An authoritative analysis of Poland's booming BESS market, critical subsidy deadlines, and how to choose partners for guaranteed project success.

With Europe's energy transition accelerating, Poland has emerged as the continent's most dynamic and opportunity-rich commercial and industrial (C&I) battery energy storage system (BESS) market. As of early 2026, the country is in the midst of a critical, time-sensitive deployment window, driven by substantial national subsidies with strict spending deadlines. For project developers and enterprises, the pressing question is no longer if to invest, but how to successfully navigate the complex landscape to select a supplier capable of ensuring on-time grid connection and subsidy lock-in before the mid-2026 cutoff. This comprehensive guide provides the strategic framework and technical insights necessary to make that decisive choice.

Poland's Storage Imperative: Understanding the Market Momentum

Poland's rapid ascent as a storage hotspot is a direct consequence of its explosive renewable growth, primarily in solar PV, which has outpaced grid modernization efforts. This mismatch creates acute grid stability challenges, turning BESS from a luxury into a critical infrastructure need for balancing supply and demand.

The numbers are telling. From a base of 44 MW in 2023, Poland's BESS capacity is forecast to reach 4.6 GW by 2030, with the most intense growth occurring now. A key driver is the EU-approved support of €12 billion to deploy 5.4 GWh of storage. Furthermore, the opening of a flexible power market and the awarding of 17-year capacity market contracts provide long-term revenue certainty, fueling developer interest. This confluence of factors has triggered a wave of tenders, with project commissioning heavily concentrated in the 2026-2028 period.

*Table 1: Key Polish Subsidy Programs for Energy Storage (2025-2026)*

| Program Name | Administrator | Key Focus | Total Budget | Maximum Support | Critical Deadline |

| Energy Storage Systems Scheme | National Fund for Environmental Protection and Water Management (NFOŚiGW) | Construction of large-scale BESS (0.9 GWh target) | 893.46 million PLN | Subsidy of up to 45% of eligible costs | Spending deadline: 30 June 2026 |

| Energy Efficiency Funding for Enterprises | NFOŚiGW | Energy modernization, including RES with storage | 184 million PLN | Preferential loan with investment bonus (up to 85% of costs) | Application deadline: 27 February 2026 |

| Aid for Storage to Stabilise the Grid | NFOŚiGW | Storage for Distribution Grid Operators | غير محدد | غير محدد | Application open until 30 June 2025 |

The 2026 Deadline: A Window of Opportunity and Risk

The most time-sensitive pressure point for many large-scale projects is the Energy Storage Systems Scheme, which mandates that awarded funds must be spent by June 30, 2026. This is not a soft target but a hard cutoff for subsidy eligibility.

This deadline creates a non-negotiable project timeline. Considering lead times for equipment manufacturing, shipping, customs clearance, construction, installation, and grid connection procedures, projects must be in the advanced procurement and delivery phase in early 2026 to have any chance of compliance. A delay at any stage—supplier delivery, component certification, or local integration—can result in missing the deadline, jeopardizing the project's financial viability.

Therefore, the core challenge transforms from simple procurement to de-risking the entire project delivery timeline. The supplier choice becomes the single most critical factor in this equation.

The Supplier Selection Blueprint: Beyond Price to Guaranteed Delivery

In a normal market, selection criteria might prioritize upfront cost. In Poland's 2026 context, proven delivery capability and localized support must be paramount. The following framework outlines a multi-dimensional assessment beyond the bill of materials.

1. Validated Track Record of On-Time, At-Scale Delivery

A supplier's resume must be scrutinized for evidence of completed, grid-connected projects of similar or greater scale and complexity. Look for:

- Global vs. Local Portfolio: While a global footprint (e.g., 300+ projects across continents) indicates scalability, specific experience in the European Union or, ideally, Central and Eastern Europe is invaluable for understanding regional grid codes and compliance.

- Reference Projects: Demand verifiable case studies with client testimonials. The ability to point to a successfully delivered 2MW/4MWh+ project that achieved commercial operation date (COD) on schedule is worth more than a theoretical capacity promise.

- Financial and Industry Standing: Recognition from authoritative bodies, such as inclusion on BloombergNEF's Tier 1 list, serves as an independent validation of a manufacturer's bankability and execution capability, a factor heavily weighted by financiers.

2. Deep Localization: The Key to Navigating Polish Requirements

"Localization" extends far beyond having a local sales office. It is an integrated support ecosystem essential for navigating Poland's specific landscape.

- Technical & Compliance Hub: Does the supplier have in-country engineers who understand Poland's grid connection standards (e.g., Polskie Sieci Elektroenergetyczne - PSE requirements) and can tailor system configuration accordingly?

