Strategic insights for businesses navigating the next generation of energy solutions.

Introduction: The Corporate Energy Shift

The global energy landscape is undergoing a fundamental transformation. In 2025, global energy investments are projected to surpass $3.3 trillion, with the energy storage sector soaring to $65 billion—a remarkable 49% year-on-year increase. For businesses worldwide, this represents both an unprecedented opportunity and a complex challenge.

As we approach 2026, corporations face a critical decision point: continue with traditional energy models or embrace the strategic advantages of photovoltaic (PV) and energy storage systems. This guide provides comprehensive insights to navigate this transition successfully, avoiding common pitfalls while optimizing budget allocation for maximum return on investment.

The Global Policy Landscape: Incentives and Regulations in 2026

Understanding the evolving policy environment is crucial for effective budget planning and project timing.

United States: Strategic Continuity Amid Change

The "Build Big and Beautiful" Act has reshaped America's energy incentives landscape. While光伏 subsidies face significant reductions, energy storage emerges as a relative winner with tax credit phase-outs now extended to 2033-2036. This policy stability, combined with grid modernization initiatives, creates a favorable environment for corporate storage investments.

For businesses with operations in the U.S., this means:

- Storage-first strategy: Prioritizing storage deployments can leverage longer-term policy certainty

- Tariff considerations: Despite geopolitical tensions, storage systems have faced lower tariff rates compared to solar components

- State-level opportunities: Additional incentives in states like California, Texas, and New York further enhance project economics

European Union: Building Local Resilience

The EU's Net Zero Industry Act establishes ambitious local content requirements, mandating that 40% of net-zero technology must originate from local manufacturing by 2030. Countries like Germany and France have already implemented "30% local content" bidding rules for public projects.

For international corporations, this means:

- Supply chain diversification: Partner with suppliers having EU-based manufacturing capabilities

- Compliance planning: Factor localization requirements into procurement decisions and timelines

- Grid service opportunities: European electricity markets offer sophisticated revenue streams for storage assets

Asia-Pacific: Diversified Growth Markets

From Taiwan's four-year, NT$5 billion subsidy program for behind-the-meter storage to China's Three-Year Action Plan for New Energy Storage, the Asia-Pacific region presents diverse opportunities. China's policy push aims to reduce storage costs by 30% compared to 2023 levels while accelerating large-scale deployment.

Critical Procurement Pitfalls and How to Avoid Them

Based on extensive industry analysis, here are the most significant risks in PV and storage procurement for 2026.

System Integration: The Overlooked Quality Factor

The American Clean Energy Association (CEA) has conducted over 700 integration inspections of battery energy storage systems, revealing a startling finding: most defects occur during final integration rather than cell or module production. These system-level issues cause commissioning delays, rework costs, and operational losses.

Table: Most Common System-Level Defects in Energy Storage Systems

| Defect Category | Prevalence | Primary Risks | Quality Assurance Solution |

| Fire Detection & Suppression | 28% | Emergency system failure, false activations | Verify smoke detector orientation, temperature sensor connections |

| Enclosure Issues | 30% | Water intrusion, corrosion, structural damage | Check panel welds, door seals, protective coatings |

| Auxiliary Circuit Boards | 19% | Intermittent power loss during high loads | Validate wiring, terminal fixation, connection security |

| Thermal Management | 15% | Accelerated battery degradation, thermal runaway | Test coolant hose leaks, pipe joints, compressor controls |

| Capacity Test Failures | 6% | High internal resistance from manufacturing defects | Implement detailed final functional testing |

The EMS "Black Box" Problem

Energy Management Systems (EMS) serve as the "brain" of storage installations, yet many vendors obscure their functionality through misleading marketing claims. Common traps include:

- "Zero-touch deployment" promises that shift integration costs to the customer

- Theoretical optimization rates that don't reflect real-world operating conditions

- "Lifetime free upgrade" commitments with hidden limitations on critical features

Protection Strategy: Insist on transparent, data-backed demonstrations of optimization logic and require clear Service Level Agreements (SLAs) with performance guarantees.

Battery Quality: Beyond Spec Sheets

The market has been flooded with aged batteries and leaky cells sold at substantial discounts—sometimes up to 50% below market price. These inferior products compromise system safety, performance, and longevity.

Due Diligence Checklist:

- Verify manufacture dates (ideally within 3 months of installation)

- Require full traceability back to cell origin

- Review independent test reports from accredited laboratories

- Confirm compliance with international safety standards

Budget Planning and Total Cost of Ownership

Strategic budget allocation must balance initial investment with long-term performance and reliability.

2026 Price Projections and Allocation Recommendations

The storage industry is experiencing a fundamental inflection point after a prolonged period of price compression. After hitting bottom, system prices have begun to rebound, particularly for international markets.

