging | Peak-valley arbitrage, grid services | Capacity leasing, market arbitrage |

| Return Profile | Reduced electricity costs | ¥12M annual revenue | Leading regional returns |

For organizations exploring storage solutions, Google's commitment to non-lithium long-duration energy storage (LDES) research with Salt River Project represents the kind of forward-thinking approach necessary to overcome current technological limitations. As businesses plan their energy infrastructure, considering scalable solutions that can adapt to emerging technologies is crucial.

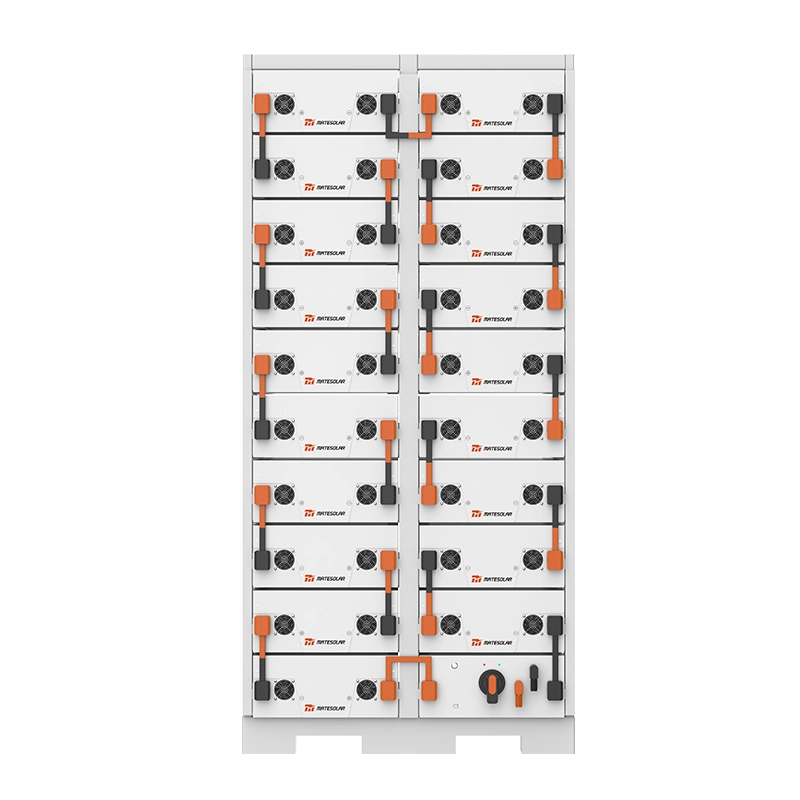

For organizations seeking robust and scalable Commercial and Industrial (C&I) energy storage solutions, MateSolar's 20ft Liquid Cooling Container Energy Storage System (BESS)

represents a high-capacity, utility-grade option engineered for reliability and performance. This containerized solution, model MTCB-20FT-LC, is built upon LiFePO4 (lithium iron phosphate) battery technology, offering nominal capacities of 3,354 kWh or 5,015.96 kWh to suit a range of medium-to-large-scale commercial operational demands . The system is designed for high-voltage applications, with an operating voltage range between 1164.8V and 1497.6V, and supports a rated charge/discharge performance of up to 0.5C . A key feature is its advanced liquid cooling methodology, which ensures precise thermal management by maintaining a minimal cell-to-cell temperature delta, a critical factor for maximizing battery lifespan, safety, and consistent efficiency . The system boasts an IP55 protection rating for outdoor durability and operates effectively in temperatures from -20°C to +50°C, making it suitable for diverse environmental conditions . With a cycle life of 8,000 cycles and backed by a 10-year warranty, the product is engineered for long-term economic viability and a lower total cost of ownership . Furthermore, its design incorporates comprehensive communication capabilities, including CAN and RS485 interfaces supporting Modbus and IEC104 protocols, enabling sophisticated grid interaction, remote monitoring, and seamless integration into broader energy management systems for optimal energy dispatch and grid support functions .

At MateSolar, our core philosophy is centered on delivering end-to-end, turnkey solar-plus-storage solutions that seamlessly integrate into your commercial or industrial energy strategy. We understand that a successful project extends beyond hardware to encompass meticulous planning, flawless execution, and lifelong support. That's why we assign a dedicated team of seasoned application engineers to every client, providing expert guidance from the initial feasibility study and system design through to installation, commissioning, and long-term operational maintenance. Our unwavering commitment to engineering excellence ensures that we address all pre-sales and post-sales challenges with authoritative, tailored solutions, guaranteeing optimal system performance and a rapid return on your investment.