- Warehousing & Logistics: Local inventory of critical spare parts or even semi-assembled units can shave weeks off the delivery schedule, acting as a buffer against global supply chain delays.

- Partner Network: Established relationships with trusted Polish EPC contractors, electricians, and grid compliance consultants are crucial for seamless field execution.

- After-Sales Service: A commitment to 24/7 local technical support with guaranteed response and resolution times (e.g., 4-hour remote response, 48-hour on-site dispatch) ensures long-term operational reliability.

3. Product Architecture: Modularity, Scalability, and Grid Compliance

The physical product must be designed for speed, flexibility, and compliance.

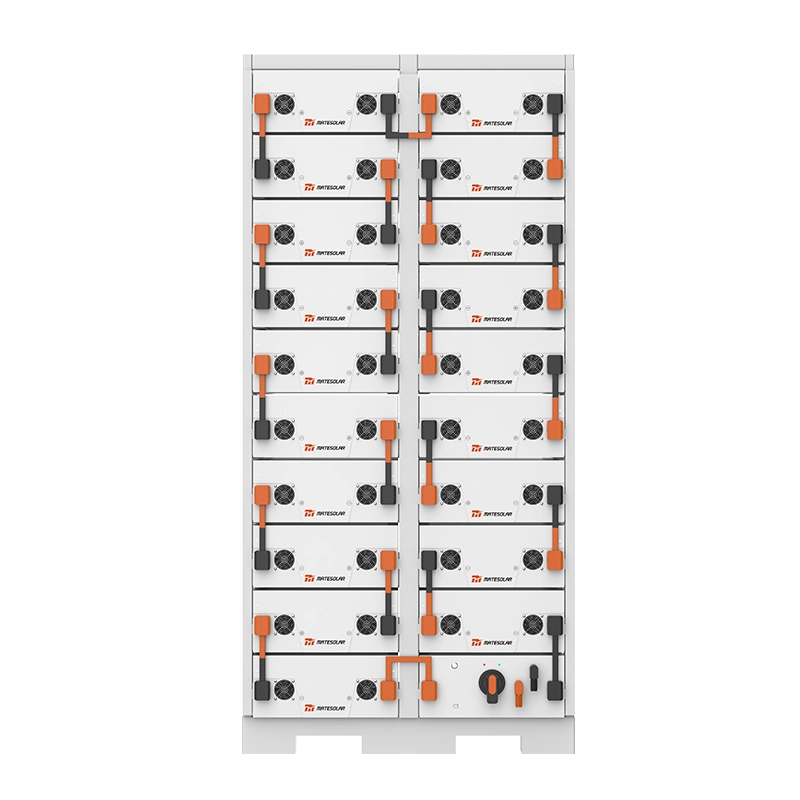

- Modular, Containerized Solutions: Pre-assembled, factory-tested containerized systems are the industry standard for rapid deployment. Look for 20ft and 40ft container solutions that can be easily transported and interconnected on-site.

- For robust, high-capacity needs, explore our حاوية تبريد الهواء المبردة بالهواء ESS (40 قدمًا (1 ميجاوات ساعة - 2 ميجاوات ساعة) or the high-energy-density 20ft Liquid Cooling Container (3MWh-5MWh).

- Advanced Thermal Management: As systems scale, efficient cooling is critical for safety and longevity. Liquid cooling technology is becoming the mainstream for large-scale projects due to its superior heat dissipation, which maintains cell temperature uniformity and extends cycle life to over 12,000 cycles.

- Grid-Forming (Inverter) Capabilities: As Poland's grid evolves, the ability of storage systems to provide grid stability services (frequency response, voltage support) becomes a revenue multiplier. Inverters with advanced, grid-forming capabilities are a forward-looking feature.

- Full System Certification: Ensure the complete system—not just individual cells—holds relevant EU and Polish certifications, including safety (e.g., UL 9540A, IEC), grid compliance, and CE marking.

