يمر قطاع الطاقة في أمريكا اللاتينية بتحول عميق. وتقف المنطقة على شفا ثورة في مجال الطاقة الشمسية والتخزين، مدفوعةً بالتقاء قوي بين انخفاض تكاليف التكنولوجيا، وسياسات تحديث الشبكة الصارمة، والحاجة الملحة إلى مرونة الطاقة، مما يجعلها على شفا ثورة في مجال الطاقة الشمسية والتخزين. وبينما هيمنت أسواق مثل البرازيل على العناوين الرئيسية منذ فترة طويلة، فإن القصة الحقيقية لعام 2026 تكمن في تسارع اعتماد دول مثل تشيلي والمكسيك وكولومبيا والأرجنتين وبيرو على هذه التقنيات. هذا التحول ليس مجرد تحول تدريجي؛ فهو يمثل إعادة تفكير جوهرية في كيفية توليد الطاقة واستهلاكها وإدارتها في الشركات والمرافق والمجتمعات. لقد انتهى عصر الاعتماد على مولدات الديزل باهظة الثمن والملوثة وشبكات الكهرباء الهشة، وحلّت محلها أنظمة ذكية وهجينة توفر السيادة الاقتصادية والتشغيلية.

يتعمق هذا التحليل في الديناميكيات الأساسية التي تشكل سوق عام 2026، ويتناول مباشرةً المخاوف الحرجة للمتبنين المحتملين، ويحدد الضرورات الاستراتيجية لأصحاب المصلحة الذين يهدفون إلى الريادة في هذا النموذج الجديد للطاقة.

الجزء 1: العوامل المحركة الأساسية لعام 2026 - تقارب الاقتصاد والسياسات

1.1 اقتصاديات إزاحة الديزل التي لا تقاوم

إن القوة السوقية الوحيدة الأكثر فاعلية في عام 2026 هي الميزة الاقتصادية الحاسمة لأنظمة الطاقة الشمسية مع التخزين على توليد الطاقة التقليدية التي تعمل بالديزل. لم يعد هذا خيارًا متخصصًا ومتميزًا صديقًا للبيئة بل أصبح الخيار الافتراضي للعمليات ذات التكلفة المنخفضة في التعدين والزراعة والمواقع الصناعية النائية.

وقد وفرت الأبحاث الأكاديمية، مثل دراسة أجريت في عام 2023 باستخدام محاكاة مونت كارلو لشبكة مصغرة في منطقة الأمازون، التحقق المبكر من صحة ذلك. ووجدت الدراسة أن سعر التعادل للديزل كان أقل بكثير من سعره الفوري الفعلي، مما يجعل نظام الطاقة الكهروضوئية - الديزل - البطارية الهجينة الخيار المجدي اقتصاديًا. وبحلول عام 2026، سيزداد هذا الواقع الاقتصادي على مستوى العالم. كما هو مذكور في توقعات الصناعة لعام 2026، تستفيد آسيا وأفريقيا وأمريكا اللاتينية من انخفاض تكاليف الطاقة الشمسية والتخزين)، مما يربط مباشرة بين خفض التكلفة وارتفاع الطلب.

تقوم الحجة الاقتصادية على التكلفة الإجمالية للملكية (TCO). في حين أن مولد الديزل قد يكون له نفقات رأسمالية أولية أقل (CapEx)، فإن تكاليفه التشغيلية (OpEx) - الوقود والصيانة والنقل - متقلبة ومرتفعة بشكل دائم. وعلى النقيض من ذلك، فإن نظام التخزين الشمسي الهجين أو خارج الشبكة يوفر "وقودًا" مجانيًا من الشمس لأكثر من 25 عامًا. ويوضح الجدول التالي مقارنة نموذجية لتكلفة التكلفة الإجمالية للملكية لنظام طاقة رئيسي بقدرة 500 كيلوواط على مدى 10 سنوات، وهو أمر بالغ الأهمية للمناجم والمزارع الكبيرة.

