The global transition toward renewable energy is accelerating, and commercial and industrial (C&I) energy storage stands at the forefront of this transformation. With the release of the "Zero-Carbon Intelligent Manufacturing: 2025 Bluebook on Commercial and Industrial Solar and Storage Development" and recent various countries and regions policy directives, the energy storage sector is poised for unprecedented growth and innovation. This white paper examines the current state, key trends, and future prospects of the C&I energy storage market in 2025, providing stakeholders with actionable insights and data-driven analysis.

Market Overview and Policy Dynamics: The International Landscape

The global commercial and industrial (C&I) energy storage market is experiencing a transformative phase, shifting from policy-driven incentives to market-driven sustainability. This transition is fueled by escalating electricity demands, grid modernization imperatives, and the urgent need for energy resilience across diverse international regions.

Explosive Growth in International Orders

The international demand for energy storage systems, particularly from Chinese manufacturers who dominate the global supply chain, serves as a key indicator of worldwide growth dynamics. In the first half of 2025, Chinese energy storage firms secured 199 new overseas orders, totaling a staggering 160 GWh—a remarkable 220.3% year-over-year increase. This surge significantly surpasses the 81.5 GWh of new installed capacity in the international market throughout the entire previous year. While established markets like Europe and North America remain crucial, emerging markets in the Middle East, Australia, and East Asia are becoming substantial contributors, accounting for 35 GWh, 33 GWh, and 20 GWh in Q1 2025 orders, respectively.

Regional Policy Dynamics and Market Drivers

1. Europe: Tackling Grid Constraints and Price Volatility

Europe's energy storage landscape is characterized by efforts to address renewable energy curtailment and dynamic electricity pricing.

- Policy Shift: The region is moving from subsidizing solar feed-in tariffs to promoting self-consumption and grid stability. Germany's introduction of dynamic electricity pricing in January 2025 requires suppliers to offer real-time linked tariffs, creating significant "arbitrage space" for storage. France has drastically reduced or eliminated feed-in tariffs for small-scale PV, effectively pushing prosumers to maximize self-consumption through storage.

- Market Impact: These policies are accelerating the adoption of C&I storage. The European C&I storage market is expected to see a CAGR of 55% from 2024 to 2029, with projected new installations of 3.6 GWh in 2025, a 62% increase year-over-year. Furthermore, Western Europe is entering a phase of "reducing solar support to supplement storage," cutting traditional PV subsidies while introducing new incentives for storage to enhance grid reliability and flexibility.

2. North America: Modernizing a Aging Grid

The North American market, particularly the U.S., is driven by the critical need to reinforce an aging grid infrastructure against rising demand and instability.

- Market Growth: The U.S. added approximately 37.1 GWh of energy storage in 2024, solidifying its position as the world's second-largest storage market. This growth is propelled by increased electricity demand from data center expansion, manufacturing re-shoring, and electric vehicle adoption, all straining a grid plagued by frequent outages and interconnection delays.

- Regional Hotspots: States like California (CAISO) and Texas (ERCOT) are leaders, with deployed storage power reaching 10.8 GW and 6.7 GW, respectively. Storage is no longer optional but a "essential patch" for ensuring power supply stability and alleviating grid congestion.

3. Australia: Extreme Weather and Economic Incentives

Australia's market is catalyzed by climate-induced grid vulnerabilities and supportive government schemes.

- Climate & Economics: Extreme weather events have caused over 32,000 insurance claims in early 2025, surpassing the 2024 total, highlighting grid fragility. Nationwide default wholesale electricity price hikes of up to 9.7% in July 2025 have made storage an attractive economic solution for peak shaving.

- Subidy Boost: The government's "Cheap Home Battery Scheme" (May 2025), with a A$2.3 billion budget, offers ~30% upfront cost subsidies for small battery systems (5kWh-100kWh). This policy is expected to slash the investment payback period for residential storage from 7-8 years to 4-5 years, potentially unlocking a wave of retrofits for existing PV systems.

4. Middle East & Africa: Energy Security and Transition

These regions represent a burgeoning frontier, where storage is less a luxury and more a necessity for basic electricity access and diesel displacement.

- Middle East: Geopolitical conflicts have devastated infrastructure. Iraq suffers daily blackouts of 7 hours, while Kurdistan endures 19 hours. Countries are responding with supportive policies; Iraq offers low-interest loans up to 7 years with rates capped at 2.5% for distributed solar+storage. Iran is developing solar-powered industrial parks with dedicated storage.

- Africa: The continent holds 60% of global solar resources but only 3% of its power generation. Nigeria's grid collapsed 9 times in 2024, and a 300% electricity tariff hike has made diesel generation prohibitively expensive. Solar-plus-storage, with a Levelized Cost of Energy (LCOE) around ¥0.2/kWh, presents a viable alternative to diesel. International initiatives, like China's pledge to implement 30 clean energy projects in Africa, including distributed PV-storage systems, are further stimulating market development.

5. Southeast Asia: Industrial Growth Meets Grid Limitations

Rapid industrialization and weak grid infrastructure are driving demand in Southeast Asia.

