As global electricity markets phase out static feed-in tariffs (FiT) and embrace dynamic time-of-use (TOU) pricing, solar-storage hybrids have evolved from grid-support assets to sophisticated profit engines. Europe’s day-ahead markets (DAM) now enable storage arbitrage values surging by 20%–50% through AI-optimized bidding, while U.S. states like California report 30% ROI boosts for commercial systems leveraging peak shaving. This shift is accelerated by two critical trends:

<1> TOU Structural Expansion: 87% of U.S. utilities now enforce TOU rates with peak/off-peak spreads exceeding $0.25/kWh, notably in CA, MA, and AZ.

<2> FiT Sunsetting: Germany’s solar FiT dropped 75% since 2012, creating a "golden cross" where self-consumption via storage outperforms grid sales.

Table 1: Financial Payback Periods Under TOU Regimes (Commercial Scale, 100kW PV + 200kWh Storage)

| Region | Peak/Off-Peak Spread ($/kWh) | Avg. Payback (Years) | Arbitrage Share of Revenue |

| California (PG&E) | 0.32 | 3.8 | 65% |

| Germany | 0.28 | 4.2 | 58% |

| Japan (Kansai) | 0.22 | 5.1 | 51% |

| Australia (NSW) | 0.26 | 4.5 | 62% |

The Algorithmic Edge in Modern Arbitrage

Traditional battery control systems react to prices; next-generation platforms predict and strategize. Key innovations include:

1. Transformer-Based Price Forecasting

<1> New York’s 2024 trial used temporal fusion transformers to predict real-time prices 36 hours ahead, achieving 92% accuracy. This enabled day-ahead market bids to capture 18.7% higher margins compared to real-time-only bidding.

2. Multi-Market Bidding Integration

<1> As demonstrated in two-settlement markets, splitting capacity between day-ahead (DAM) and real-time (RTM) auctions reduces negative-profit days by 31%. Storage assets now function as dual-revenue streams: DAM for base income, RTM for peak exploitation.

3. Grid-Fee-Aware Optimization

<1> Belgium’s case study revealed that variable grid fees—based on peak draw—can slash arbitrage profits by 20%–50%. Next-gen systems now embed fee structures into MILP (Mixed-Integer Linear Programming) models, constraining discharge during high-fee windows

Beyond Batteries: System Design for Maximum TOU Exploitation

Efficiency losses and duration limits cripple ROI. Data confirms:

<1> Round-trip efficiency >85% is critical; sub-75% systems see profit erosion of ≥22% in high-volatility markets;

<2> Duration sweet spot: 4–6 hours. Extending to 10 hours adds <3% marginal value due to price curve flattening;

<3> DC-Coupled Architecture (e.g., integrated PV-storage inverters) boosts efficiency 7%–9% versus AC retrofits, directly amplifying arbitrage gains.

Table 2: Impact of Technical Parameters on Annual Arbitrage Revenue (Per MWh Storage).

| المعلمة | Baseline | Optimized | Revenue Change |

| Round-Trip Efficiency | 70% | 90% | +24.5% |

| Forecast Accuracy (DA Prices) | 75% | 92% | +18.7% |

| Grid Fee Avoidance Strategy | لا يوجد | Dynamic MILP | +15.2% |

| Duration (Hours) | 2 | 4 | +41.3% |

Q&A: Addressing Core Technical Concerns in Solar-Storage Arbitrage

Q: How do TOU structures impact battery degradation?

A: Algorithms now incorporate cycle-based degradation models. For example, limiting discharges to >$0.20/kWh spreads extends cycle life 27% versus price-agnostic operation.

Q: Can legacy FiT systems retrofit for TOU profit?

A: Yes—FiP (Feed-in Premium) schemes now allow hybrid models: sell surplus at fixed premiums while directing low-cost solar to storage for peak resale. Japan’s 2022 shift to FiP increased storage attach rates by 34%

Q: What software integration is critical?

A: Three layers: (1) Price forecast APIs (e.g., Day-ahead auctions, CME power futures), (2) Regulatory compliance engines (e.g., grid fee calculators), (3) Risk controls (e.g., CVaC models for fuzzy price environments).