*الجدول 1: مقارنة التكلفة الإجمالية للملكية لمدة 10 سنوات: الديزل مقابل النظام الهجين للطاقة الشمسية والتخزين (500 كيلوواط من الطاقة الأولية)*

| مكون التكلفة | مولد ديزل فقط | نظام الطاقة الشمسية + التخزين الهجين | الملاحظات |

| النفقات الرأسمالية الأولية (CapEx) | $150,000 - $250,000 | $700,000 - $1,000,000 | استثمار أولي أعلى للطاقة الشمسية/التخزين. |

| تكاليف الوقود (10 سنوات) | $1,800,000 - $2,500,000 | $50,000 - $150,000 | وقود الطاقة الشمسية مجاني؛ وتكلفة الديزل تفترض $1.2/L، و20 ساعة/يوم تشغيل. يستخدم الهجين الحد الأدنى من الوقود الاحتياطي. |

| الصيانة وقطع الغيار (10 سنوات) | $200,000 - $400,000 | $80,000 - $120,000 | يتطلب الديزل تغيير الزيت بشكل متكرر، واستبدال الفلاتر، وإجراء إصلاحات شاملة. |

| ضريبة الكربون/تكاليف الامتثال/ضريبة الكربون | $50,000 - $200,000 (متزايدة) | $5,000 - $20,000 | تزايد الضغط التنظيمي على الانبعاثات. |

| إجمالي التكلفة الإجمالية للملكية الإجمالية لمدة 10 سنوات | $2,200,000 - $3,350,000 | $835,000 - $1,290,000 | توفر الطاقة الشمسية-التخزين الهجين 50-65% تكلفة إجمالية للملكية أقل. |

| فترة استرداد قسط التأمين الهجين | غير متاح | 3 - 6 سنوات | يسدد الاستثمار الأولي الإضافي تكاليفه من خلال توفير الوقود. |

الوجبات الجاهزة الرئيسية: حالة الاستثمار واضحة. عادةً ما يتم سداد قسط نظام تخزين الطاقة الشمسية في غضون 3-6 سنوات، وبعد ذلك يستفيد المشغل من تكاليف الطاقة المنخفضة بشكل كبير والتي يمكن التنبؤ بها خلال العمر الافتراضي المتبقي للنظام الذي يتراوح بين 15 و20 عاماً. وهذا يعني توفير الملايين من النفقات التشغيلية.

1.2 ضرورات الشبكة وتسريع السياسات

بالإضافة إلى الاقتصاديات خارج الشبكة، يؤدي تحديث الشبكة وتفويضات السياسات إلى خلق طلب هائل على التخزين على نطاق المرافق. تعمل الحكومات الوطنية بنشاط على هيكلة الأسواق لمكافأة المرونة والقدرة.

- تشيلي - رائدة تخزين الشبكات: يعتبر وضع شيلي مثالاً يحتذى به. فمواردها الشمسية ذات المستوى العالمي في صحراء أتاكاما منفصلة جغرافياً عن مراكز التحميل الرئيسية، مما يخلق اختناقات شديدة في النقل وعدم استقرار الشبكة. كانت استجابة الحكومة استباقية، حيث أطلقت مناقصات تخزين واسعة النطاق لتعزيز مرونة الشبكة. وقد أدى ذلك إلى ازدهار سوق مزدهرة لحلول التخزين على نطاق واسع في حاويات. على سبيل المثال، تُظهر مشاريع مثل نظام التخزين في موقع واحد بقدرة 1.2 جيجاوات في الساعة الذي تم تسليمه إلى منطقة أتاكاما الحجم المطلوب، حيث يضم حلولاً مجهزة في حاويات مزودة بتبريد سائل للتعامل مع البيئات القاسية.

- المكسيك - رائد الانتداب: اتبعت المكسيك نهجًا أكثر تنظيمًا. تفرض السياسات الآن تكامل التخزين لبعض مشاريع الطاقة المتجددة الجديدة وكبار المستهلكين. وهذا يخلق سوقًا يحركه الامتثال، مما يدفع المطورين إلى البحث عن حلول تخزين موثوقة وقابلة للتمويل.

- الزخم الإقليمي: أطلقت الأرجنتين أيضاً مناقصات نظام التخزين بالبطاريات (BESS), بينما تقوم بيرو بتطوير أكبر مشروع لها حتى الآن (مشروع تشيلكا بقدرة 26.5 ميجاوات). وتؤكد عمليات التمويل التي تقودها مؤسسة التمويل الدولية (IFC)، مثل حزمة التمويل التي تبلغ قيمتها $600 مليون دولار أمريكي لصالح شركة إنجي في بيرو، على ثقة المجتمع المالي في هذا الاتجاه.

