Executive Summary: The Dawning of a New Era

The global energy storage industry stands at a pivotal threshold in 2026, marked by a powerful convergence of ambitious policy frameworks, rapid technological evolution, and unprecedented market demand. Commercial and Industrial (C&I) and utility-scale containerized storage solutions are transitioning from niche applications to indispensable pillars of the modern grid. Driven by the dual imperatives of energy security and deep decarbonization, markets across Europe, North America, and Latin America are unveiling compelling growth narratives, each with unique drivers and dynamics. This analysis delves into the core of this transformation, providing a comprehensive roadmap for navigating the opportunities and complexities of the 2026 energy storage landscape.

The scale of anticipated growth is staggering. Globally, the solar energy storage battery market is projected to surge from USD 7.83 billion in 2026 to over USD 52.55 billion by 2035, representing a compound annual growth rate (CAGR) exceeding 23.3%. This expansion is not uniform but is instead led by distinct regional accelerators: policy-driven tariff programs in the U.S., aggressive Renewable Energy Sources Act targets in Europe, and emerging market liberalization and auction schemes in Latin America. For industry stakeholders, understanding these intertwined threads of policy, economics, and technology is crucial for strategic positioning in the coming year.

Market Overview and Core Drivers

The foundational driver for energy storage worldwide is the inexorable rise of variable renewable energy (VRE), primarily solar PV. As grid penetration of solar increases, so does the critical need for flexibility to ensure stability, optimize asset utilization, and defer costly grid upgrades. Energy storage is the keystone technology enabling this transition.

*Table 1: Global C&I & Utility-Scale Storage Market Drivers & Growth Indicators*

| Region | Key Policy Driver | 2026 Market Characteristic | Primary Growth Segment | Estimated 2026 Demand/Activity |

| Europe (ex. Germany) | EU Fit for 55, National REPA Targets | High Grid Service Value, Capacity Markets | Utility-Scale (Grid-Side) | Exceeding 50 GWh total installs |

| Germany | Renewable Energy Sources Act (2030: 215 GW PV) | High C&I & Prosumer Adoption | C&I, Behind-the-Meter | Leading EU installer; >22 GW/year PV pace needed from 2026 |

| United States | Inflation Reduction Act (IRA) ITC, OBBBA | Supply Chain Reorientation, "Safe Harbor" Rush | Utility-Scale, Community Storage | ~59 GWh installs; post-2025 FEOC rule adaptation |

| Latin America | Energy Auction Incorporation, Net Metering Reform | Early-Stage Rapid Growth, Price Sensitivity | Utility-Scale (Renewable Hybrids), C&I | Brazil targeting 15 GWh by 2030; regional auctions expanding |

Policy as the Primary Catalyst: Governments are no longer just observers but active architects of the storage market. China's *New Energy Storage Scale Construction Action Plan (2025-2027)* aims to add over 100 GW of new storage capacity by 2027, driving down global technology costs through scale. In Europe, the German Solar Package I is a quintessential example, designed to "accelerate the expansion of PV installations" by streamlining bureaucracy for balcony systems, commercial PV, and landlord-tenant electricity supply models. Similarly, the U.S. IRA's Investment Tax Credit (ITC) provides a foundational 30% credit, but its forthcoming "foreign entity of concern" (FEOC) rules are causing a strategic rush to secure supply chains before 2026.

Economic Fundamentals Reach Inflection Point: For C&I consumers, the business case has solidified. Storage provides demand charge reduction, backup power resilience, and arbitrage opportunities in volatile energy markets. For utilities and grid operators, large-scale containerized storage is now often the lowest-cost solution for frequency regulation, congestion relief, and capacity needs. After a period of price deflation, the market is witnessing a price stabilization and increase for key components like 280/314Ah battery cells, signaling robust demand and a shift away from a purely cost-driven market to one valuing performance, safety, and reliability.

Deep Dive: Regional Market Analysis for 2026

1. Europe: Maturity, Market Complexity, and Grid Integration

Europe's storage market is bifurcating and sophisticating. While the residential segment remains strong, the large-scale utility segment is the new growth frontier, expected to see installations surge from 8.8 GWh in 2024 to over 16 GWh in 2025.

