The European commercial and industrial (C&I) energy storage market is poised for remarkable growth in the coming years, with projections indicating a compound annual growth rate (CAGR) of 55% from 2025 to 2030. This surge is primarily driven by escalating electricity demands from AI data centers, favorable government policies, and improving economic viability of storage solutions. Tech giants like Meta are leading this transition through massive renewable energy procurement—exemplified by their recent 791MW clean energy agreement with Invenergy—creating unprecedented opportunities for C&I storage solutions across the continent.

European C&I Storage Market Overview

Current Market Landscape and Growth Trajectory

According to SPIR research data, Europe's C&I energy storage sector demonstrated significant momentum in the first half of 2025, with shipment volumes reaching 4GWh, representing a 93% year-over-year increase. Germany and France have emerged as core growth markets, with typical project internal rates of return (IRR) now reaching 16.88%—a 30% reduction in investment payback periods compared to previous years.

The market structure is undergoing a notable transformation, with independent energy storage projects increasing their share from 36% in 2024 to 43% in 2025. Spain exemplifies this trend, having added 388.9MW of independent storage projects in H1 2025, accounting for 82.9% of all newly applied projects.

*Table: European C&I Energy Storage Market Key Metrics (2025-2030)*

| Metric | 2025 (Projected) | 2026 (Projected) | 2030 (Projected) | CAGR |

| Annual Shipments (GWh) | 6+ | 9.3+ | 60.5+ | 55% |

| Market Value (€ billion) | 4.2 | 6.5 | 42.0 | 52% |

| Average Project Size (MWh) | 37 | 42 | 68 | 11% |

| Typical Project IRR | 16.88% | 18.50% | 22.00% | 4.5% |

Policy Drivers Accelerating Adoption

European governments have implemented strong policy frameworks to accelerate C&I storage deployment. The EU's "Green Deal" mandates that renewable energy sources constitute 45% of total energy production by 2030, creating a foundational driver for storage investments.

Several countries have introduced targeted incentives:

- Czech Republic: Offers 35% investment cost subsidies for C&I storage installations

- Greece: Launched a €154 million funding program to support commercial storage projects

- Spain: Andalusian region allocated €70 million specifically for independent energy storage

- Germany: Extended VAT exemption policies from residential storage to include C&I applications

These policies complement evolving electricity market mechanisms. Spain's spot market now exhibits intraday price differentials of up to €169.47/MWh, creating substantial arbitrage opportunities for storage assets. Germany's time-of-use electricity pricing has significantly expanded profit margins for C&I storage operators.

The AI Revolution: Data Centers Driving Storage Demand

Tech Giants' Renewable Energy Procurement

Major technology companies are making ambitious renewable energy commitments to power their AI data centers. Meta's recent announcement of four additional clean energy agreements totaling 791MW of solar and wind capacity demonstrates the scale of this transition. This follows their 2024 procurement of 1,000MW from Invenergy, bringing their collaboration total to 1,800MW.

These projects are strategically distributed across multiple states:

- Yellow Wood Solar Center (Ohio): 300MW (expected commercial operation: 2027)

- Pleasant Prairie Solar Center (Ohio): 140MW (expected: 2027)

- Decoy Solar Center (Arkansas): 155MW (expected: 2027)

- Seaway Wind Center (Texas): 196MW (expected: 2028)

As Urvi Parekh, Meta's Global Energy Director, stated: "We are focused on advancing our AI goals—for that, we need clean, reliable energy".

Storage Solutions for Data Center Reliability

For data centers, where outage costs can exceed €100,000 per minute, energy storage provides critical backup power while delivering significant economic benefits. Advanced C&I storage systems offer:

- 2ms seamless switching between grid power and storage

- Black start capability for complete off-grid operation

- Valley electricity cold storage technology that reduces air conditioning energy consumption by 60%

A case study from Eastern China demonstrates that a data center implementing these solutions achieved annual operational savings of €800,000 while earning "National Green Data Center" certification.