*الجدول 2: سياسات الطاقة الشمسية والتخزين ومحركات السوق لعام 2026 في دول أمريكا اللاتينية الرئيسية (باستثناء البرازيل)*

الجزء 2: معالجة الشواغل الأساسية لعميل 2026

2.1 ما وراء الاسترداد البسيط: رؤية دقيقة للاقتصاديات

يتفهم المشتري المتمرس لعام 2026 مفهوم التكلفة الإجمالية للملكية ولكنه يتطلب تفصيلاً أعمق. تشمل الأسئلة الرئيسية ما يلي:

- الحساسية لتقلب أسعار الديزل: كيف يكون أداء النموذج إذا ارتفعت أسعار الديزل 30%؟ (الإجابة: يتسارع الاسترداد بشكل كبير).

- مسؤولية الكربون: كيف يتم أخذ ضرائب الكربون أو خطط تداول الكربون المستقبلية في الاعتبار؟ (الإجابة: إنها تحسن بشكل كبير من عائد الاستثمار في تخزين الطاقة الشمسية).

- قيمة وقت التشغيل والإنتاجية: ما هي القيمة المالية للتخلص من مخاطر توصيل الوقود وتقليل وقت تعطل صيانة المولدات؟ يجب أن يقدم مقدمو الخدمات نماذج مالية ديناميكية قابلة للتخصيص تستوعب هذه المتغيرات، وتتجاوز حسابات الاسترداد الثابتة.

2.2 قهر البيئات القاسية: حتمية هندسية

تتطلب جغرافية أمريكا اللاتينية - بدءًا من غبار صحراء أتاكاما إلى برودة جبال الأنديز على ارتفاعات عالية والرطوبة الاستوائية - هندسة متينة. يتساءل العملاء في مجال التعدين والأعمال الزراعية عن مدى مرونة المعدات.

- الحماية: يجب أن تتمتع الأنظمة بتصنيف IP65 كحد أدنى للحاويات، مع تحقيق المكونات الحرجة مثل وحدات البطاريات لمعيار IP67. تعتبر الطلاءات المضادة للتآكل (C5-M للأجواء البحرية/الصناعية القاسية) قياسية للتطبيقات الساحلية أو التعدينية.

- الإدارة الحرارية: هذا هو محور الموثوقية وطول العمر. تتفوق أنظمة التبريد بالسائل، مثل تلك المستخدمة في الحلول المعبأة في حاويات متطورة، على التبريد بالهواء في البيئات المتربة ذات درجات الحرارة العالية. فهي تحافظ على درجة الحرارة المثلى للخلية، مما يضمن الأداء والسلامة وإطالة عمر الدورة. كما هو موضح في أتاكاما، يجب أن تعمل الأنظمة بشكل موثوق في نطاق محيط يتراوح بين -35 درجة مئوية و55 درجة مئوية.

- حالة مثبتة في الواقع: إن نجاح المشاريع الكبرى في صحراء أتاكاما، باستخدام مكونات ذات تصاميم أطر مضادة للغبار، ومواد مقاومة للأشعة فوق البنفسجية، وأنظمة تتبع ذكية مع ميزات تصريف الرمال، يقدم شهادة قوية على ما هو ممكن من الناحية التكنولوجية. وبالمثل، عرضت عمليات النشر في كولومبيا منتجات مصممة هندسيًا لتناسب درجات الحرارة والرطوبة العالية، مع التركيز على المتانة وانخفاض معدلات التدهور.

3.2 إطلاق العنان لرأس المال: التمويل الابتكاري هو مفتاح التوسع في التوسع

تظل التكلفة الأولية المرتفعة هي العائق الرئيسي. ويكمن الحل في الابتكار المالي المتنوع:

- الطاقة كخدمة (EaaS): يدفع العملاء رسومًا شهرية مقابل طاقة مضمونة، دون أي نفقات رأسمالية. ويمتلك مزود الخدمة النظام ويقوم بتشغيله وصيانته. ويكتسب هذا النموذج زخمًا سريعًا في قطاع C&I.