*Table: 2026 Budget Allocation Guidelines for Commercial PV + Storage Projects*

| مكوّن النظام | Recommended Allocation | Critical Considerations | Cost Avoidance Strategies |

| Battery System | 45-55% | Cell quality, degradation rate, cycle life | Avoid discounted "new old stock"; prioritize performance warranties |

| تحويل الطاقة | 15-20% | Response time, grid support capabilities, efficiency | Select systems with advanced grid-forming capabilities |

| تكامل النظام | 10-15% | Manufacturing quality control, testing protocols | Prioritize suppliers with comprehensive factory acceptance testing |

| Thermal Management | 5-8% | Cooling efficiency, environmental adaptability | Match cooling technology to local climate conditions |

| Energy Management | 8-12% | Optimization algorithms, scenario adaptability | Require demonstrated performance in similar applications |

| Installation & Commissioning | 10-15% | Site-specific challenges, grid connection requirements | Include comprehensive project management allocation |

The True Cost of "Bargain" Procurement

Recent industry analysis reveals that initial price savings of 20-30% from inferior systems typically result in 2-3x higher lifetime costs due to:

- Reduced operational efficiency from suboptimal cycling capabilities

- Premature replacement costs for degraded or failed components

- Opportunity costs from unavailable capacity during critical price signals

- Higher maintenance expenses for corrective interventions

Technology Selection: 2026 Standards and Future-Proofing

Battery Chemistry Selection Framework

The dominant lithium iron phosphate (LFP) chemistry continues to improve, with new 314Ah and 280Ah cells becoming the standard for commercial applications. Emerging options include:

- Extended cycle life LFP: Offering up to 8,000 cycles while maintaining 80% capacity

- Sodium-ion batteries: Providing 30% cost reduction potential with improved low-temperature performance

- Flow batteries: Delivering exceptional cycle life exceeding 20,000 cycles for demanding applications

Selection criteria should prioritize safety, cycle life, and degradation characteristics over marginal price differences.

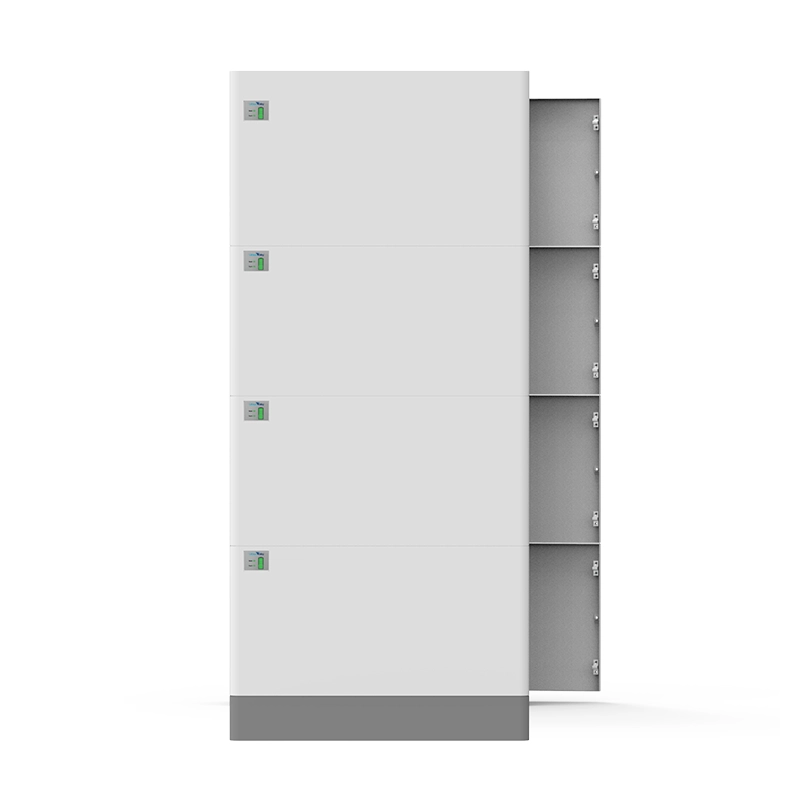

Architectural Considerations: Centralized vs. Distributed

The industry is shifting from simple centralized storage toward more sophisticated architectures:

- Containerized solutions offer rapid deployment but limited site optimization

- Distributed modular systems provide scalability and redundancy advantages

- DC-coupled solutions maximize efficiency for new solar+storage projects

- AC-coupled approaches offer flexibility for storage retrofits

Implementation Excellence: From Procurement to Operation

Quality Assurance Protocols

Leading organizations are implementing rigorous quality controls throughout the procurement process:

Factory Acceptance Testing (FAT) should verify:

- Wiring polarity and grounding integrity

- Fire detection loop continuity

- Thermal management system performance

- Control system functionality under simulated loads

Documentation and Traceability must include:

