في برلين، ألمانيا، يستخدم مصنع متوسط الحجم في برلين نظام تخزين الطاقة الذي تم تكوينه حديثًا لتخزين الطاقة الكهروضوئية خلال فترات انخفاض أسعار الكهرباء وتفريغها خلال ساعات الذروة المسائية عندما ترتفع الأسعار فوق 200 يورو لكل ميجاوات ساعة. وقد أدت هذه العملية إلى خفض تكاليف الكهرباء السنوية بما يقرب من 401 تيرابايت 3 تيرابايت.

وصل سوق الطاقة الكهروضوئية وتخزين الطاقة في أوروبا إلى نقطة انعطاف تاريخية. إن صندوق المناخ والتحول (KTF) الذي أنشأته ألمانيا حديثًا بقيمة 100 مليار يورو، والإعانات الإسبانية التي تغطي ما يصل إلى 851 تيرابايت 3 تيرابايت من التكاليف، وآلية 'الحد الأقصى والحد الأدنى' في المملكة المتحدة للتخزين طويل الأمد، تعيد تعريف النماذج الاقتصادية لمشاريع التخزين.

وفي الوقت نفسه، تتطور آليات السوق بوتيرة غير مسبوقة. في عام 2024، وصلت المدة التراكمية لأسعار الكهرباء السلبية في ألمانيا إلى 468 ساعة، بزيادة سنوية قدرها 381 تيرابايت 3 تيرابايت، مما يجعل نماذج الأعمال التي تعتمد فقط على المراجحة البسيطة غير مقبولة بشكل متزايد.

01. المشهد الكلي: الانتقال العميق من النمو المدفوع بالسياسات إلى النمو المدفوع بالسوق

تشهد قصة تحول الطاقة في أوروبا تحولًا جوهريًا. فنموذج النمو السابق الموجه فقط نحو الطاقة المركبة يتحول بسرعة إلى استراتيجية شاملة تهدف إلى تعزيز مرونة النظام وضمان أمن الطاقة وتحقيق الاستفادة الاقتصادية المثلى.

ووفقًا لتوقعات مؤسسات أبحاث الطاقة الأوروبية، ستتجاوز المنشآت التراكمية لتخزين الطاقة في أوروبا 200 جيجاوات ساعة بحلول عام 2030. هذا النمو مدفوع بقوة مزدوجة: الاعتراف المتزايد بالقيمة الاستراتيجية للتخزين من قبل الحكومات الوطنية والنضج التدريجي لآليات السوق.

تشير التطورات الأخيرة في السياسة إلى أن أوروبا الغربية تدخل بشكل جماعي مرحلة "تقليل الدعم الكهروضوئي وتعزيز دعم التخزين"، مما يؤدي إلى ضغط الدعم التقليدي للطاقة الكهروضوئية مع تضخيم الطلب على التخزين بسرعة من خلال ضمانات الإيرادات والمنح المخصصة. ويعكس هذا التحول في السياسة الضغط الحقيقي على الشبكات الأوروبية: لا يمكن لقدرة الشبكة الحالية على الاستيعاب إلا أن تلبي حوالي 601 تيرابايت و3 تيرابايت من الطلب على دمج الطاقة المتجددة المتغيرة، في حين أن توجيه الاتحاد الأوروبي للطاقة المتجددة (RED III) يتطلب أن يتجاوز إجمالي قدرة الرياح والطاقة الشمسية الكهروضوئية 1100 جيجاوات بحلول عام 2030.

على المستوى الوطني، أنشأت ألمانيا صندوقًا وطنيًا للبنية التحتية بقيمة 500 مليار يورو من خلال تعديل قانونها الأساسي، مع تخصيص جزء مخصص لصندوق المناخ والتحول بقيمة 100 مليار يورو. وحصلت إسبانيا على موافقة المفوضية الأوروبية على خطة مساعدات التخزين مع دعم يصل إلى 851 تيرابايت 3 تيرابايت من التكاليف، ومن المتوقع أن تستفيد من 1.5 مليار يورو من رأس المال الخاص. ويدل إنشاء أنظمة دعم عالية الكثافة من هذا القبيل على أن التخزين قد تحول من "عنصر إضافي اختياري" إلى "عنصر إلزامي" في نظام الطاقة.

