As countries around the world accelerate their energy transition, European and South American countries like Spain and Cuba are leading the way with innovative policies and attractive investment incentives.

The global renewable energy landscape is undergoing a significant transformation in 2025. Countries are implementing aggressive policies to boost solar and storage capacity, creating substantial opportunities for investors and developers. This article examines the latest regulatory developments and investment potential in two key regions: Spain and South America.

Spain's Comprehensive Storage Push: Policy-Driven Market Transformation

Spain has positioned itself as a European leader in renewable energy adoption through a series of strategic policy interventions. The approval of the "Renewable Energy Value Chain Strengthening Project" (RENOVAL) in June 2025, with €296 million allocated to 33 projects, demonstrates the country's commitment to developing a robust domestic renewable energy industry.

The Spanish government's dedication to energy transition became even more evident with its recent 3.68 GW grid capacity tender announced in July 2025. This initiative targets eight specific regions where connection bottlenecks had previously hindered renewable projects.

Revolutionary Legislation: Royal Decree-Law 7/2025

Perhaps the most groundbreaking development came with Spain's Royal Decree-Law 7/2025, designed specifically to accelerate energy storage deployment. This legislation addresses multiple barriers that have historically constrained storage projects:

- Expedited Permitting: Storage projects now benefit from fast-track approvals with environmental assessment requirements either waived or significantly simplified, particularly for hybrid renewable-storage installations.

- Grid Access Guarantees: The law redefines storage facilities' grid connection rights, recognizing them as "non-consumer" entities when drawing power from the grid. This critical classification exempts them from certain restrictions and charges applied to conventional consumers.

- Priority Dispatch Assurance: The legislation guarantees that renewable projects with storage maintain equal priority status in dispatch, eliminating concerns that adding storage might reduce their grid access privileges.

- Public Utility Status: Storage facilities that feed electricity back to the grid are now classified as public utility infrastructure, placing them on equal footing with traditional power generation assets.

South America's Solar Revolution: Diverse Markets, Shared Ambition

Across South America, countries are implementing attractive policies to spur renewable energy development, with Cuba and Mexico standing out for their innovative approaches.

Cuba's Tariff Exemption Strategy

In a significant move to accelerate its energy transition, Cuba's Ministry of Finance and Prices issued Resolution 169 in June 2025, which exempts imported renewable energy equipment from customs duties. This policy covers photovoltaic devices and components, solar water heaters, wind turbines, and electric vehicle charging equipment.

The exemption, which took effect retroactively from May 2025 and extends through December 2027, aims to support Cuba's ambitious plan to build 55 new photovoltaic parks in 2025 as part of a broader strategy to develop 92 solar parks providing over 2,000 MW of capacity by 2028.

Mexico's Storage Mandate and Market Potential

Mexico has emerged as another South American leader with its mandatory storage policy requiring all new wind and photovoltaic projects to include energy storage equivalent to 30% of their installed capacity (with a minimum duration of 3 hours). This regulation, effective from March 2025, represents one of the region's most ambitious storage mandates.

Additional incentives include:

- Tax exemptions for renewable energy projects

- "Carbon credit" support allowing renewable projects to be exempt from carbon tax (approximately $3.5/ton of CO₂) or offset up to 10% of taxes through carbon credits

- VAT reduction for storage systems, decreased to 8%

Revenue Streams for Storage Projects: Unlocking Value

The new regulatory frameworks in both Spain and South America have created multiple revenue streams that enhance the business case for storage investments:

1. Energy Arbitrage

Storage systems can capitalize on price differentials in electricity markets, charging during low-price periods (often when renewable generation is high) and discharging during high-price periods. In Spain's liberalized market, this strategy has become increasingly profitable as renewable penetration grows and price volatility increases.

2. Capacity Markets and Grid Services

Spain's regulatory reforms explicitly recognize storage's value in providing capacity guarantees and grid stability services. Storage projects can now participate in capacity markets, receiving payments for being available during peak demand periods.

3. Avoided Curtailment

For renewable project developers, adding storage provides insurance against curtailment risk. As Spain continues to lead in renewable deployment (with a target of 74% renewable energy by 2030), the ability to store otherwise-curtailed energy represents significant value.

4. Enhanced Renewable Energy Value

Storage enables renewable generators to shift delivery to periods of higher demand and value, effectively increasing the achievable price for each generated megawatt-hour.

Case Study: Bunzi Group's Integrated Energy Storage Project

A representative example of how these policies translate into tangible returns can be seen in the recently announced Bunzi Group Northern Coast Integrated Energy Project, which exemplifies the economic potential of storage-coupled renewables:

Table: Project Overview & Key Metrics

| Parâmetro | Valor |

| Total Investment | €14.21 billion |

| Wind Capacity | 160 MW |

| Capacidade solar | 100 MW |

| Capacidade de armazenamento | 130 MW / 260 MWh |

| Annual Green Power Generation | 424 million kWh |

| Construction Timeline | 2 years |

| Self-consumption Rate | 63% |

Table: Financial Performance Indicators

| Métrica | Valor |

| Project Payback Period | 12.06 years |

| Project IRR (after tax) | 7.47% |

| Capital IRR | 17.31% |

| Estimated Annual Net Profit | €5.04 million |

| Annual CO₂ Reduction | 450,000 tons |

The project's favorable economics are directly enabled by Spain's supportive policy environment, which includes guaranteed grid access for hybrid projects and streamlined permitting processes that reduce development timeline uncertainty.