We invite you to explore our comprehensive portfolio of cutting-edge energy storage products designed to meet your specific needs and to contact our specialists for a personalized consultation. Discover more about our energy storage systems solutions here: [ https://www.mate-solar.com/category/system ]

The Emerging Business Model: From Asset Ownership to Value Stacking

The most significant evolution in distributed solar-storage systems lies not in the technology itself, but in the business models they enable. The once-dominant approach of simple behind-the-meter cost avoidance is expanding into sophisticated value-stacking strategies.

The Huayan energy storage station in Ningxia exemplifies this transition. Since its grid connection 21 months ago, it has charged over 210 million kWh and discharged 190 million kWh, achieving a system conversion efficiency of 89.94%. The station has expanded its revenue streams through capacity leasing agreements with 17 renewable energy facilities, leasing out 200MW/400MWh of capacity.

This multi-revenue approach demonstrates the future of commercial storage projects: simultaneously valuing energy arbitrage, grid services, capacity rights, and renewable integration.

FAQ: Addressing Common Technical and Commercial Questions

Q: What is the optimal storage capacity ratio for a typical commercial solar project?

A: Current project data suggests that allocating storage capacity at 50% of solar capacity for 2-hour duration represents a balanced approach. For example, a 5MW solar project would pair effectively with 5MWh of storage. However, optimal ratios vary based on local rate structures, solar irradiation profiles, and specific load patterns.

Q: How long do modern commercial battery systems typically last?

A: High-quality systems demonstrate exceptional longevity. The Huayan project reported 98% State of Health (SOH) after 21 months of operation, far exceeding industry averages. Properly maintained systems can maintain 80% capacity after 6,000-12,000 cycles depending on battery chemistry and operational practices.

Q: What are the key factors impacting energy storage system efficiency?

A: Critical factors include: PCS conversion efficiency (up to 98.5% in advanced systems), battery cluster balance (99.9% equilibrium in optimized systems), thermal management efficiency, and discharge depth (98% achievable with string-based cluster control).

Q: How are energy management systems evolving to address solar-storage integration?

A: Modern systems like those deployed in the Shache project employ AI algorithms that optimize generation, storage, and consumption patterns in real-time. These systems can increase solar generation by 8% while reducing curtailment to under 3%, dramatically improving project economics.

Q: What revenue streams beyond peak shaving are available for commercial solar-storage projects?

A: Sophisticated projects now access multiple revenue streams including: frequency regulation services, capacity payments, demand charge management, renewable energy credit generation, and participation in electricity spot markets. The Shifeng Group project, for example, earned ¥860,000 in auxiliary service revenue in just one month.

For businesses considering containerized solutions at scale, Google's approach to infrastructure architecture offers valuable insights into how modular, scalable systems can be deployed efficiently across multiple locations.

Conclusion: The Path Forward for Distributed Solar-Plus-Storage

The distributed solar-storage market is undergoing a necessary maturation. From its initial phase of policy-driven growth, the industry is advancing toward market-based sustainability. This transition favors projects with sophisticated technical configurations and business models that stack multiple value streams.

The successful projects of 2025 share common characteristics: AI-driven optimization, modular and scalable architectures, and diversified revenue models that extend beyond simple arbitrage. As the market consolidates—with reports indicating 20% of integrators currently lack orders—the emphasis on bankable, optimized designs intensifies.

For commercial and industrial energy consumers, the message is clear: distributed solar-storage projects represent not just environmental stewardship, but compelling economic opportunities when correctly configured. By embracing active storage allocation strategies, leveraging AI optimization, and stacking value streams, businesses can transform their energy infrastructure from a cost center into a profit center.

The companies that will thrive in this new environment are those that approach solar-storage integration not as simple infrastructure projects, but as sophisticated energy assets requiring the same rigorous analysis and optimization as any other capital investment.

MateSolar is a leading provider of comprehensive solar-storage solutions, offering customized systems that address the specific challenges of commercial and industrial energy consumers. Our integrated approach combines advanced technology with financial optimization to deliver projects with superior returns and reliability.