- تمويل المشاريع والقروض الخضراء: تعمل مؤسسات تمويل التنمية مثل مؤسسة التمويل الدولية بنشاط على تقديم قروض مرتبطة بالاستدامة لمشاريع الطاقة المتجددة والتخزين. وتحذو البنوك المحلية حذوها بشكل متزايد.

- التأجير واتفاقيات شراء الطاقة (PPAs): تعمل هذه الهياكل على نقل ملكية الأصول ومخاطر الأداء إلى المطور/الممول، مما يجعل اعتمادها سلسًا للمستخدم النهائي.

- النماذج المجتمعية: تظهر صناديق مبتكرة مثل صندوق فرص الأسهم المجتمعية (CEOF)، والتي تمزج بين رأس المال للسماح للمجتمعات المحلية بالاستثمار المشترك والملكية المشتركة للمشاريع، مما يخفف من المخاطر الاجتماعية ويطلق العنان لخطوط مشاريع جديدة.

الجزء 3: خارطة الطريق الاستراتيجية لريادة السوق في عام 2026

3.1 الريادة بالذكاء الاقتصادي الشفاف للغاية

لن تتضمن المقترحات الفائزة مجرد نموذج مالي، بل ستُبنى حوله. يجب أن تتحول فرق المبيعات إلى مستشارين ماليين، باستخدام أدوات تفاعلية لوضع سيناريوهات تعاونية مع العملاء - أسعار الديزل المتغيرة ونمو الأحمال وتكاليف الكربون وهياكل الحوافز - لبناء حالة عمل مصممة خصيصاً لكل موقع.

3.2 عرض العمق الهندسي من خلال دراسات الحالة

يجب أن يتحول التسويق من أوراق المواصفات إلى دليل موثق على الأداء في الظروف القاسية. تعتبر دراسات الحالة التفصيلية من منجم في بيرو أو مزرعة في غواتيمالا أو مصايد الأسماك في تشيلي أكثر قيمة من أي كتيب. قم بتسليط الضوء على ميزات تصميم محددة - مثل دورات التبريد المخصصة أو العبوات المعززة - التي حلت تحديًا بيئيًا معينًا.

3.3 إقامة الشراكات المالية وليس فقط المبيعات

سيكون رواد السوق هم أولئك الذين يدمجون التمويل في عروضهم الأساسية. ويعني ذلك إقامة شراكات مفضلة مع البنوك المحلية ومؤسسات التمويل الإنمائي الدولية وشركات التأجير التمويلي لتزويد العملاء بحل "شامل": التكنولوجيا والشراء والبناء والتشييد والتمويل، في عقد واحد.

الجزء 4: مطابقة الحلول القوية مع احتياجات دول أمريكا اللاتينية المتنوعة

يفشل نهج واحد يناسب الجميع في منطقة متنوعة مثل أمريكا اللاتينية. فالنجاح يتطلب نشر بنية النظام المناسبة للتطبيق المحدد.

الجدول 3: محفظة الحلول لقطاعات السوق الرئيسية في أمريكا اللاتينية

| سيناريو التطبيق | التحدي الأساسي | بنية النظام الموصى بها | ميزات المنتج الرئيسية |