- Comprehensive inspection reports linked to serial numbers

- Detailed non-conformance records with root cause analysis

- Documented corrective actions with verification closure

Contractual Best Practices

Procurement contracts must translate technical requirements into enforceable supplier obligations. Key elements include:

- Explicit third-party inspection rights at manufacturing facilities

- Clear pass/fail criteria for Factory Acceptance Testing

- Supplier-funded rework obligations for non-conforming deliverables

- Economic penalties for quality deviations

- Well-defined responsibility matrix for subsystem interfaces

Global Opportunities: Regional Value Propositions

United States: High-Value Grid Services

With 45GWh expected in 2025 growing to 59GWh by 2026, the U.S. market offers sophisticated revenue stacking opportunities. Beyond simple energy arbitrage, corporate storage assets can generate income through:

- Frequency regulation services to grid operators

- Demand charge management for facility operations

- Resource adequacy payments for capacity commitments

Europe: Structural Transition Support

European storage deployments are projected to reach 50GWh by 2026, an impressive 67% year-on-year growth. The transition from feed-in tariffs to market-based compensation creates ideal conditions for storage investments, particularly:

- Intraday trading to capture price volatility

- Balancing services for grid stabilization

- Capacity mechanisms supporting reliability objectives

Asia-Pacific: Policy-Driven Growth

From Taiwan's behind-the-meter storage subsidies to China's massive front-of-meter deployments, Asian markets offer diverse opportunities aligned with local policy frameworks.

Actionable Implementation Roadmap for 2026

Q1 2026: Energy Analysis and Baseline Establishment

- Conduct detailed load profiling

- Analyze local electricity tariff structures

- Evaluate site-specific constraints and opportunities

- Establish clear financial objectives and success metrics

Q2 2026: Technology Selection and Partner Identification

- Develop comprehensive technical specifications

- Issue competitive procurement packages

- Evaluate bids against total cost of ownership criteria

- Select partners with demonstrated capabilities

Q3 2026: Project Finalization and Commissioning

- Execute detailed engineering design

- Implement rigorous factory acceptance testing

- Coordinate site preparation and utility interfaces

- Conduct comprehensive commissioning validation

Q4 2026: Operational Ramp-Up and Optimization

- Verify performance against project objectives

- Refine operating strategies based on actual conditions

- Establish ongoing maintenance and optimization protocols

- Document lessons learned for subsequent deployments

FAQ: Addressing Common Corporate Questions

What is the realistic lifespan of modern commercial battery systems?

A: Today's quality LFP batteries typically deliver 6,000-8,000 cycles while maintaining 80% of original capacity, translating to 15-20 years of operational life in most commercial applications. System longevity is heavily influenced by operating strategies, thermal management, and maintenance practices.

How should we evaluate supplier financial stability?

A: Require audited financial statements covering at least three years, verify production capacity and utilization rates, check customer references for similar projects, and confirm warranty support mechanisms such as insurance wraps or escrow accounts.

What are the critical insurance considerations for storage assets?

A: Coverage should specifically address electrochemical energy storage risks, include business interruption protection reflecting value of grid services, and be supported by comprehensive risk management documentation including hazard mitigation plans and emergency response procedures.

How do storage economics vary by electrical tariff structure?

A: Storage value is maximized in environments with high demand charges, significant time-of-use differentials, and opportunities for grid services. Detailed analysis of local tariff structures is essential for accurate economic forecasting.

What operational expertise is required for storage assets?

A: While modern systems emphasize automated operation, successful deployments require power market trading knowledge, basic electrical troubleshooting capabilities, performance analytics skills, and emergency response preparedness.

Conclusion: Strategic Energy Procurement in 2026

The corporate energy transition presents both unprecedented opportunities and complex challenges. By applying the insights and frameworks presented in this guide, organizations can navigate the 2026 landscape with confidence, avoiding common pitfalls while maximizing investment returns.

The organizations that thrive in this new environment will be those that treat energy not as a simple commodity, but as a strategic resource requiring sophisticated management and continuous optimization.

Explore Our Solutions:

At MateSolar, we provide commercial-grade energy solutions designed for diverse business needs. Discover how our integrated approach ensures reliability and maximizes returns:

1. Learn more about our comprehensive portfolio of solar photovoltaic energy storage systems.

2. Explore the 50KW Commercial Hybrid Solar System,

ideal for small businesses, factories, and campus environments.

MateSolar is a leading provider of integrated photovoltaic energy storage solutions, helping businesses worldwide navigate the energy transition with confidence. Our comprehensive approach combines technology expertise, project execution excellence, and ongoing optimization services to deliver superior customer outcomes.

اتخذ الخطوة الأولى نحو الاستقلالية في مجال الطاقة - اتصل ب MateSolar اليوم للحصول على تقييم مخصص لتخزين الطاقة التجارية!