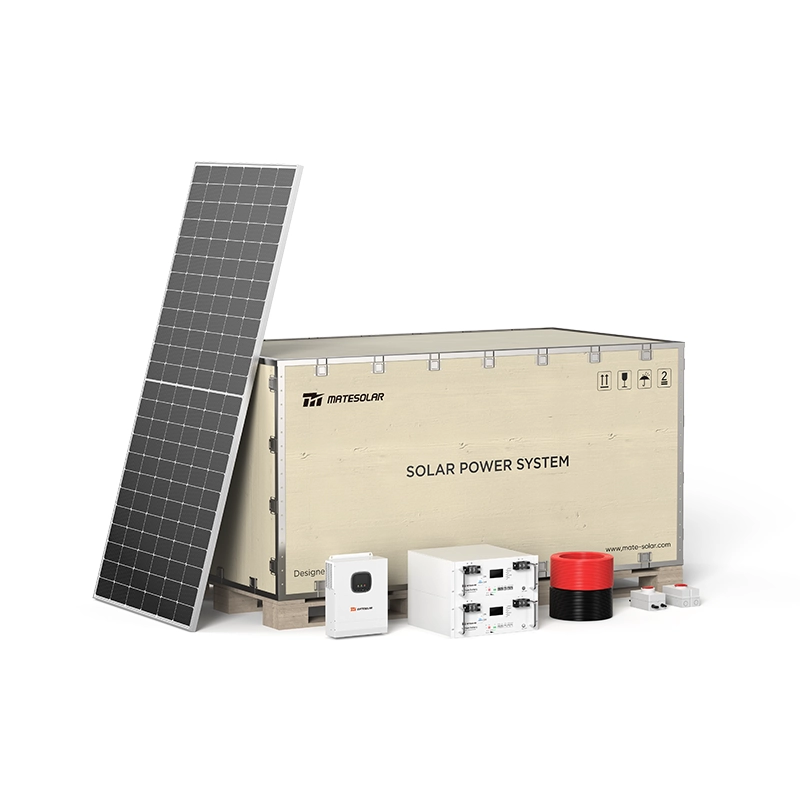

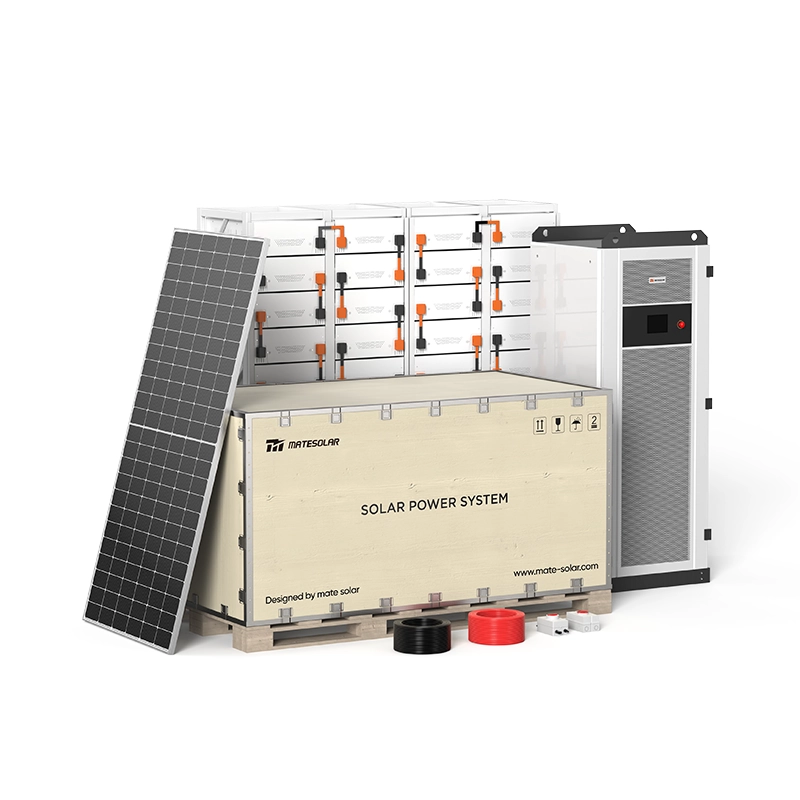

MateSolar: Architecting Your Profit-Optimized Energy Ecosystem

The arbitrage revolution demands more than hardware—it requires orchestration. MateSolar’s GridSynergy Platform delivers:

<1> AI-Powered Bidding: Transformer-based DAM/RTM bidding with real-time REC (Renewable Energy Certificate) price integration

<2> Regulatory Shields: Automated compliance for FiP, RPS (Renewable Portfolio Standards), and dynamic grid fees across 30+ markets.

<3> Lifecycle Economics: Degradation-adjusted bidding to maximize 10-year ROI, not short-term revenue.

"The future belongs to assets that navigate markets, not just generate electrons. Our systems turn price spreads into your most reliable revenue stream."— MateSolar