02. تفكيك السياسات المتعمقة: مسارات وطنية متباينة وفرص تجارية متباينة

تُظهر سياسات تخزين الطاقة في مختلف الدول الأوروبية خصائص إقليمية وتركيزات استراتيجية متميزة. وفهم هذه الاختلافات هو مفتاح الدخول الناجح إلى السوق.

يكمن ابتكار السياسة الألمانية في نموذج ضخ رأس المال الهيكلي. ويستخدم الصندوق الجديد الذي تبلغ قيمته 100 مليار يورو بشكل مبتكر آلية "التمويل المختلط"، مما يسمح لمشاريع التخزين بالتقدم بطلب للحصول على ائتمانات ضريبية استثمارية وقروض منخفضة الفائدة وطويلة الأجل في آن واحد. هذا التصميم يقلل بشكل كبير من تكاليف رأس مال المشروع. يمكن أن تغطي الائتمانات الضريبية ما يصل إلى 301 تيرابايت 3 تيرابايت من الاستثمار، في حين يمكن أن تصل معدلات الفائدة على القروض إلى 1.51 تيرابايت 3 تيرابايت. وبالإضافة إلى ذلك، طبقت ألمانيا آلية مزاد للقدرات، مما يوفر عائدات مؤكدة لمشاريع التخزين التي تقدم خدمات الشبكة. يجعل نظام الدعم متعدد الطبقات هذا ألمانيا واحدة من أكثر الوجهات الأوروبية جاذبية للاستثمار في التخزين.

تتميز إسبانيا بكثافة الدعم الذي تقدمه. ويشمل مخطط المساعدات الذي وافق عليه الاتحاد الأوروبي بقيمة 700 مليون يورو بشكل رائد أنظمة التخزين المستقلة في نطاق الدعم. يمكن أن تتلقى المشروعات على جانب الشبكة تغطية تكلفة تصل إلى 851 تيرابايت 3 تيرابايت، بينما تتلقى المشروعات التي تقع خلف العداد ما يصل إلى 651 تيرابايت 3 تيرابايت. يقلل مستوى الدعم المرتفع هذا من حواجز الدخول إلى السوق، ومن المتوقع أن يساعد إسبانيا على تحقيق طفرة في قدرة التخزين المركبة تبلغ 3.2 جيجاوات قبل عام 2026.

*جدول: مقارنة بين سياسات دعم تخزين الطاقة في البلدان الأوروبية الرئيسية (2025-2026)*

| البلد | السياسة/الصندوق الأساسي | كثافة الدعم/آلية الدعم/آلية الدعم | الهدف/التأثير |

| ألمانيا | صندوق المناخ والتحول (KTF)، وهو جزء من صندوق البنية التحتية بقيمة 500 مليار يورو | التمويل المدمج: ائتمان ضريبي يصل إلى 301 تيرابايت 3 تيرابايت + 1.51 تيرابايت 3 تيرابايت 3 تيرابايت قروض منخفضة الفائدة | تحديث الشبكة، ودعم قدرة 20 جيجاوات جديدة تعمل بالغاز، وتسريع نشر التخزين |

| اسبانيا | خطة مساعدات بقيمة 700 مليون يورو وافق عليها الاتحاد الأوروبي؛ خطة منفصلة للاستثمار في الطاقة المتجددة بقيمة 2 مليار يورو | ما يصل إلى 85% للتخزين المستقل؛ 65% للمشاريع خلف العدادات | تحقيق قدرة تخزينية تبلغ 3.2 جيجاوات قبل عام 2026؛ والوصول إلى قدرة تخزينية تبلغ 22.5 جيجاوات بحلول عام 2030 |