Table 2: Supplier Evaluation Matrix for Polish BESS Projects

| معايير التقييم | Weight for 2026 Deadline | Basic Supplier | Qualified Supplier | Ideal Partner |

| Proven Delivery Record | 30% | No relevant project portfolio. | Has delivered projects in Europe, but not at scale or with some delays. | Has multiple, on-time references for >5MWh projects in EU/CEE. |

| Localization Depth | 25% | Sales agent only; no local technical support. | Technical support staff in region; some local spare parts. | In-country engineering hub, local warehouse, established EPC partner network, 24/7 local service SLA. |

| Product Suitability | 20% | Custom-built systems; long lead times. | Standard container products but limited configuration flexibility. | Pre-assembled, modular containers (e.g., 20ft/40ft); liquid-cooled; certified for Polish grid codes. |

| Financial Stability | 15% | Unproven or privately held with limited disclosure. | Publicly listed or with solid financials; some industry recognition. | BNEF Tier 1 or equivalent; strong balance sheet; favorable bankability reports. |

| Commercial Flexibility | 10% | Rigid payment terms; limited warranty. | Standard industry terms (e.g., 10-year performance warranty). | Willing to align payment milestones with project cash flow; comprehensive, long-term warranty. |

Integrating with Solar: The Hybrid Advantage

Many Polish subsidies also support integrated renewable generation. Pairing storage with solar PV maximizes investment returns and energy independence. For large industrial sites, a 500KW hybrid solar system is a potent configuration, allowing for direct consumption of solar power, peak shaving, and backup capacity. Choosing a supplier that offers integrated solar-plus-storage solutions from a single source simplifies design, installation, and commissioning, further de-risking the timeline.

Explore our comprehensive range of integrated systems under our نظام الطاقة الشمسية الكهروضوئية والتخزين portfolio for seamless hybrid solutions.

Navigating Implementation: From Contract to COD

Once a supplier is selected, disciplined project management is key.

1. Contractual Safeguards: The contract must include liquidated damages for late delivery, performance guarantees, and clear definitions of scope (Incoterms, commissioning responsibilities).

2. Phased Delivery: For multi-container projects, negotiate phased delivery and commissioning to initiate grid connection processes for earlier units.

3. Parallel Pathing: Work with your supplier and local partner to run grid application, civil works, and equipment procurement in parallel, not sequence.

Table 3: Project Critical Path Milestones (Target: Commissioning by Q2 2026)

| Milestone | Q4 2025 | Q1 2026 | Q2 2026 |

| Procurement & Planning | Supplier selection & contract signing. | Final design approval; grid connection application submitted. | Equipment arrival in Poland. |

| Logistics & Build | Site preparation begins. | Civil works & foundation completion. | Container installation & electrical interconnection. |

| Testing & Compliance | System commissioning, grid compliance testing, and final inspection. | ||

| Commercial Operation | Achieve COD and final subsidy certification before 30 June. |

FAQ: Navigating Poland's BESS Landscape

Q1: What is the single biggest risk to meeting the June 2026 subsidy spending deadline?

A: Supply chain and delivery delays. All other risks (construction, grid connection) stem from or are exacerbated by late equipment arrival. Mitigation lies entirely in selecting a supplier with a proven, at-scale delivery track record and localized logistics buffers.

Q2: Are there subsidies available for smaller commercial or industrial storage projects?

A: Yes. While the large-scale scheme targets major BESS, programs like the Energy Efficiency Funding for Enterprises support investments in RES with storage for medium and large companies, with applications open until February 27, 2026.

Q3: How important is "local content" or assembly in Poland for subsidy eligibility?

A: Current major subsidy schemes do not mandate local assembly, but it is a growing trend and strategic advantage. Suppliers with local assembly partnerships (like those seen in other markets) can offer faster delivery, lower logistics costs, and better-tailored after-sales support, significantly de-risking projects.

Q4: What technical specifications are most critical for the Polish grid?

A: Compliance with PSE grid codes is mandatory. Key specs include voltage and frequency ride-through capabilities, defined active and reactive power control (P/Q control), and specific protection settings. Your supplier must have demonstrable experience configuring their inverters and control systems to meet these requirements.

Conclusion: Partnering for Success in a Defining Market

The Polish energy storage market in 2026 presents a definitive, time-bound opportunity. The difference between capturing its full value and facing financial shortfall will be determined by the rigor of the supplier selection process. In this high-stakes environment, the winning formula combines a supplier's ironclad delivery record, a deeply embedded local support ecosystem, and a modular, compliant product portfolio.

As a global, one-stop PV & energy storage solution provider, MateSolar embodies this partner profile. We bring to the Polish market not just containerized products like our high-density liquid-cooled systems, but a commitment to local project execution support, proven by a portfolio of timely, at-scale global deliveries. Our solutions are engineered to meet stringent grid requirements, ensuring our partners can confidently build, connect, and secure their future in Europe's most vibrant storage market.

Disclaimer: This article is for informational purposes. Specific subsidy rules and grid codes are subject to change. Always consult with official program authorities (NFOŚiGW, PSE) and legal/financial advisors for project-specific guidance.