Investment Outlook: Regional Comparisons

Table: Policy & Investment Landscape Comparison

| Country | Key Support Policies | Investment Opportunities | Major Risks |

| Spain | RENOVAL Fund (€296M), Royal Decree-Law 7/2025, 3.68GW grid capacity tender | Storage integration with existing renewables, grid services, industrial green power | Grid congestion in specific regions, regulatory complexity |

| Cuba | Customs duty exemption until 2027, 55 planned solar parks in 2025 | Equipment supply, solar park development, distributed generation | Limited domestic financing, infrastructure constraints |

| Mexico | 30% storage mandate for new projects, tax incentives, 8% VAT on storage systems | Storage system deployment, solar-storage hybrid projects, EV charging infrastructure | Local content requirements (30%), geopolitical factors |

| Chile | Clear regulatory framework, capacity payment mechanisms, 2GW storage target by 2026 | Large-scale storage projects, mining industry power supply | Concentration of projects in northern regions |

FAQs: Addressing Key Investor Questions

How does Spain's new legislation reduce development risk for storage projects?

The Royal Decree-Law 7/2025 significantly de-risks storage investments by guaranteeing grid access, expediting permitting through simplified environmental assessments, and establishing clear compensation mechanisms for grid services. These measures reduce both timeline uncertainty and revenue ambiguity.

What makes Cuba's market attractive despite its smaller size?

Cuba's customs duty exemption until 2027 effectively lowers equipment costs by 15-20%, improving project economics. Combined with an ambitious pipeline of 55 solar parks in 2025 alone, this creates scale opportunities despite the country's current challenges.

How does Mexico's storage mandate create opportunities for international developers?

The 30% storage requirement for new renewable projects creates a built-in market for storage solutions. International players can leverage their expertise in integrated solar-storage systems to partner with local developers who need to comply with these regulations.

What role can commercial and industrial (C&I) players expect in these markets?

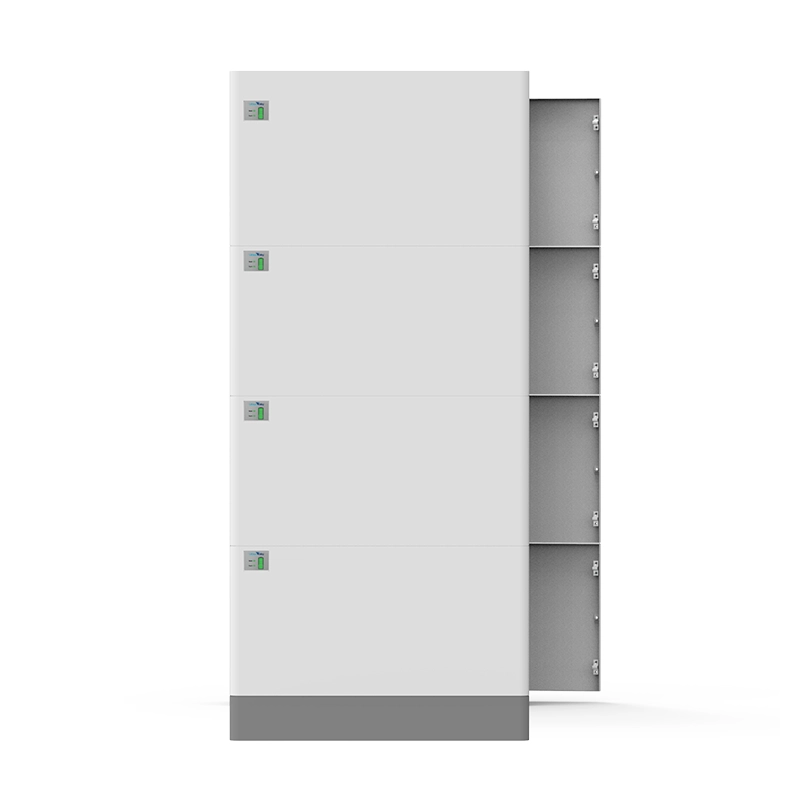

For businesses seeking to strategically integrate solar energy into their operational framework, MateSolar delivers customized C&I energy storage solutions designed to transform solar power into a reliable and valuable asset. Our diverse portfolio includes scalable systems such as the 50KW Hybrid Solar System,

ideal for smaller commercial applications, alongside robust offerings like the Sistema solar híbrido de 150KW

tailored for medium and small-scale enterprises. These systems combine substantial capacity with high efficiency, incorporating advanced battery management to maximize lifespan and intelligent controls for seamless grid interaction. This integrated approach significantly reduces electricity costs and strengthens operational resilience. To explore our full range of storage technologies, visit our energy storage systems category page, https://www.mate-solar.com/category/system, where you can evaluate different configurations to meet your specific energy independence and cost-saving objectives.

C&I consumers are increasingly active through corporate PPAs and behind-the-meter installations. For businesses with consistent energy needs, such as those exploring a High Quality 50KW Commercial Hybrid Solar Power System, these markets offer reduced operating costs and enhanced sustainability credentials.

Conclusion: Seizing the Storage Opportunity

The energy storage markets in Spain and South America present compelling opportunities for developers, investors, and equipment suppliers in 2025. Supportive policies, tangible revenue streams, and proven project economics create a favorable environment for storage investments.

As these markets mature, success will increasingly depend on choosing the right technology partners with proven expertise in integrating storage with renewable generation. The convergence of ambitious climate targets, supportive regulations, and improving economics makes this an ideal moment to enter these dynamic markets.

MateSolar is a leading provider of integrated photovoltaic storage solutions, helping commercial and industrial clients navigate complex energy markets to maximize returns while achieving sustainability goals. Our expertise in system design and project development supports clients across Spain and South America in harnessing the full potential of their energy investments.