| المملكة المتحدة | آلية أوفجيم 'الحد الأقصى والحد الأدنى | يقين الإيرادات للتخزين لفترات طويلة (≥8 ساعات)، وتحديد سقوف وأسعار دنيا | يحافظ على استقرار معدل العائد الداخلي للمشروع في نطاق مستقر؛ ويدعم على وجه التحديد تخزين مدة تتراوح بين 4 و8 ساعات |

| ايطاليا | المزاد الأول في إطار آلية MACSE | دعم تشغيلي لمدة 15 عاماً؛ ما يصل إلى 32,000 يورو/ميغاواط ساعة/سنة لأنظمة بطاريات الليثيوم التي تعمل لمدة 4 ساعات | يدعم أنظمة تخزين البطاريات ≥4 ساعات وتقنيات التخزين غير المائية |

| بولندا | 4 مليارات زلوتي بولندي (حوالي 880 مليون يورو) صندوق مخصص | دعم متدرج: 451 تيرابايت 3 تيرابايت أساسية، حتى 651 تيرابايت 3 تيرابايت للشركات الصغيرة والمتوسطة؛ تتطلب محتوى محليًا يزيد عن 601 تيرابايت 3 تيرابايت | يحفز تطوير النظام البيئي الصناعي؛ يدعم التخزين المتصل بالشبكة |

وتجدر الإشارة إلى أن تصميم السياسة الإيطالية جدير بالملاحظة بشكل خاص. إن أول مزاد قادم للتخزين في البلاد في إطار آلية MACSE مخصص تحديدًا لأنظمة التخزين بالبطاريات لمدة 4 ساعات أو أكثر وتقنيات التخزين غير المائية، مع فترات تعاقد تصل إلى 15 عامًا. إذا أخذنا نظام بطاريات الليثيوم لمدة 4 ساعات كمثال، في ظل افتراضات محددة لتكاليف الاستثمار والتشغيل والصيانة، يمكن أن يصل الدعم السنوي إلى 32,000 يورو لكل ميجاوات ساعة، أي ما يقرب من 400,000 يورو على مدار فترة العقد. ويوفر هذا اليقين في الإيرادات على المدى الطويل إمكانية تنبؤ نادرة للمستثمرين، وهو أمر جذاب بشكل خاص لرأس المال المؤسسي الذي يسعى إلى تحقيق عوائد مستقرة.

تُظهر أوروبا الشرقية إمكانات نمو هائلة. يستخدم صندوق بولندا الذي تبلغ تكلفته 4 مليارات زلوتي بولندي تصميم دعم متدرج ويتطلب على وجه التحديد أن تستخدم المشاريع معدات تخزين ذات محتوى محلي يزيد عن 601 تيرابايت 3 تيرابايت. تحفز هذه السياسة الطلب في السوق بينما تهدف إلى تنمية سلسلة توريد محلية، مما يوفر فرصًا فريدة للشركات ذات القدرات الإنتاجية المحلية.

03. تحليل أصحاب المصلحة: الشواغل الأساسية والاستجابات الاستراتيجية

يواجه مختلف المشاركين في السوق تحديات وفرصاً مختلفة. ويعد فهم شواغلهم الأساسية شرطاً أساسياً لتقديم حلول فعالة.