Economic Viability and Business Cases

Diverse Revenue Streams

Modern C&I storage systems generate value through multiple revenue streams:

1. Peak-Valley Price Arbitrage: The core revenue source, particularly in regions with high price differentials. In Zhejiang province, a company with annual consumption of 3 million kWh deploying a 200kWh storage system could achieve annual savings of approximately €51,100 through daily charge-discharge cycles.

2. Capacity Management: By reducing monthly maximum demand, businesses can lower their capacity charges. Reducing demand to 400kW/month could yield approximately €48,000 in annual savings.

3. Demand Response: A 1MW/2MWh storage project in Shenzhen participating in demand response programs generated approximately €200,000 in additional annual revenue (on top of peak-valley arbitrage).

4. Policy Subsidies: Regions like Wenzhou's Pingyang County offer €0.10/kWh subsidies for discharge during peak periods, directly enhancing project returns.

Investment Returns Analysis

A comprehensive economic analysis of a typical 10kV industrial user with a 1MW/2MWh storage system reveals compelling economics:

*Table: Economic Analysis of 1MW/2MWh C&I Storage System in Different Regions*

| Parameter | High Incentive Region | Medium Incentive Region | Low Incentive Region |

| Annual Operation Days | 310 | 310 | 310 |

| Comprehensive Efficiency | 87% | 87% | 87% |

| Discharge Depth | 90% | 90% | 90% |

| Estimated IRR | 19.06%-31.80% | 12.15%-18.50% | 6.25%-10.40% |

| Payback Period | ~4 years | ~5-6 years | ~8-10 years |

| Primary Revenue Sources | Peak-valley arbitrage + subsidies + demand response | Peak-valley arbitrage + capacity management | Peak-valley arbitrage |

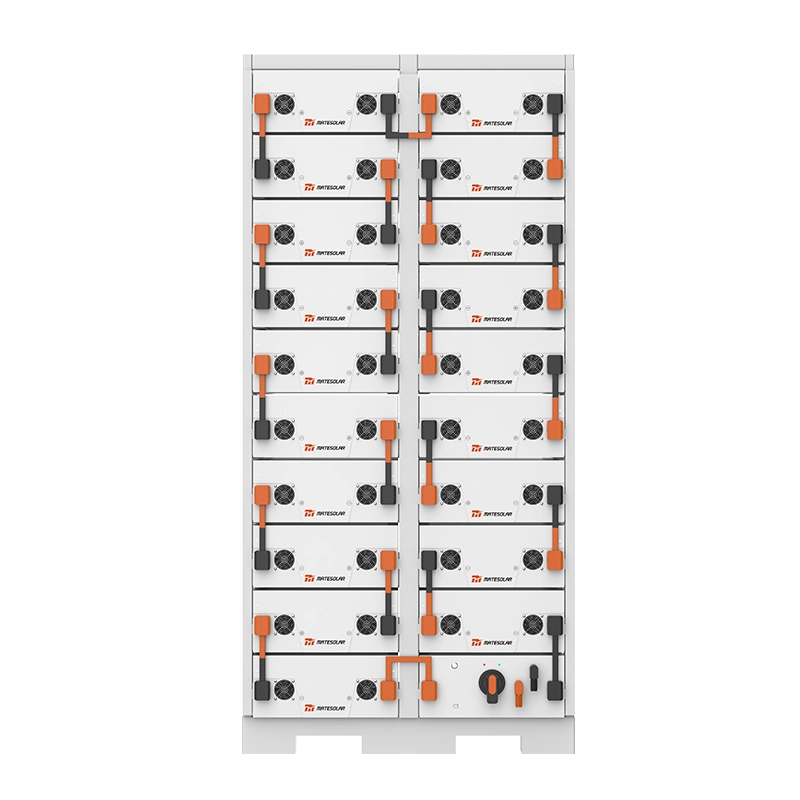

For organizations considering implementing C&I storage solutions, MateSolar's solar energy storage system products

https://www.mate-solar.com/category/system

offer a comprehensive range of options suitable for various commercial applications. The 250KW Hybrid Solar System

provides an ideal balance of capacity and efficiency for medium-sized commercial operations, featuring advanced battery management and grid interaction capabilities.