Germany: The Policy Blueprint

Germany's target of 215 GW of total installed PV capacity by 2030—half on rooftops, half on ground-mounted systems—creates a non-negotiable demand for storage integration. The Solar Package I facilitates this by:

- Simplifying registration for balcony power plants and C&I installations.

- Encouraging landlord-to-tenant electricity supply, unlocking the multi-apartment building sector.

- Prioritizing dual-use agrivoltaics and installations on sealed areas like parking lots in auctions.

This creates a fertile environment for C&I solutions that can help businesses manage their consumption, participate in grid-balancing schemes (like the Regelenergie market), and maximize self-consumption of solar power. The policy intentionally reduces red tape, making projects faster to deploy and more financially attractive.

Pan-European Grid Challenges as an Opportunity: Across Europe, aging grid infrastructure and slow permitting for new lines are major bottlenecks for the energy transition. This directly fuels demand for grid-edge and grid-replacement storage. Storage systems can be deployed at critical nodes to alleviate congestion, provide local voltage support, and defer costly grid upgrades for years. The business model is evolving from simple energy shifting to providing a suite of stacked grid services, enhancing project economics.

2. North America: Policy Whiplash, Security, and Scale

The North American market, led by the U.S., is characterized by immense opportunity tempered by complex trade policies and stringent safety standards.

The U.S. IRA: A Double-Edged Sword

The IRA's ITC has supercharged the U.S. storage economy. However, the looming application of FEOC restrictions on battery components starting in 2026 has created a decisive "safe harbor" rush. Project developers are incentivized to start construction with qualifying equipment in 2025 to lock in the full ITC, leading to a surge in orders and anticipated strong installations in 2026. Counter to earlier fears, this dynamic suggests 2026 U.S. storage additions may increase to an estimated 59 GWh, rather than decline.

The Tariff and Standards Hurdle

Chinese manufacturers face significant headwinds: a potential tariff increase from 40.9% to 82.4% in 2026, and the non-negotiable requirement for rigorous certifications like UL 9540 and UL 9540A (large-scale fire testing). Furthermore, grid interconnection requirements are becoming more demanding, with states like California mandating sub-two-second response times for frequency regulation. This environment rewards technological sophistication, safety-by-design, and local partnership. It has accelerated the trend of Chinese industry leaders establishing local assembly or partnering with North American integrators.

*Table 2: 2025-2026 North American RE+ Exhibition Snapshot: Key Product Trends*

3. Latin America: The Emerging Frontier of Renewables Integration

Latin America, blessed with superb solar resources, is moving beyond early adopter status into structured market growth. The region is transitioning from seeing storage as a luxury to recognizing it as a tool for energy affordability and security.

Brazil: The Regional Anchor

Designated as the fifth-largest global and largest Latin American PV and storage market, Brazil is setting the pace. Key developments include:

- A national target of 15 GWh of energy storage by 2030, representing a potential market worth USD 3.79 billion.

- The formal inclusion of battery storage solutions in federal energy auctions, guaranteeing revenue visibility for large-scale projects.

- Reforms to the net metering scheme that now incentivize storage for commercial users, allowing them to sell surplus power back to the grid with tax benefits.

Chile, Argentina, and Beyond: Diversifying Models

- Chile's spot market with high price volatility creates perfect conditions for merchant storage projects that arbitrage daily price spreads.

- Argentina and Caribbean nations like Jamaica are increasingly focused on storage for grid stability and fossil fuel displacement, often supported by international development banks.

- Costa Rica, despite its clean grid, is exploring storage to manage hydroelectric variability and integrate more distributed solar.