بالنسبة للمستهلكين التجاريين والصناعيين (C&I)، يعد ارتفاع أسعار الكهرباء واستقرار الإمدادات من المشاكل الأساسية. وقد أدى اتساع فارق الأسعار من الذروة إلى خارج الذروة في أوروبا في عام 2024 إلى تحسين اقتصاديات تكوين التخزين من أجل موازنة الأسعار بشكل كبير. ومع ذلك، فإن تكرار حدوث الأسعار السلبية يشكل مخاطر على استراتيجيات "الشراء بسعر منخفض والبيع بسعر مرتفع" البسيطة. يجب أن يكون نظام التخزين المتطور قادرًا على التنبؤ بذكاء باتجاهات الأسعار وتحسين استراتيجيات الشحن/التفريغ تلقائيًا - الشحن بشكل مناسب خلال فترات الأسعار السلبية وزيادة التفريغ إلى أقصى حد خلال ذروة الأسعار. وقد أصبحت قدرة التحسين الديناميكية هذه ميزة تنافسية أساسية لمشاريع التخزين الخاصة بالشركات والمؤسسات.

يواجه مطورو المشاريع ومنتجو الطاقة المستقلون تحديات أكثر تعقيداً. فهم يحتاجون إلى مشروعات ذات عوائد جذابة مع ضمان الامتثال لقواعد المحتوى المحلي المتزايدة الصرامة في الاتحاد الأوروبي. وتتطلب سياسة بولندا صراحةً أكثر من 601 تيرابايت 3 تيرابايت من المحتوى المحلي، وتُظهر دول الاتحاد الأوروبي الأخرى اتجاهات مماثلة. علاوة على ذلك، لا يمكن تجاهل مخاطر التصاريح والمخاطر التنظيمية أثناء تطوير المشروع. في ألمانيا، على سبيل المثال، من المتوقع أن يستغرق مشروع الطاقة الشمسية (مع التخزين) حوالي 18 شهرًا من بدء المشروع إلى استلام التصريح، مع احتمال أن تمتد الموافقة النهائية إلى الربع الثالث من عام 2026. وقد أصبح اختيار الشركاء ذوي الخبرة المحلية الذين يمكنهم التنقل بكفاءة في عمليات التصاريح أمرًا بالغ الأهمية.

بالنسبة لأصحاب المنازل والمالكين التجاريين الصغار والمتوسطين، تعتبر سهولة استخدام النظام وسلامته واقتصادياته من الاعتبارات الأساسية. سوق التخزين السكني الأوروبي ناضج للغاية، حيث أصبحت مناقشات المستخدمين أكثر تعقيدًا. لا يهتم المستخدمون بمعدلات الاستهلاك الذاتي فحسب، بل يهتمون أيضًا بالقدرة على بيع فائض الكهرباء في الأسواق الفورية لتحقيق إيرادات أعلى، وما إذا كان يمكن توسيع الأنظمة بسلاسة في المستقبل لاستيعاب احتياجات إضافية من الطاقة الكهروضوئية أو شحن السيارات الكهربائية.

الجدول: شواغل أصحاب المصلحة الرئيسيين والحلول المتطابقة

| أصحاب المصلحة | الاهتمامات الأساسية | التحديات الرئيسية | اتجاه الحل |

| مستهلكو C&I | عائد الاستثمار/العائد على الاستثمار، والتحكم في تكلفة الكهرباء، واستقرار إمدادات الطاقة | الأسعار السلبية المتكررة، وزيادة تقلب الأسعار، وتحسين استراتيجية المراجحة | تحسين الخوارزمية الذكية، والمشاركة في أسواق متعددة (الطاقة + الخدمات الإضافية)، ووظيفة الطاقة الاحتياطية |

| مطورو المشاريع/منتجو المشاريع المستقلون | عائد المشروع، والامتثال (المحتوى المحلي للاتحاد الأوروبي)، والموثوقية على المدى الطويل، وعملية الربط بالشبكة | قواعد المحتوى المحلي (على سبيل المثال، بولندا >60%)، والتصاريح والمخاطر التنظيمية، وقوائم انتظار توصيل الشبكة | المنتجات ذات الاعتماد المحلي الكامل، ودعم الخدمات المحلية، والمساعدة في الحصول على التصاريح وتوصيل الشبكة |