- Case of Vietnam: Accelerated industrialization has outpaced grid development, leading to severe power shortages and factory outages. Many factories already have rooftop PV but lack storage, rendering them useless during grid failures. High electricity demand and rising tariffs are making PV+storage a critical pathway to resolve power shortages and stabilize costs.

Diverse Policy Mechanisms

Globally, governments are employing a variety of instruments to foster storage deployment:

- Investment Subsidies: Direct capital expenditure support (e.g., Australia's 30% battery subsidy, Austria's 20% bonus for using European components in PV and storage projects).

- Market Mechanisms & Regulations: Germany's dynamic pricing, Australia's allowance for Virtual Power Plants (VPPs) to participate directly in wholesale markets, and Italy's MACSE mechanism for long-term capacity payments.

- Mandates & Ambitions: Saudi Arabia's "Vision 2030" underpins massive projects, and Hungary has revised its energy and climate plan target upwards to 12 GW of solar.

The global C&I energy storage market is thus thriving on a powerful confluence of factors: deep-seated structural energy challenges, evolving policy frameworks that increasingly value flexibility over mere capacity, and improving project economics. This synergy is transforming energy storage from a complementary technology into an indispensable cornerstone of the global energy transition.

Technological Advancements Driving Efficiency

Technological innovation remains the core driver of the C&I energy storage sector. Several key developments are enhancing system efficiency, safety, and scalability:

- N-Type TOPCon Cells: Dominating the market with a 71% share, these cells offer higher efficiency and better performance in diverse conditions.

- BC (Back Contact) Modules: Leading the distributed market with 24.4% conversion efficiency, making them ideal for space-constrained installations.

- Flexible Mounting Systems: Single-cable flexible supports reduce steel usage by 10%–15% and enhance wind resistance to Level 12, while also improving land utilization by 25% or more in mountainous regions.

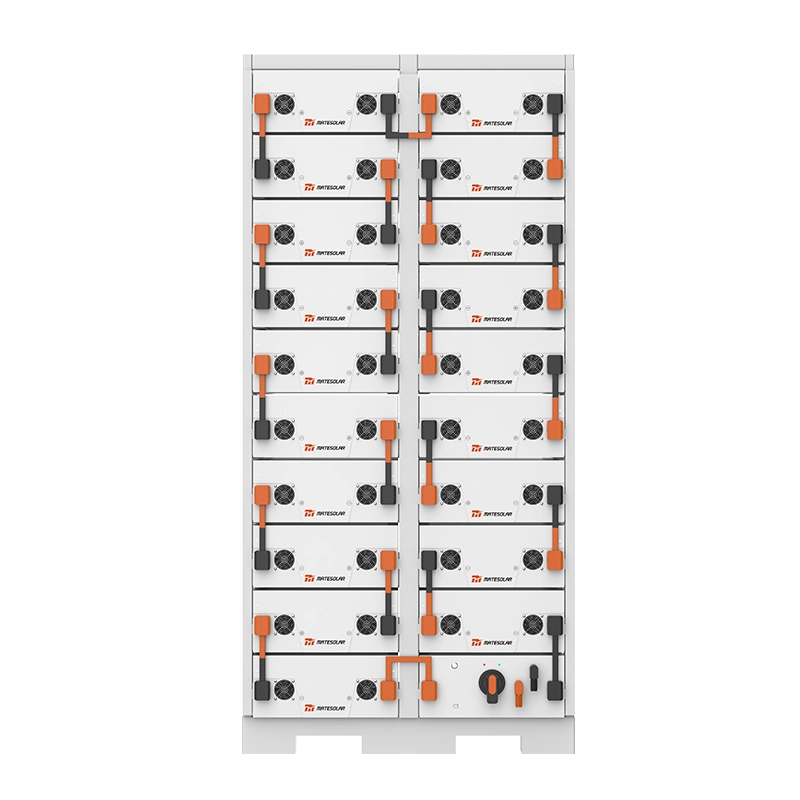

- Liquid Cooling Containerized Storage Systems: Systems like MateSolar’s 5MWh solution incorporate triple-layer safety controls, reducing cell temperature differences to ≤3°C and extending cycle life by 20% compared to air-cooled systems.

Economic Analysis and Investment Trends

The levelized cost of energy (LCOE) for solar combined with storage is becoming increasingly competitive. Current estimates indicate:

- Solar LCOE: ¥0.260/kWh based on an EPC cost of ¥2.8/W.

- Storage LCOE: ¥0.326/kWh at a system cost of ¥0.8/Wh.

- Breakeven Point: A 31.3% solar-storage ratio with 4 hours of storage achieves grid parity with coal-fired power benchmarks.

However, storage system prices are declining rapidly due to intense competition. The average price for a 215kWh integrated storage unit has fallen from ¥0.8/Wh in early 2024 to ¥0.66/Wh in mid-2025—a reduction of nearly 19%.