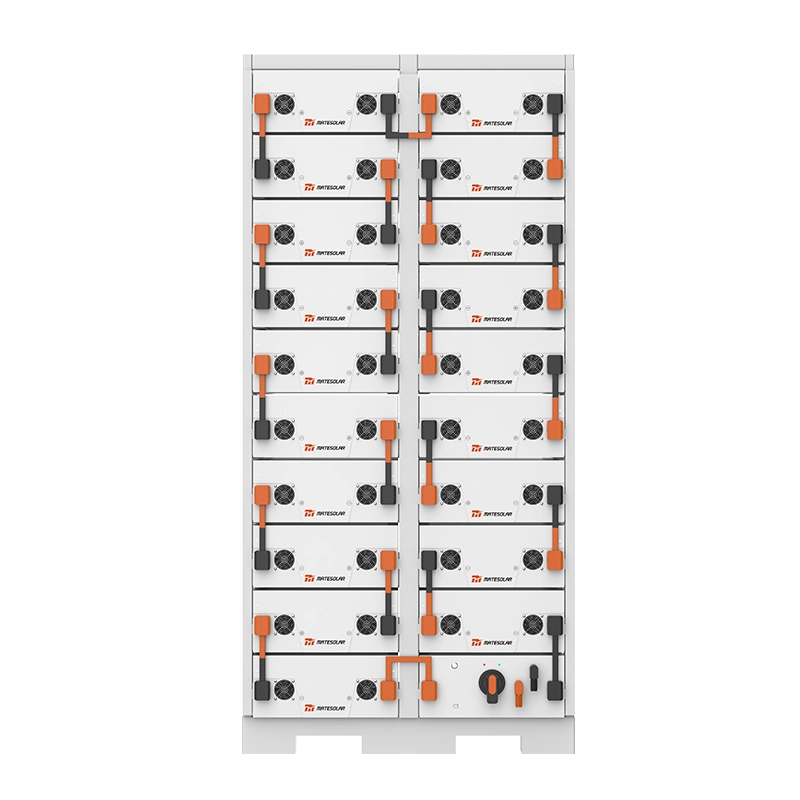

| منجم كبير/منشأة صناعية كبيرة | حمولة عالية ومستمرة؛ وظروف الموقع القاسية؛ وخفض التكلفة. | نظام هجين خارج الشبكة/خارج الشبكة (طاقة شمسية + تخزين كبير + ديزل احتياطي). | تخزين الطاقة على نطاق المرافق، وتخزين الطاقة في حاويات لقابلية التوسع والنشر البسيط. تبريد سائل للحرارة الشديدة/الغبار. كيمياء بطارية عالية التدوير للاستخدام اليومي. |

| تجاري وصناعي (مصنع، فندق، معالجة زراعية) | ارتفاع فواتير الكهرباء بموجب تعريفة وقت الاستخدام؛ الحاجة إلى طاقة احتياطية. | نظام هجين على الشبكة مع إمكانية النسخ الاحتياطي. | أنظمة الطاقة الشمسية الهجينة التجارية المتكاملة (على سبيل المثال، في نطاق 500 كيلوواط) التي تعمل على تحسين الاستهلاك الذاتي وتوفير الدعم الاحتياطي على مستوى UPS والمشاركة في إدارة شحن الطلب. |

| الأعمال السكنية والصغيرة | ارتفاع تعريفة البيع بالتجزئة؛ الانقطاع المتكرر للشبكة. | نظام الطاقة المنزلية مع التخزين. | أنظمة هجينة سكنية متكاملة (على سبيل المثال، فئة 25 كيلوواط) سهلة التركيب وآمنة وتدير بذكاء الاستهلاك الذاتي للطاقة الشمسية والطاقة الاحتياطية للأحمال الأساسية. |

استكشف مجموعتنا الشاملة من الحلول الهندسية المصممة خصيصاً لمواجهة هذه التحديات بالتحديد:

- للتعمق في تقنيات وبنى الأنظمة الأساسية، تفضل بزيارة موقعنا حلول الطاقة الشمسية وأنظمة التخزين الصفحة.

- بالنسبة للمنشآت التجارية والصناعية المتوسطة والكبيرة الحجم، فإن نظام الطاقة الشمسية الهجين التجاري بقدرة 500 كيلوواط يوفر حلاً مثالياً ومتكاملاً لتوفير فواتير الطاقة والموثوقية.

- بالنسبة للتطبيقات على نطاق المرافق أو التعدين أو التطبيقات الصناعية الكبيرة التي تتطلب سعة تخزين هائلة وموثوقية قوية، فإن نظام تخزين الطاقة في حاوية تبريد سائل تبريد سائل بقدرة 20 قدمًا بقدرة 3 ميجاوات ساعة/5 ميجاوات ساعة يحدد المعيار.

- بالنسبة لأصحاب المنازل والشركات الصغيرة الذين يسعون إلى تحقيق الاستقلالية في مجال الطاقة، فإن نظام الطاقة الشمسية الهجين السكني بقدرة 25 كيلوواط يوفر نسخاً احتياطياً سلساً واستهلاكاً ذاتياً للطاقة الشمسية.