| ملاك المنازل/التجارية الصغيرة | سهولة استخدام النظام وسلامته واقتصادياته وقابليته للتوسع المستقبلي | التعقيد التقني، واحتياجات الصيانة، والاستثمار المقدم، ومرونة النظام | تصميم التوصيل والتشغيل، وبرنامج ذكي لإدارة الطاقة، وبنية معيارية للتوسعة |

| مشغلو الشبكات/صناع السياسات | مرونة النظام، وتكامل مصادر الطاقة المتجددة، واستقرار الشبكة، وفعالية التكلفة | ارتفاع حصة الطاقة المتجددة المتغيرة، وقيود النقل/التوزيع، واسترداد تكاليف الاستثمار | تقنيات التخزين طويل الأمد، وتوفير الخدمات الإضافية المتعددة (التردد، والاحتياطي)، والمشاركة في أسواق القدرات |

04. تطور الحلول التكنولوجية: التوحيد القياسي والذكاء والتوطين

في مواجهة بيئة السوق المعقدة واحتياجات العملاء المتنوعة، تتطور حلول تكنولوجيا تخزين الطاقة في ثلاثة اتجاهات رئيسية: التوحيد القياسي والذكاء والتوطين.

يؤدي ظهور أنظمة التخزين الموحدة إلى تغيير اقتصاديات المشروع. تعمل الحلول الجاهزة المجهزة في حاويات مسبقة الصنع، مثل أنظمة تخزين الطاقة في حاويات التبريد السائل بقدرة 20 قدمًا بقدرة 3 ميجاوات ساعة أو 5 ميجاوات ساعة، على نقل أعمال تكامل النظام المعقدة إلى بيئة المصنع، مما يقلل بشكل كبير من وقت التركيب والتشغيل في الموقع. يمكن لهذا النهج "التوصيل والتشغيل" أن يقصر دورات تسليم المشروع بأكثر من 401 تيرابايت في الساعة، مما يوفر قيمة هائلة للمستثمرين الذين يسعون إلى الاستفادة من نوافذ الدعم القصيرة. لا يؤدي التوحيد القياسي إلى تسريع عملية التسليم فحسب، بل يقلل أيضًا من التكاليف من خلال الإنتاج على نطاق واسع. والأهم من ذلك أن معايير التصميم والتصنيع الموحدة تؤدي إلى أداء نظام أكثر موثوقية وتشغيل وصيانة أبسط.

أصبحت أنظمة إدارة الطاقة الذكية (EMS) الأداة الأساسية للتغلب على الأسعار السلبية وتقلبات السوق. تقوم الخوارزميات المتقدمة بتحليل بيانات الأسعار التاريخية وتوقعات الطقس وأنماط الأحمال للتنبؤ باتجاهات الأسعار قبل 24-48 ساعة، وتحسين استراتيجية الشحن/التفريغ في نظام التخزين وفقًا لذلك. عندما يتنبأ النظام باحتمالية عالية للأسعار السلبية، فإنه يقوم بتعديل خطط الشحن؛ وعندما يتنبأ بارتفاع الأسعار المحتمل، فإنه يحتفظ بسعة كافية لالتقاط فرص المراجحة. يمكن لهذه القدرة الديناميكية على التحسين الديناميكي أن تعزز معدل عائد مشروع التخزين بنسبة 15-301 تيرابايت إلى 3 تيرابايت.

القدرة على الخدمة المحلية هي مفتاح النجاح في السوق الأوروبية. فلدى دول الاتحاد الأوروبي اختلافات كبيرة في المعايير التقنية ومتطلبات الاعتماد وإجراءات التوصيل بالشبكة. على سبيل المثال، يتطلب معيار VDE-AR-E 2510-2 الذي تم تطبيقه حديثًا في ألمانيا أن تمتلك أنظمة التخزين قدرات تشكيل الشبكة على مستوى الميلي ثانية، وهي شهادة لم يحصل عليها سوى عدد قليل من المزودين العالميين. ولتقديم خدمة فعالة في أوروبا، يحتاج الموردون إلى فرق تقنية محلية ذات معرفة عميقة باللوائح الوطنية وقواعد السوق، وقد يتطلب الأمر حتى مرافق إنتاج أوروبية لتلبية متطلبات المحتوى المحلي.