*Table 3: Latin America - Key Country Focus for 2026*

| Country | Primary Driver | Storage Application Focus | Market Entry Consideration for 2026 |

| Brazil | Auction mechanisms, Net Metering reform | Utility-scale hybrids, C&I behind-the-meter | Understand local content trends, partner with strong local EPC. |

| Chile | Merchant energy arbitrage, Grid congestion | Large-scale standalone or PV-coupled storage | Financial modeling expertise for volatile market is critical. |

| Argentina | Grid modernization, Reducing diesel dependence | Transmission & Distribution support, Microgrids | Navigate macro-economic factors, seek multilateral funded projects. |

| Caribbean (e.g., Jamaica) | High electricity costs, Fuel price volatility | C&I and small utility-scale for fuel savings | Focus on robust, low-maintenance systems and clear TCO models. |

Technology Evolution: Containerization, Intelligence, and Safety

The product landscape is evolving to meet the specific demands of C&I and utility-scale applications.

The Rise of the "Super Container": The standard 20-foot container is becoming a powerhouse. The race for energy density has moved from 2.5-3 MWh per container a few years ago to now routinely exceeding 5 MWh, with leaders showcasing designs approaching 6-7 MWh. This is achieved through:

- Larger Format Cells: The shift from 280Ah to 314Ah, 588Ah, and even 661Ah cells reduces cell count, interconnection complexity, and potential failure points.

- Advanced Thermal Management: Liquid cooling is becoming standard for large systems, offering superior temperature uniformity, longer cell life, and lower auxiliary power consumption compared to air cooling.

- System-Level Integration: Embedding the Power Conversion System (PCS), transformer, and medium-voltage switchgear within a thermally managed enclosure reduces balance-of-system costs and installation time.

Intelligence as a Differentiator: Beyond hardware, the software and control layer is where true value is extracted. Modern systems feature:

- AI-driven optimization that forecasts energy prices, renewable generation, and load to maximize revenue across multiple value streams.

- Advanced Battery Management Systems (BMS) that perform cell-level active balancing and state-of-health prognostics, extending system life and availability.

- Grid-Forming (Grid-Constructing) Capabilities: Essential for providing inertia in renewables-heavy grids, this feature is moving from R&D to a key procurement requirement in many markets.

Navigating the Market: The Role of the Integrated Solution Provider

For end-users—whether a manufacturing plant in Germany, a utility in Texas, or a mining operation in Chile—navigating this complex landscape is daunting. This underscores the critical value of a one-stop-shop solution provider that can deliver not just hardware, but certainty.

A true partner manages the entire value chain: from initial energy analysis and financial modeling, through system design with the optimal technology mix, to securing equipment that meets local standards, managing logistics and installation, and providing long-term performance guarantees and maintenance. They de-risk the project for the owner, translating technological and market complexity into a simple, reliable energy asset.

For businesses exploring their storage options, understanding the full spectrum of solutions is key. From comprehensive solar energy storage system classifications that outline technological pathways, to tailored products like a Commercial 250KW Hybrid Solar System designed for predictable payback in mid-size operations, to massive Liquid Cooling Container Energy Storage Systems delivering grid-scale impact, the right solution depends on precise needs and constraints.

Frequently Asked Questions (FAQ)

Q1: With potential U.S. tariffs rising to 82.4% in 2026, is it still viable to source storage systems from Chinese-integrated suppliers?

A: Yes, but the model is evolving. Pure hardware export is challenged. Viability in 2026 will belong to suppliers who: 1) Offer superior total cost of ownership (TCO) through high energy density and efficiency that offsets tariff costs, 2) Have local warehousing or assembly partnerships to mitigate supply chain risk, and 3) Provide unmatched bankability and performance guarantees. For many developers, the technological lead and proven reliability of top-tier integrators continue to justify the cost.

Q2: What is the single most important policy to watch in Europe for C&I storage growth in 2026?

A: The implementation of the EU's Electricity Market Design (EMD) reform. It will mandate member states to create capacity mechanisms and improve market access for demand-side response and storage. This will create new, stable revenue streams for C&I storage assets beyond self-consumption, dramatically improving project economics across the continent.

Q3: For a factory in a market like Chile or Brazil, what is the typical payback period for a C&I storage system today, and what factors affect it most?

A: Payback periods can range from 5 to 8 years, but can be shorter in areas with high demand charges or time-of-use tariffs with large spreads. Key factors are: Electricity rate structure (the difference between peak and off-peak prices), solar self-consumption profile, available government incentives or tax treatments, and financing cost. A detailed hourly energy analysis is essential for an accurate projection.