*Table 1: Cost-Benefit Analysis of a 10MW/20MWh Storage Project (Assuming Peak-Valley Price Difference of ¥0.7/kWh)*

| Metric | Value | Commentary |

| Annual Revenue | ¥330,000+ | Derived from peak-valley arbitrage |

| System Efficiency | >89% | Higher than industry average of 85% |

| Cycle Life Improvement | 20% | Compared to air-cooled systems |

| Payback Period | 6–8 years | Varies based on local policy and usage patterns |

| Lifetime ROI | ~200% | Over 20-year operational lifespan |

Source:

Global Expansion and Localization Strategies

International markets critical for energy storage enterprises. While Europe and North America still account for 51% of overseas orders, emerging markets in the Middle East, Southeast Asia, and Africa are becoming key growth drivers.

- Middle East: Saudi Arabia’s "Vision 2030" has triggered demand for large-scale storage, including a 7.8 GWh project.

- Africa: Solar exports surged 55% year-over-year, supported by declining costs and improving technology.

- Localization Strategies: Leading companies are adopting "technology output + localization" models to enhance market penetration and comply with regional regulations.

Table 2: Global Market Forecast for Commercial and Industrial Energy Storage (2025–2027)

| Region | 2025 Forecast (GWh) | 2027 Projection (GWh) | Key Growth Drivers |

| China | 10.56 | ~25 | Policy support, peak-valley price differentials, industrial decarbonization |

| Europe | 6.5 | 19.6 | Energy security concerns, rising electricity prices, favorable net metering policies |

| North America | 5.2 | 14.3 | Grid modernization, investment tax credits, state-level storage mandates |

| Middle East | 3.8 | 12.0 | Solar-rich resources, economic diversification, national vision projects (e.g., Saudi Vision 2030) |

| Southeast Asia | 2.5 | 7.5 | Industrial growth, rising energy demand, renewable integration initiatives |

Source:

FAQs: Addressing Common Questions on C&I Storage

1. How does adding storage impact existing solar PV systems?

It depends on the current consumption pattern. If the facility already consumes most of its solar generation, storage may not significantly increase solar ROI. However, if there is excess solar generation (especially during midday), storage can enhance self-consumption and revenue through peak shaving.

2. What are the operational costs and losses associated with storage systems?

Storage systems incur internal power consumption for cooling, monitoring, and auxiliary systems (typically 3–5%). These losses should be factored into financial models.

3. Can storage systems be monitored and controlled remotely?

Yes. Modern systems come with energy management systems (EMS) that enable 24/7 monitoring, data export, remote control, and grid interaction. For example, Kstar’s EMS allows users to export charge-discharge data and receive real-time alerts.

4. What is required to maintain a storage system?

Regular maintenance includes inspecting electrical connections, battery health, cooling systems (e.g., coolant levels in liquid-cooled systems), and software updates. Most containerized systems are designed for unmanned operation with periodic inspections.

5. Who is responsible for operation and maintenance after installation?

The project investor or owner typically holds O&M responsibility. They may perform maintenance in-house, contract with the user, or engage a third-party service provider.

Innovations and Strategic Outlook

The integration of artificial intelligence (AI) and cloud computing is transforming energy storage management. Platforms like OxeanCloud use AI algorithms to optimize charge-discharge strategies, improving dispatch efficiency and profitability. In projects like the Zhongyuan Group’s high-energy consumption park, such systems have achieved an annual ROI of over 10% while reducing carbon emissions by 4,800 tons.

Moreover, energy storage is expanding into new applications, including:

- Virtual Power Plants (VPPs): Aggregating distributed storage to provide grid services.

- Behind-the-Meter for Data Centers: Ensuring reliable power for energy-intensive computing facilities.

- Green Hydrogen Production: Providing stable power for electrolysis

Leveraging Google’s Solar API for Project Development

To enhance site selection and planning, industry players are increasingly leveraging geospatial data and AI-driven tools. Google’s Solar API, part of its Geospatial Services, offers detailed insights into solar potential, building roof configurations, shading analysis, and historical weather patterns. With data on over 350 million buildings worldwide, this tool helps developers identify high-yield locations and optimize system design.

For instance, integrating Google’s Solar API into pre-feasibility studies can reduce project development time and improve accuracy in energy yield assessments. Explore Google’s Solar API capabilities and its applications for renewable energy projects on the Google Cloud Solar API page.

For businesses considering specific system configurations, such as a 150KW hybrid solar storage system, detailed technical parameters and case studies are available on product pages like Google’s 150KW Hybrid Solar System product description.

These resources provide invaluable information for engineers and developers designing efficient and scalable systems.

Conclusion: Embracing the Future of C&I Energy Storage

The C&I energy storage sector is transitioning from a policy-dependent industry to a market-driven, technologically advanced ecosystem. With breakthroughs in battery technology, intelligent management systems, and innovative business models, energy storage is becoming a cornerstone of the global renewable energy landscape.

Companies that prioritize safety, efficiency, and adaptability will lead the next wave of growth—not only in mature markets but also across emerging economies in the Middle East, Africa, and Southeast Asia.

At MateSolar, we are committed to driving this transformation as a one-stop solution provider for photovoltaic and storage systems. From design and installation to maintenance and optimization, our expertise ensures that businesses worldwide can harness the power of solar and storage to achieve energy independence, reduce costs, and contribute to a sustainable future.