05. مجموعة حلول ماتيسولار المتكاملة من ماتيسولار

من خلال تلبية الاحتياجات المعقدة والمتنوعة للسوق الأوروبية، نقدم حلولاً شاملة ومحلية للطاقة الكهروضوئية والتخزين مصممة لمساعدة العملاء على تحقيق أقصى قدر من الفوائد في السياسات وتحسين عوائد الاستثمار.

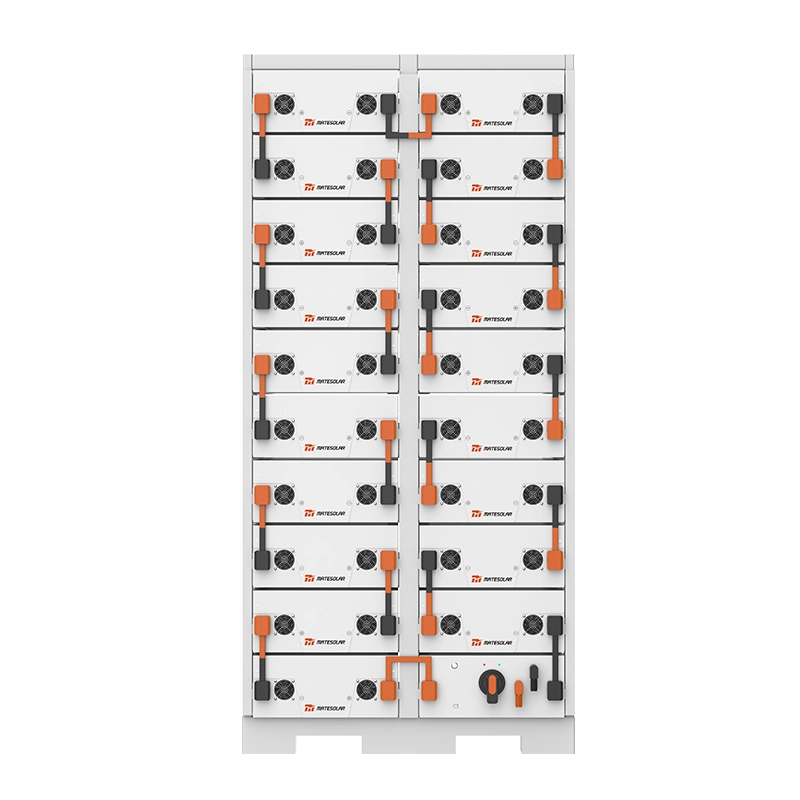

بالنسبة لمطوّري المشاريع الذين يسعون إلى النشر على نطاق واسع، فإن منتجات التخزين الموحدة والمعتمدة بالكامل هي الخيار المثالي لمطوري المشاريع الذين يسعون إلى النشر على نطاق واسع. خذ على سبيل المثال نظام تخزين الطاقة في حاوية تبريد سائلة بقدرة 20 قدمًا بقدرة 3 ميجاوات ساعة / 5 ميجاوات ساعة كمثال. يتميز هذا النظام بتصميم معياري للتوسع المرن، وتحمل جميع المكونات الهامة شهادات الاتحاد الأوروبي الضرورية مثل CE وIEC وEN. والأهم من ذلك، نحن نقدم وثائق فنية كاملة ونماذج مالية مصممة خصيصًا لتلبية متطلبات التطبيق لصناديق مثل صندوق KTF الألماني والإعانات الفائقة في إسبانيا، مما يساعد العملاء في إكمال عملية التطبيق بكفاءة وتقصير فترة استرداد رأس المال.