Technology Innovations Enhancing Value

AI-Driven Optimization

Advanced artificial intelligence algorithms are significantly improving storage economics through:

- Load prediction that synchronizes with production line start-stop rhythms

- Automated trading strategies that capture electricity price fluctuations

- Predictive maintenance that reduces operational costs by 15-20%

One user reported an 18% additional revenue increase through AI-powered peak-valley arbitrage strategies.

Specialized Solutions for Different Sectors

Manufacturing

High-energy-consumption manufacturers face particular challenges, with electricity costs comprising 35% of production expenses. Two-charge-two-discharge technology enables daily dual cycles utilizing midday solar power and nighttime valley electricity, delivering annual electricity savings of €12 million for a aluminum plant with a 10MWh system and a payback period under four years.

Electric Vehicle Charging Stations

Charging station operators confront transformer upgrade costs reaching €2 million per station for ultra-fast charging infrastructure. Dynamic power compensation solutions enable 240kW ultra-fast charging stations to operate with only 100kW of grid capacity, while solar-storage-charge integration meets 50% of station electricity needs. A case study from Shenzhen showed a daily revenue increase of €3,000 per station.

FAQs: Addressing Key Market Questions

What is driving the rapid growth of Europe's C&I energy storage market?

Three primary factors are driving this growth: (1) Strong policy support including subsidies and tax incentives; (2) Increasing electricity prices and peak-valley differentials; (3) Technology improvements that enhance economic returns.

How do AI data centers influence the C&I storage market?

AI data centers require massive, reliable clean energy sources. Tech giants like Meta are procuring gigawatt-scale renewable energy, creating adjacent opportunities for storage to ensure grid stability and maximize renewable utilization.

What are the key revenue streams for C&I storage projects?

Primary revenue streams include: peak-valley price arbitrage, capacity fee management, demand response participation, policy subsidies, and carbon credit generation.

What is the typical payback period for C&I storage investments?

In regions with strong incentives and favorable market conditions, payback periods can be as short as 4 years. In average conditions, 5-6 years is typical, while in less favorable markets, payback may extend to 8-10 years.

How are battery cost reductions impacting the C&I storage market?

Significant battery cost declines—with carbonate lithium prices falling over 77% in 2023 alone—have dramatically improved storage economics, reducing the battery portion of system costs to approximately 50% of the total.

What technical innovations are most impactful for C&I storage?

Critical innovations include: two-charge-two-discharge technology, AI-powered optimization systems, seamless grid transfer capabilities (2ms switching), and hybrid solutions combining different storage technologies.

Future Outlook and Emerging Trends

The European C&I storage market is evolving toward more sophisticated business models and technology integration. Virtual power plants that aggregate distributed storage resources are gaining traction in the UK and Italy, enabling participation in auxiliary service markets.

The decline in battery costs—with lithium-ion system prices falling 18% year-over-year to approximately €0.09/Wh—continues to improve project economics. Meanwhile, emerging technologies like sodium-ion batteries, solid-state storage, and hydrogen-based long-duration storage are progressing from demonstration to commercialization.

By 2030, SPIR projects the global C&I storage market will reach 439GWh, with Europe representing a significant portion of this growth. This expansion will be accompanied by increasing regional differentiation, with areas like Catalonia favoring independent storage projects while Cuenca Province focuses on renewable-storage coupling.

Conclusion

The European C&I energy storage market stands at the threshold of transformative growth, offering substantial opportunities for businesses that strategically integrate storage into their energy management approaches. With a projected 55% CAGR through 2030, driven by policy support, technological advancement, and evolving electricity market dynamics, storage solutions have transitioned from niche applications to mainstream business investments delivering compelling returns.

For commercial and industrial enterprises seeking to navigate this complex landscape, MateSolar provides comprehensive photovoltaic storage solutions tailored to diverse operational requirements. As a one-stop photovoltaic storage solution provider, MateSolar combines industry expertise with cutting-edge technology to deliver optimized outcomes across manufacturing, data center, and commercial applications.

This analysis incorporates the latest market data from leading research institutions including SPIR, CESA, and industry reports from major financial analysts. Actual results may vary based on specific project conditions and regional market developments.