الجزء 5: الأسئلة المتداولة (FAQ)

السؤال 1: مع التحسن التكنولوجي السريع، هل يجب أن أنتظر بطاريات أرخص/أفضل في غضون سنوات قليلة؟

ج: عادةً ما تفوق الخسارة الاقتصادية للانتظار الوفورات المستقبلية المحتملة. كل سنة تأخير هي سنة من نفقات الديزل المرتفعة أو مدفوعات الشبكة التي لن تستردها أبداً. توفر تقنية بطاريات LiFePO4 الحالية دورة حياة وقيمة ممتازة. من المحتمل أن تمول الوفورات التي تبدأ في تحقيقها من نظام تم تركيبه في عام 2026 أي ترقية تقنية مستقبلية.

س2: كيف يمكنني ضمان أداء نظام التخزين الخاص بي وسلامته على المدى الطويل، خاصة في المواقع البعيدة؟

A: وهذا يؤكد على أهمية اختيار مزود رعاية صحية لديه منصة رقمية قوية للتشغيل والصيانة الرقمية. تعد المراقبة عن بُعد التي توفر بيانات في الوقت الفعلي عن حالة الشحن ودرجات حرارة الخلية وكفاءتها أمرًا ضروريًا. ابحث عن مزودي الخدمة الذين يقدمون ضمانات الأداء وخدمات الصيانة الاستباقية بناءً على هذه البيانات، مما يمنع حدوث مشاكل قبل أن تتسبب في التوقف.

س3: هل توجد بدائل قابلة للتطبيق لبطاريات أيونات الليثيوم للتخزين على نطاق واسع في هذه المنطقة؟

ج: بينما تهيمن بطاريات الليثيوم أيون (خاصة بطاريات الليثيوم أيون) بسبب انخفاض تكلفتها وكثافة الطاقة العالية ونضجها، قد تجد تقنيات أخرى مثل بطاريات التدفق منافذ في التخزين طويل الأمد (أكثر من 8 ساعات). ومع ذلك، بالنسبة للغالبية العظمى من التطبيقات التي تغطي ذروة الحلاقة والتخزين المتجدد والدورة اليومية، فإن الأنظمة القائمة على بطاريات الليثيوم-أيون توفر أفضل مزيج من الاقتصاد والأداء والسجل الحافل.

السؤال 4: ماذا يحدث للبطاريات في نهاية عمرها؟ هل هناك خطة لإعادة التدوير؟

ج: يقوم الموردون المسؤولون الآن بدمج التخطيط لنهاية العمر الافتراضي في عروضهم. يتطور اقتصاد دائري راسخ لبطاريات أيونات الليثيوم. سيكون لدى الموردين ذوي السمعة الحسنة شراكات مع شركات إعادة التدوير لضمان جمع البطاريات ومعالجتها بشكل صحيح، واستعادة المواد القيمة مثل الليثيوم والكوبالت والنيكل. استفسر عن برنامج الاسترجاع الخاص بالمورِّد وبيانات اعتماد إعادة التدوير.

يتسم سوق الطاقة الشمسية والتخزين في أمريكا اللاتينية في عام 2026 بالنضج والإلحاح والفرص. فالحجة الاقتصادية مثبتة، واتجاه السياسة واضح، والحلول التكنولوجية قوية ومختبرة من الصحراء إلى الغابات المطيرة. سيكون الفائزون هم أولئك الذين يتصرفون بشكل حاسم - أولئك الذين ينظرون إلى الطاقة ليس كتكلفة يجب إدارتها، ولكن كأصل استراتيجي يجب تحسينه.

وتأتي ماتيسولار في طليعة هذا التحول. وباعتبارنا مزوداً متكاملاً لحلول الطاقة الكهروضوئية المتكاملة وحلول تخزين الطاقة، فإننا نجمع بين التكنولوجيا القابلة للتمويل والنمذجة المالية الدقيقة والخبرة الإقليمية العميقة لتوفير اليقين في عالم الطاقة غير المؤكد. بدءاً من دراسة الجدوى الأولية إلى ضمان الأداء على المدى الطويل، نتشارك مع عملائنا ليس فقط لبناء المشاريع، بل لبناء أساس لنمو مرن ومنخفض التكلفة ومستدام.