بالنسبة للمستهلكين من فئة C&I متوسطة الحجم، فإن نظام شمسي هجين بقدرة 150 كيلوواط يوفر التوازن المثالي بين الأداء والاقتصاد. فهو مصمم خصيصًا لأنماط استهلاك المستهلكين الأوروبيين من الشركات والمؤسسات في أوروبا، وهو يدمج برنامجًا ذكيًا لإدارة الطاقة يعمل تلقائيًا على تحسين التشغيل بناءً على أسعار الكهرباء في الوقت الفعلي والطلب على الأحمال. عندما تكون الأسعار مرتفعة، يعطي النظام الأولوية لاستخدام الطاقة الشمسية المخزنة؛ وخلال فترات الأسعار السلبية، يتم شحنها بشكل مناسب من الشبكة لخفض تكاليف الطاقة الإجمالية. هذا التحسين الذكي يقلل عادةً من فترة استرداد الاستثمار إلى 4-6 سنوات.

بالنسبة لأصحاب المنازل والمالكين التجاريين الصغار، فإن نظام الطاقة الشمسية الهجين بقدرة 20 كيلو وات يتميز النظام بسهولة استخدامه ومرونته. ويسمح التصميم المعياري للنظام بتوسيع السعة بسلاسة عندما يضيف المستخدمون المزيد من الألواح الكهروضوئية أو يشترون سيارة كهربائية في المستقبل، مما يحمي الاستثمار الأولي. ومن خلال منصتنا المتكاملة لإدارة الطاقة، لا يمكن للمستخدمين زيادة الاستهلاك الذاتي فحسب، بل يمكنهم أيضاً بيع فائض الكهرباء إلى الشبكة بناءً على الأسعار في الوقت الفعلي، مما يزيد من إيرادات الطاقة.

06. الأسئلة الشائعة (FAQ)

س: كيف يمكننا تحقيق أقصى استفادة ممكنة من صندوق KTF الألماني أو دعم التخزين في إسبانيا؟

ج: يتطلب التقدم بطلب للحصول على هذه الإعانات وثائق فنية ونماذج مالية معدة بدقة. يستخدم صندوق KTF الألماني نموذج تمويل مختلط، مما يسمح بتقديم طلبات للحصول على كل من الإعفاءات الضريبية والقروض منخفضة الفائدة. نحن نوفر حزمة وثائق كاملة تفي بمتطلبات الطلب، بما في ذلك المواصفات الفنية التفصيلية وشهادات الامتثال ونماذج التوقعات المالية القائمة على سيناريوهات العالم الحقيقي. بالنسبة للإعانات الإسبانية التي تصل إلى 851 تيرابايت 3 تيرابايت، يمكننا مساعدتك خلال العملية بأكملها بدءاً من تصميم المشروع وحتى تقديم الطلب، مع ضمان الامتثال لجميع المتطلبات الفنية.

س: كيف يمكن لنظام التخزين تحسين الإيرادات في مواجهة أسعار الكهرباء السلبية المتكررة؟

ج: قد تفشل استراتيجيات "الشراء بسعر منخفض والبيع بسعر مرتفع" البسيطة في بيئات الأسعار السلبية. يستخدم نظام إدارة الطاقة الذكي الخاص بنا خوارزميات متقدمة لتحليل البيانات التاريخية واتجاهات السوق، وتعديل استراتيجيات الشحن/التفريغ بشكل ديناميكي. لا يأخذ النظام في اعتباره الأسعار الحالية فحسب، بل يتنبأ أيضاً بالاتجاهات المستقبلية، ويتجنب الشحن غير المخطط له خلال فترات الأسعار السلبية العميقة. إلى جانب المشاركة في أسواق الخدمات الإضافية، يساعد نظامنا العملاء على الحفاظ على عوائد جذابة حتى في البيئات ذات الأسعار السلبية المتكررة.