Q4: How critical are "grid-forming" capabilities for new utility-scale storage projects in 2026?

A: Increasingly critical. As grids lose synchronous generators (coal, gas), they lose inherent inertia that maintains frequency stability. Grid-forming inverters can electronically provide this function. In markets like Australia, the UK, and parts of the U.S., grid-forming is already a grid code requirement or receives premium payments. By 2026, specifying a system with grid-forming readiness or native capability will be a standard best practice for future-proofing any large-scale storage asset.

Q5: Is the industry's focus on ever-larger battery cells (e.g., 600Ah+) a positive trend for system safety and lifespan?

A: It presents a trade-off. Larger cells improve energy density and reduce part count, which can theoretically improve reliability. However, they also concentrate more energy in a single unit, making thermal management absolutely paramount. The trend reinforces the necessity of advanced liquid cooling systems and sophisticated BMS monitoring. The ultimate test is not cell size alone, but the system's integrated design and safety protocols under thermal runaway conditions, as verified by standards like UL 9540A.

Partnering for the Future with MateSolar

The journey toward a resilient, decarbonized energy system is complex, but the path forward in 2026 is clear: scale, intelligence, and partnership. At MateSolar, we embody the essence of a one-stop-shop photovoltaic and energy storage solution provider. We move beyond supplying components to delivering certainty and optimized value.

Our expertise bridges global technology innovation with deep local market understanding—from the policy nuances of the German Solar Package to the interconnection standards of the California grid. Whether your need is a seamlessly integrated Commercial 250KW Hybrid Solar System

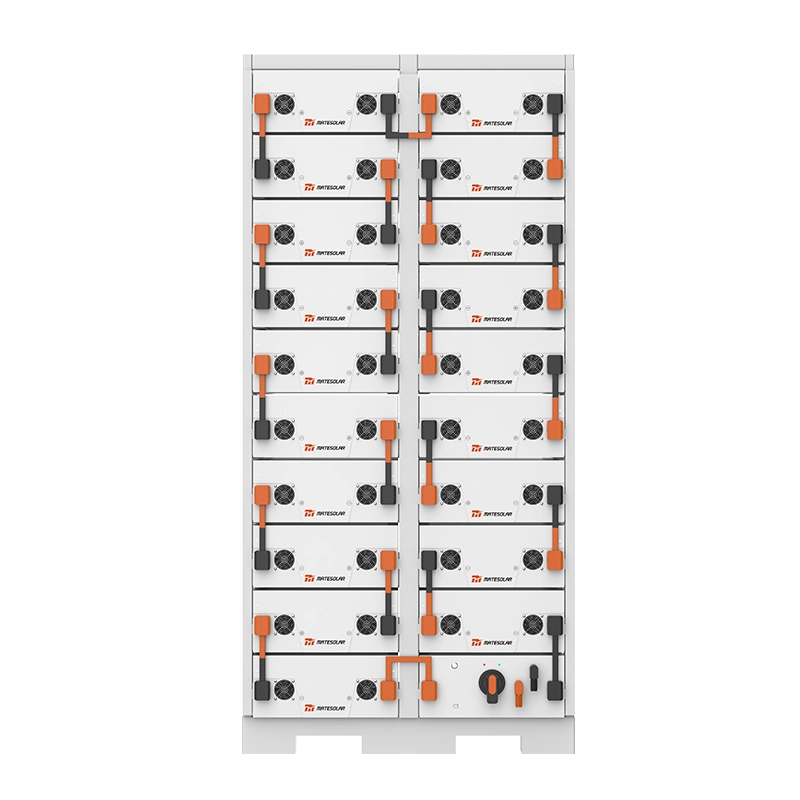

for immediate cost savings or a massive 20ft 3MWh 5MWh Liquid Cooling Container Energy Storage System

for grid-scale impact, MateSolar provides the engineering excellence, logistical mastery, and long-term partnership to ensure your project is not just built, but thrives.

The 2026 market is rich with opportunity for those who are prepared. Let's build the future of energy, together.