س: هل يمكن توسيع نظام التخزين الحالي بسلاسة في المستقبل؟

ج: نعم، إذا كان النظام يعتمد على تصميم معياري. إن حلول التخزين السكنية وحلول التخزين الخاصة بنا للمنازل والشركات مبنية على تصميم معياري. عندما تحتاج إلى زيادة السعة الكهروضوئية أو قدرة شحن السيارات الكهربائية، يمكنك تحقيق توسع سلس عن طريق إضافة وحدات البطارية وسعة العاكس المقابلة. يحمي هذا التصميم استثمارك الأولي ويضمن قدرة النظام على التكيف مع احتياجات الطاقة المستقبلية.

س: ما هي متطلبات الاعتماد الرئيسية لنشر مشاريع التخزين في أوروبا؟

ج: لدى السوق الأوروبية متطلبات اعتماد صارمة لأنظمة التخزين، بما في ذلك علامة CE (المطابقة لمعايير الصحة والسلامة والبيئة في الاتحاد الأوروبي)، وUN38.3 (سلامة نقل البطاريات)، وIEC 62619 (معيار السلامة للبطاريات الصناعية)، ومتطلبات رمز الشبكة الخاصة بكل بلد. تحمل منتجاتنا بالفعل هذه الشهادات الرئيسية ويمكننا تقديم وثائق امتثال إضافية وفقًا للمتطلبات الوطنية المحددة.

س: كيف تتعاملون مع متطلبات المحتوى المحلي المختلفة في مختلف البلدان؟

ج: لتلبية متطلبات المحتوى المحلي مثل تلك الموجودة في بولندا، نقدم حلولاً مرنة. لقد أنشأنا شبكة من الشركاء المحليين ونظام سلسلة توريد في أوروبا. واعتماداً على احتياجات المشروع، يمكننا تعديل مصادر المكونات ومواقع التجميع لضمان الامتثال لنسب المحتوى المحلي دون المساس بأداء النظام أو معايير الجودة.

يفتح باب سوق تخزين الطاقة الأوروبي على مصراعيه للحلول الذكية عالية الكفاءة. فمع تحويل المصنعين الألمان للأسعار السلبية إلى ميزة من حيث التكلفة مع التخزين الذكي، وتحقيق المحطات الكهروضوئية الإسبانية إنتاجًا مستقرًا على مدار الساعة طوال أيام الأسبوع مع دعم 85%، انتقل هذا التحول في الطاقة من مخطط السياسة إلى الواقع التجاري.

لم تعد تقلبات الأسعار في أسواق الكهرباء مجرد خطر، بل أصبحت فرصة سانحة لأنظمة التخزين المرنة للحصول على القيمة. الأطر التنظيمية والتقنيات الذكية موجودة الآن في مكانها الصحيح. والخطوة التالية هي العمل الاستراتيجي.

استكشف حلولنا المصممة خصيصاً لتعزيز استراتيجية الطاقة الأوروبية الخاصة بك:

- اكتشف مجموعتنا الكاملة من الأنظمة المدمجة لمختلف التطبيقات على موقعنا الطاقة الشمسية الكهروضوئية ونظام تخزين الطاقة الصفحة.

- للحصول على احتياجات تجارية وصناعية فعالة ومتوسطة الحجم، تعرف على المزيد عن نظام الطاقة الشمسية الهجين التجاري بقدرة 150 كيلوواط.

- بالنسبة لمشاريع المرافق العامة أو مشاريع C&I الكبيرة، استكشف المشاريع القابلة للتطوير نظام تخزين الطاقة في حاوية تبريد سائلة بقدرة 20 قدمًا بقدرة 3 ميجاوات ساعة / 5 ميجاوات ساعة.

- بالنسبة للعقارات السكنية والتجارية الصغيرة، اعثر على التوازن المثالي مع نظام الطاقة الشمسية الهجين السكني بقدرة 20 كيلوواط.

MateSolar - شريكك لحلول الطاقة الكهروضوئية وتخزين الطاقة المتكاملة.